Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.

You wouldn’t pick a loan blindfolded—so don’t.

Our blog helps you decode your options with real tips and insights.

Licensed Moneylenders vs Loan Sharks

16 Apr, 2025 BY Celest Teo

Sometimes, you need money fast. Whether it's for a sudden emergency or a cash flow for your business, turning to a moneylender might be the way to go when borrowing from banks isn’t feasible. Here is a quick snapshot between the 2 : Criteria Bank Loans Licensed Moneylenders Interest Rates Typicall

Read MoreInnovation in alternative credit data & AI credit scoring is a double-edged sword for borrowers

03 Feb, 2025 BY Daniel Tan

Dynamic pricing has been a controversial practice as it raises ethical questions about fairness and transparency. Instead of prices fluctuating due to supply and demand, e-commerce and hotel booking websites have been subjected to scrutiny; prices may vary based on a user's browsing behaviour, location, and potentially their perceived willingness

Read MoreVenture Debt: How it stacks up against loans

22 Jan, 2025 BY Daniel Tan

What is Venture Debt Venture debt is a form of financing specifically designed for more often than not, venture-backed startups. It is typically offered as a supplement to equity financing and is aimed at providing companies with additional runway or funding for specific needs. This financing method has gained popularity in Singapore and Southeast

Read MoreWhen it makes more sense to go for a more expensive loan offer?

14 Jan, 2025 BY Daniel Tan

Choosing the right loan is not always about finding the lowest interest rate. Sometimes, the deciding factor is the loan quantum (amount borrowed) or the tenure (repayment period). These elements can significantly impact your financial situation, influencing why one offer might be more attractive than another. These factors are interconnected with

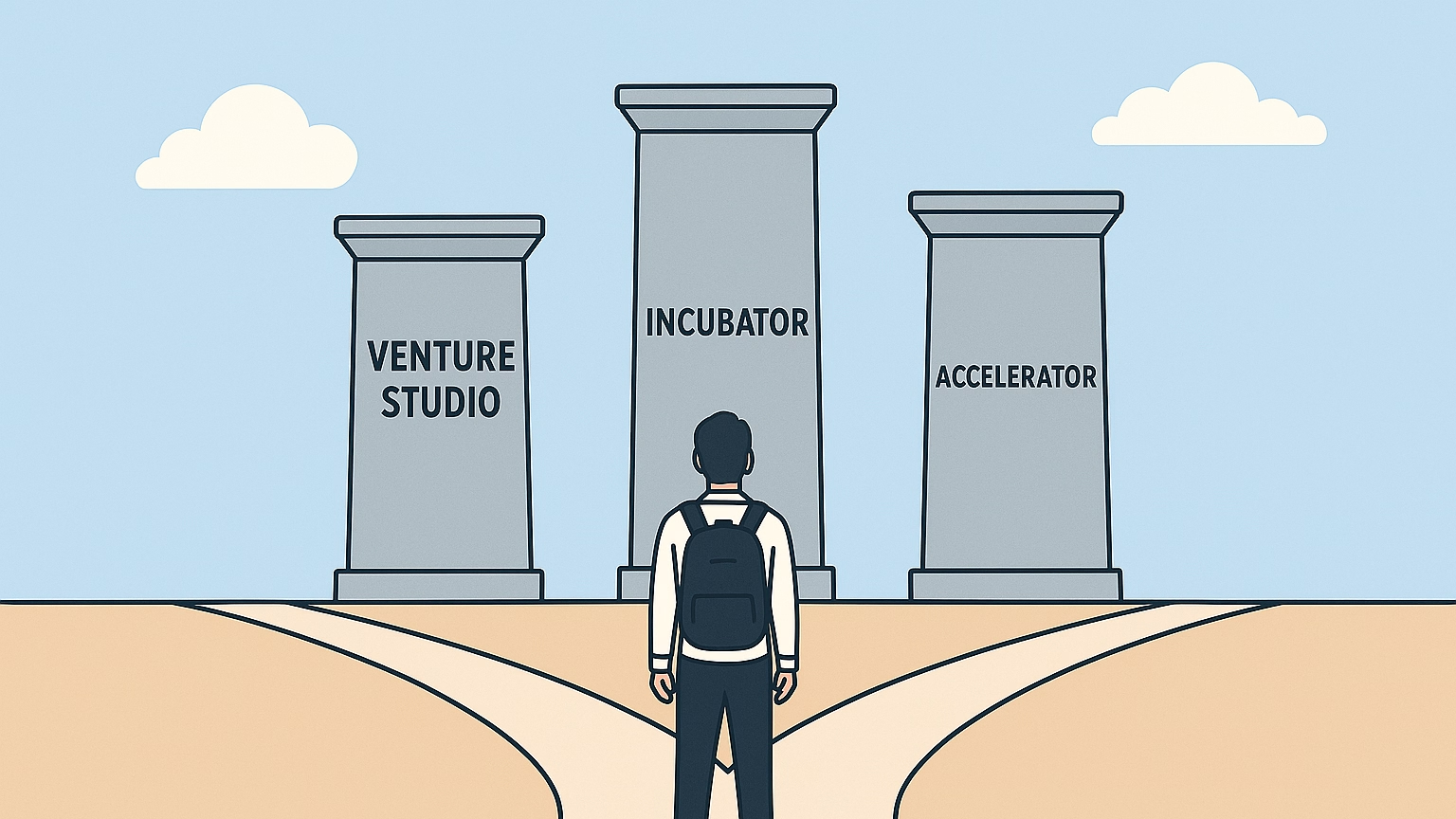

Read MoreEquity fundraising: venture studio vs incubator vs accelerator

23 Dec, 2024 BY Lee Shuen Min

In the entrepreneurial ecosystem, terms like "venture studio," "accelerator," and "incubator" often come up when discussing about equity fundraising. While all three may provide equity funding, they operate differently and cater to startups at various stages of their development. What is a Venture Studio? A venture studio, also known as a s

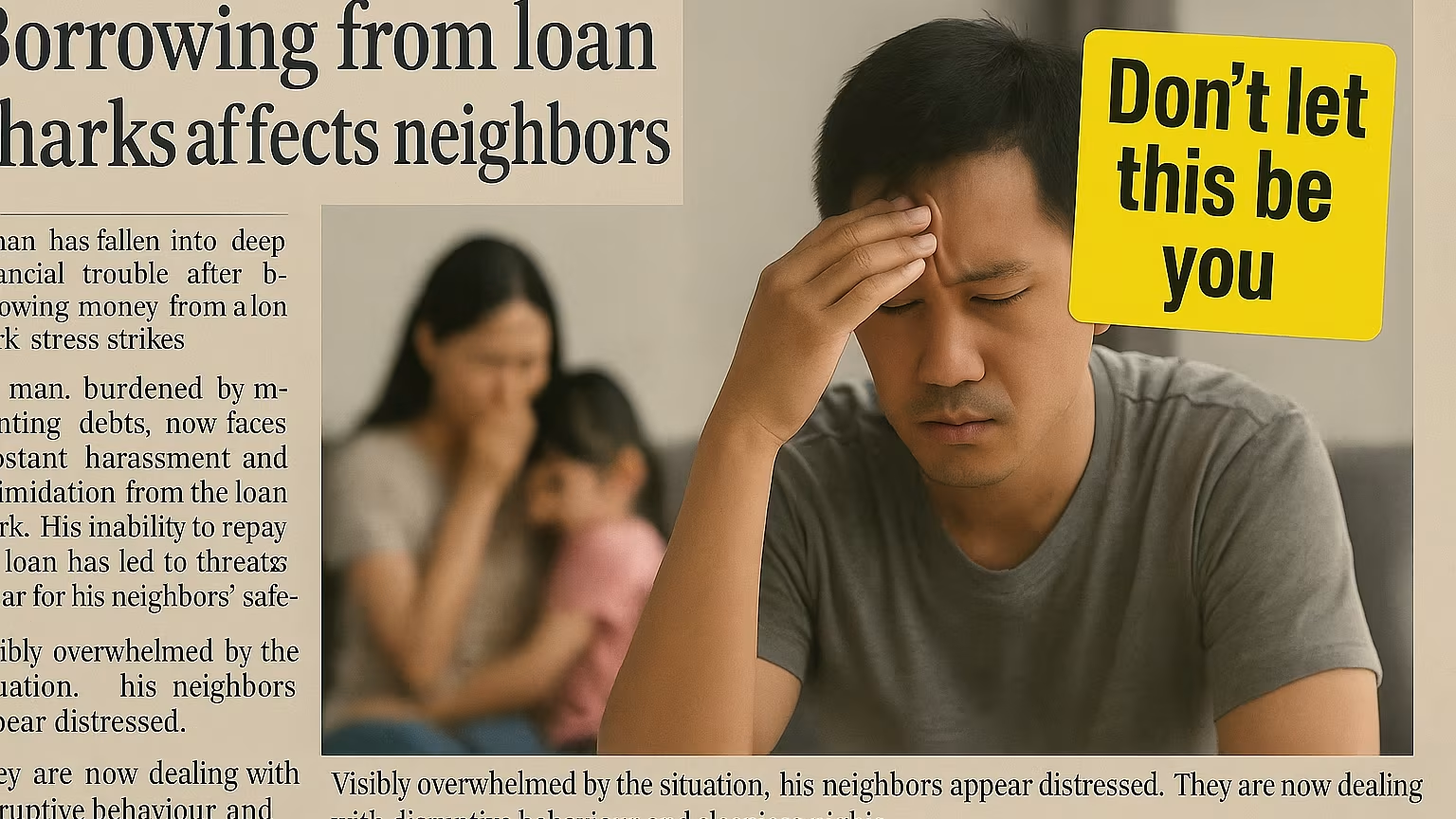

Read MoreIllegal Moneylenders in Singapore: A Threat Closer Than You Think

10 Dec, 2024 BY Daniel Tan

Very often, people may overlook the threat of illegal moneylenders, assuming they are too wise to fall into their trap. However, when a neighbour or a domestic worker borrows from such lenders, the trouble can still land at your doorstep. Such is the case for Mr Alan, who received 120 calls over three days from various unlicensed m

Read MoreThe entrepreneur’s dilemma: Fundraising or taking a loan?

27 Nov, 2024 BY Daniel Tan

Fundraising investments or taking a loan is a question, I often see being asked on Facebook groups for entrepreneurs or aspiring entrepreneurs. This article will break down all the pros and cons so that any entrepreneur deciding between the 2, may make a more informed decision.Fundraising (Equity Financing) Pros: 1)No Repayment Obligations: Inve

Read MoreWhat Is a Unique Entity Number (UEN) & What Is Its Importance?

13 Nov, 2024 BY Grof.co X FindTheLoan

Navigating business operations in Singapore starts with understanding the Unique Entity Number (UEN) – a government-issued ID for businesses. The UEN is like an NRIC for people in Singapore, providing a unique and permanent identifier for companies to interact with regulatory bodies. This guide jointly produced with our partner Grof.co, will

Read MoreDon't be clickbait by fancy loan types that don't exist!

11 Oct, 2024 BY Lee Shuen Min

Have you ever seen ads for loan types like Tech Startup Loan, Nail Salon loans, Medical loans, Fashion Boutique loans and Aquarium Shop loans? These are just clickbaits. Just like investors diversify their portfolios by investing in various industries, lenders need to diversify their customer base and do not want to attract borrowers from onl

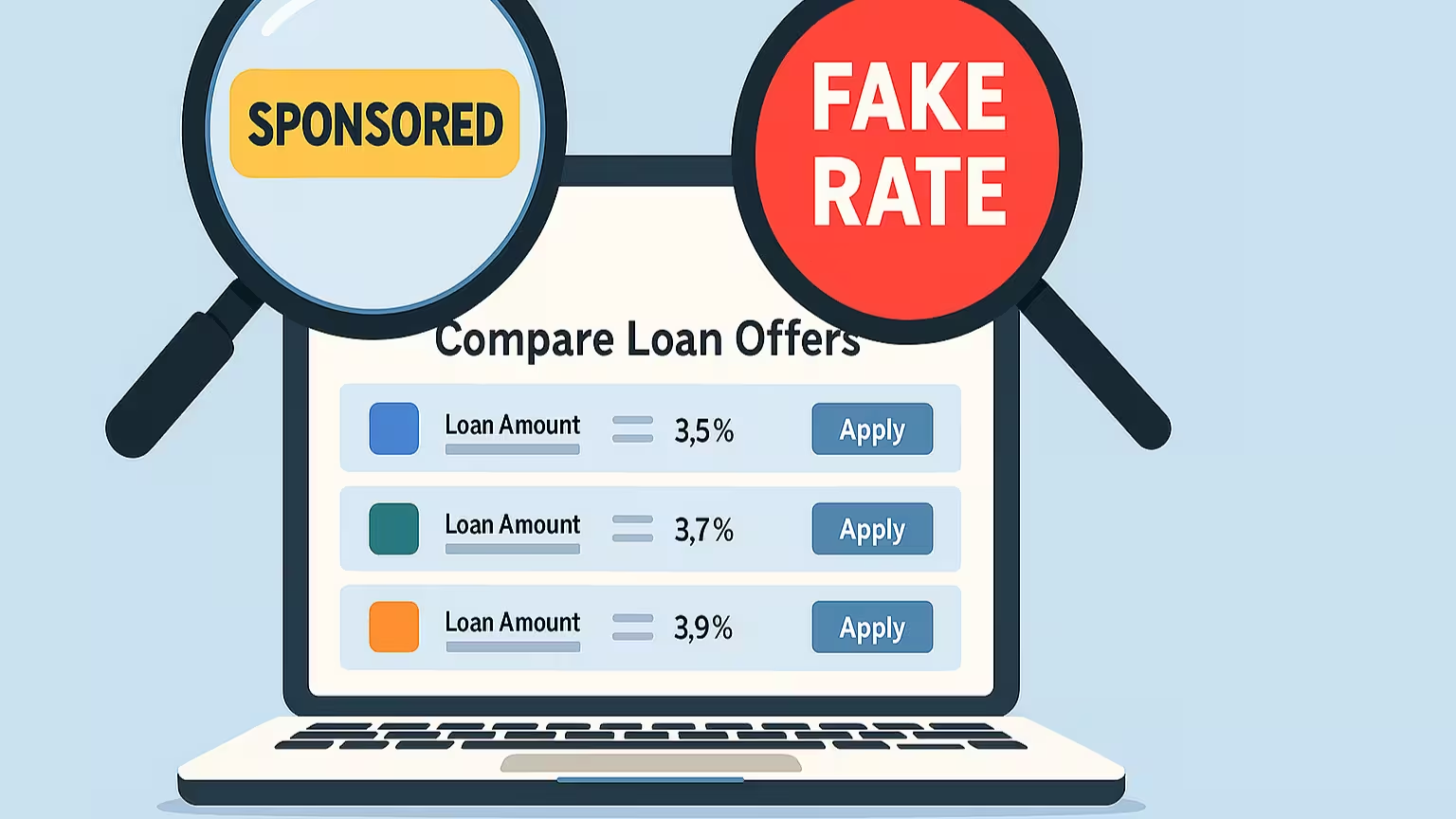

Read MoreWhat is a loan marketplace and how are you different from a comparison website or from using a broker?

27 Sep, 2024 BY Daniel Tan

Review websites can help you choose the best credit card, the best savings account, and so on with their extensive research on standardized products. But without access to your individualized profile, it might not be very helpful when it comes to taking a loan. “Up to $$$” and “as low as x%” mean nothing if they do no

Read More