Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.

You wouldn’t pick a loan blindfolded—so don’t.

Our blog helps you decode your options with real tips and insights.

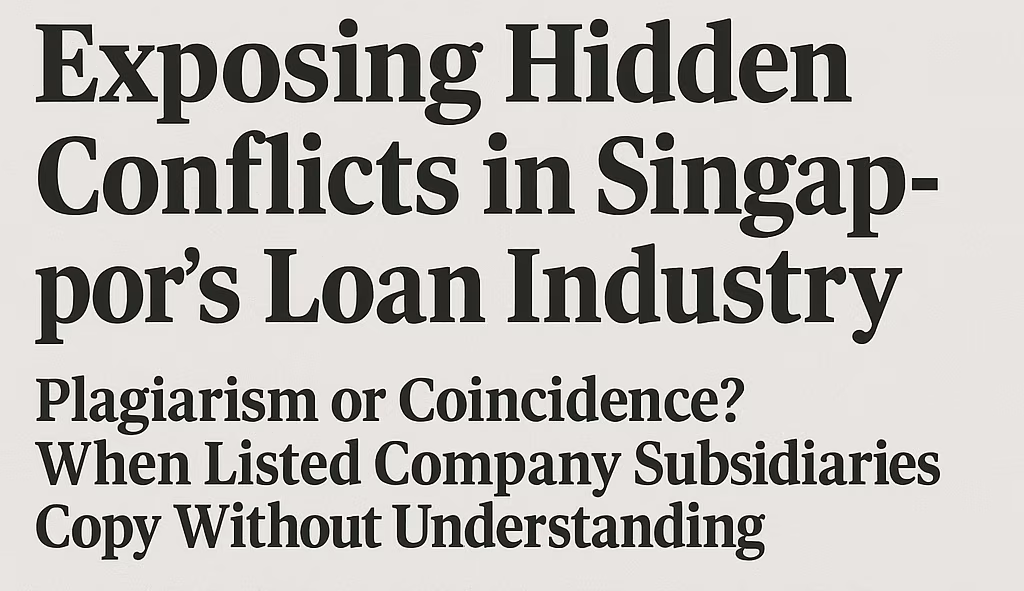

This must be good content… Someone seems to have plagiarized us!

17 Aug, 2025 BY Daniel Tan

Without a large marketing budget, we have to rely on high-quality writing to attract newsletter subscribers. We focus on quality over quantity, writing about what consumers, SMEs, and borrowers truly care about. However, we know it still pales in comparison to the massive reach of larger companies with their large marketing budget. But here&rsquo

Read MoreMake Honest Loans The Norm - Sign our petition to call for regulation to protect consumers.

05 Aug, 2025 BY Daniel Tan

Ever been promised bold claims by a broker or clicked on an ad promising “low interest rates, or claiming to be “officially appointed by chambers”? You’re not alone. These clickbait tactics aren’t just marketing— they’re the frontline in a larger, unregulated war for your trust (and your wallet). If we can

Read MoreEmbedded Lending Explained: How Xero, Shopee, Stripe & More Are Changing Business Finance

15 Jul, 2025 BY Daniel Tan

Embedded lending is a fast-growing trend where non-financial companies (such as e-commerce platforms, SaaS tools, or even ride-hailing apps) offer loans or credit options to their users directly within their own apps or websites. This approach allows users to access financing at the exact moment they need it—without ever having to visit a ban

Read MoreWhy Accountants and Financial Planners Should Start To Assist Their Clients with Loans

09 Jul, 2025 BY Daniel Tan

In the fast-evolving world of personal finance and business growth, accountants and financial planners have increasingly become trusted advisors, guiding clients on everything from tax strategy to retirement planning. Adding loans to their advisory offerings can not only deepen client relationships but also bring significant value to clients. In f

Read MoreLoan Brokers: 10 Insider Tips Every SME or borrower Should Know

25 Jun, 2025 BY Daniel Tan

Unlike in the US and UK, where regulations like the Truth in Lending Act(TILA) and Consumer Credit Act have been in place since the 1970s - there is currently no regulation on brokers in Singapore or if one even needs to set up a company or be a formal representative of a brokerage. Sometimes all they get is a company name card while working a

Read MoreACRA Number vs DUNS Number: Do Singapore Businesses Need Both?

24 Jun, 2025 BY Daniel Tan

A DUNS number—short for Data Universal Numbering System—is a unique, 9-digit identifier issued by Dun & Bradstreet (D&B). It acts like a global business passport, helping verify a company’s identity and track its financial and credit history internationally. Introduced in 1963, the DUNS number has become a trusted standar

Read More7 Smart Ways How Singapore SMEs Can Improve Cash Flow Instead of Taking a Loan.

23 Jun, 2025 BY Celest Teo

How to Improve Cash Flow Without Taking a Loan When cash gets tight, many business owners instinctively look to loans as the first solution. But borrowing isn’t the only way to ease a cash crunch. Before you take on debt, here are several strategies to improve your business’s cash flow. 1. Speed Up Your Inflows The faster you get p

Read MoreReal Estate, Insurance, Loans - How Commission-Based Advice Can Work Against You

06 Jun, 2025 BY Daniel Tan

Whether you're buying a home, taking a loan, or getting insured — Do your advisor or agent recommend what’s best for you — or what pays them more? In many industries — including loans, insurance, and real estate — loan brokers and agents can earn different commissions depending on which product or provider they recomm

Read MoreThe Dirty Secret Behind “Comparison” Sites

04 Jun, 2025 BY Daniel Tan

Some platforms that call themselves 'comparison websites' are actually pay-to-play advertising channels. While these platforms claim to help you compare loans, products, or insurance objectively, regulators from the U.S. to Australia are uncovering a different reality: many of these so-called "comparison" websites are paid to show you what they wa

Read MoreShould all shareholders be guarantors to a loan?

22 Apr, 2025 BY Lee Shuen Min

When a company seeks financing, especially for smaller enterprises or startups, shareholders often face the choice between collectively guaranteeing a business loan or having a single shareholder apply and provide a loan personally to the company. Each approach carries distinct advantages and disadvantages. Single Shareholder Lending to the Compa

Read More