When AI Makes Content Publishing Easy, Financial Accuracy Becomes Hard

Written at: 14 Jan, 2026

Last Updated: 14 Jan, 2026

As artificial intelligence dramatically lowers the cost and effort required to produce written content, the volume of explanatory material now circulating online has grown at an unprecedented pace. This shift is often celebrated as a democratization of knowledge. Yet in practice, it also introduces a quieter but more serious risk: the widespread normalization of subtle inaccuracies, particularly in domains where precision matters, such as finance.

The problem is not theoretical. Recently, a globally ranked university professor resigned after academic papers were found to contain AI-generated material with fabricated citations. While academia has its own checks and norms, the same underlying dynamic is increasingly visible in public-facing financial content. Blogs, comparison websites, and search-optimised articles now publish large volumes of AI-assisted explanations that appear authoritative, polished, and confident but are not always correct.

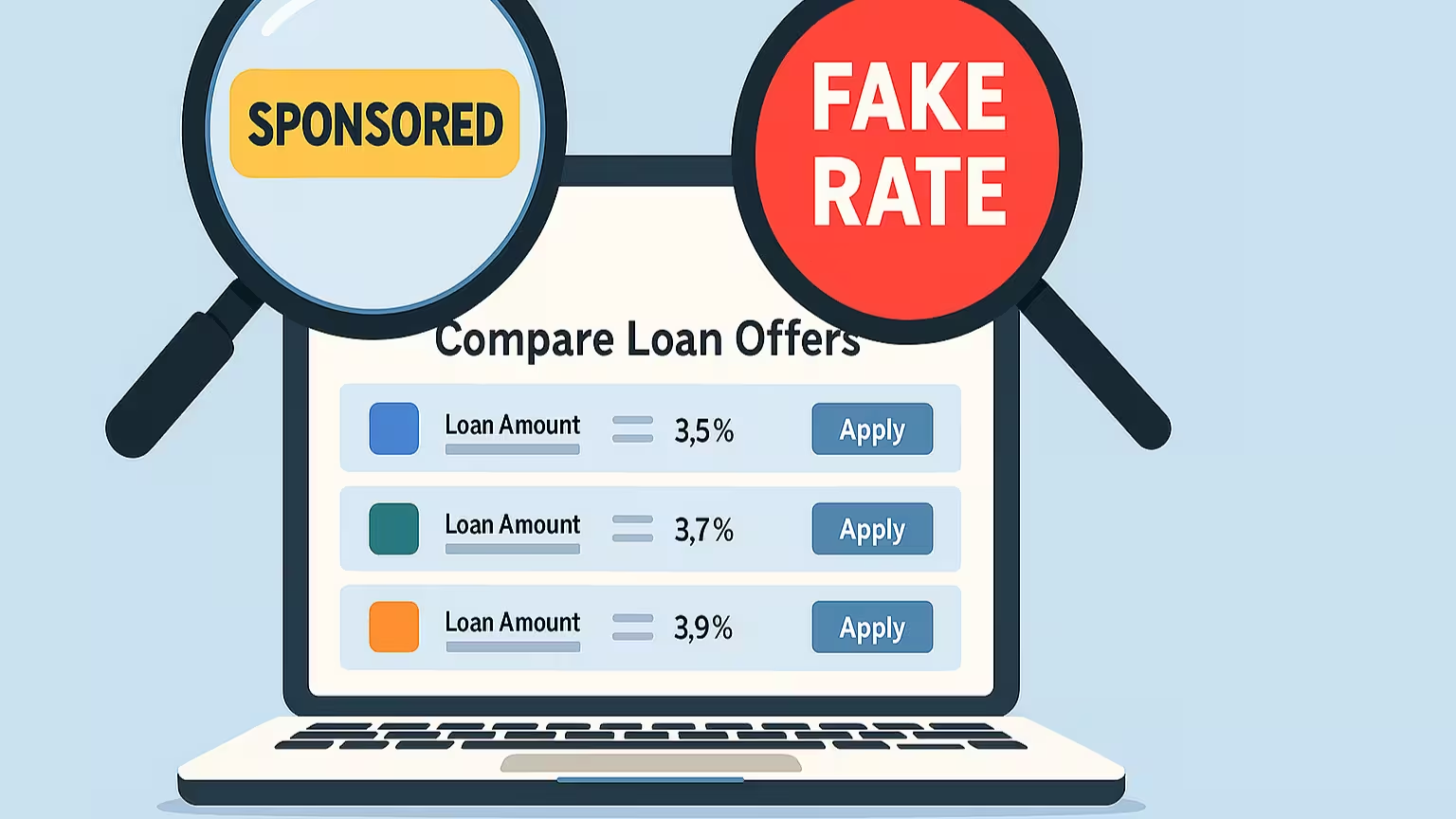

In finance, small conceptual errors can have outsized consequences. Unlike a typo or a grammatical slip, an incorrect explanation of how a financial product works can shape how readers perceive their available options, which providers they approach, and ultimately how much they pay.

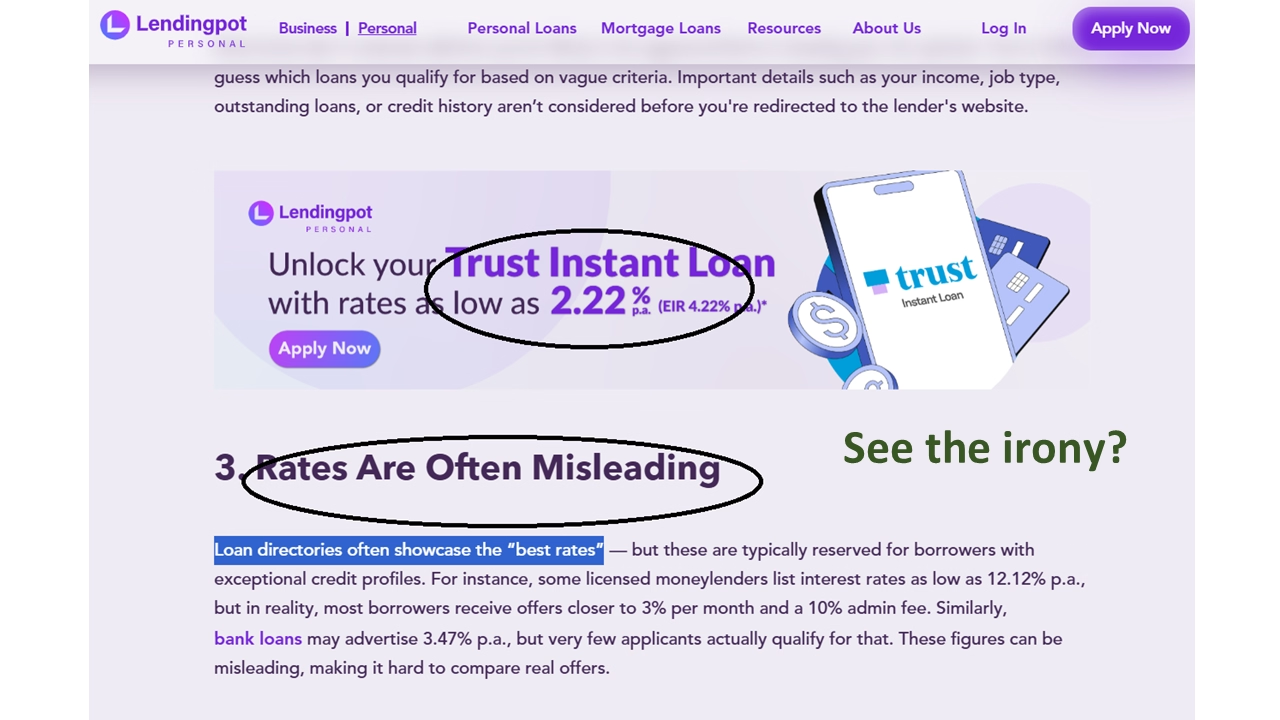

In our own work operating a loan marketplace, we have encountered a growing number of such inaccuracies on widely referenced financial websites. Many of these platforms initially focused on insurance or investment topics, before expanding rapidly into loan-related content. In doing so, some appear to have relied heavily on AI-generated explanations without sufficient subject-matter review.

One recurring example concerns how loan products are categorized. Several sites describe “startup loans” as a distinct class of financing, separate from “business loans.” This framing sounds intuitive, but it is conceptually wrong. Business loans are a broad category that includes working capital loans, invoice financing, supply-chain financing, and loans extended to startups. A startup is a type of business, not a separate loan category.

A clearer analogy helps illustrate the issue. All surgeons are doctors, but not all doctors are surgeons. Reversing that relationship would mislead patients into thinking they need to look for an entirely different profession when seeking surgical care. In the same way, treating startup loans as something fundamentally separate from business loans creates confusion about what products exist and who offers them.

On the surface, this may seem like a minor semantic mistake. In reality, its effects compound quickly. When such explanations are repeated across multiple articles, comparison tables, and search results, borrowers may come to believe that only a narrow subset of lenders can serve them. They may stop comparing alternatives, assume they are ineligible for mainstream products, and accept higher-cost financing that is, in fact, widely available.

The underlying cause is not difficult to identify. AI makes it easy to produce large volumes of plausible-sounding content at speed. When combined with commercial pressure to publish frequently and rank in search results, editorial review can become cursory or absent. Errors that would once have been caught by a domain expert now pass through, replicated and reinforced by repetition.

This represents a shift in the nature of risk. In the past, misinformation was often isolated, eccentric, or obviously unreliable, making it easier for readers to dismiss. Today, the greater danger lies in content that is mostly correct, well-written, and confidently presented, yet built on subtle conceptual errors that are difficult for non-experts to recognize. Over time, these inaccuracies can become embedded as accepted knowledge simply because they are everywhere.

As AI-assisted publishing becomes the norm, editorial responsibility becomes more important, not less. Platforms that influence financial decisions carry an obligation to ensure that explanations reflect how products actually work, not just how they can be neatly summarized by a model trained on imperfect data.

The concern, ultimately, is not about AI itself, but about how it is used. Without deliberate oversight and subject-matter accountability, the convenience of AI risks turning incorrect explanations into default truths. That is a trend worth examining closely before it quietly reshapes how borrowers understand and navigate financial decisions.

While there are some parliamentary conversations about regulating finfluencers, it appears that they are still limited in scope, as the conversation seems to forget loans are financial products that can span over years and even decades and can have an equal impact on investment decisions too.

Curious about this? Learn more about it out here.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.