The Dirty Secret Behind “Comparison” Sites

Written at: 04 Jun, 2025

Last Updated: 22 Jan, 2026

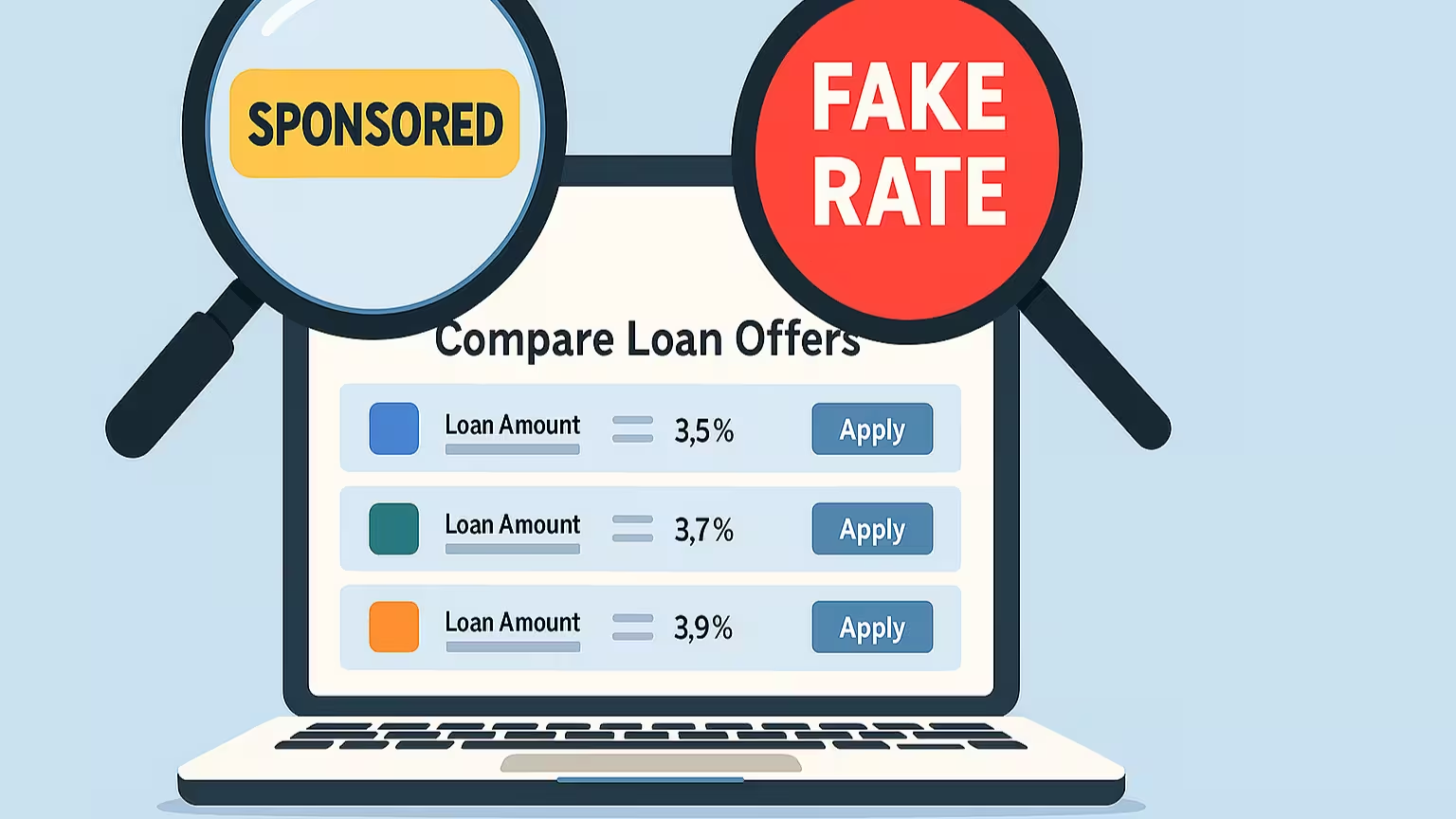

Some platforms that call themselves 'comparison websites' are actually pay-to-play advertising channels.

While these platforms claim to help you compare loans, products, or insurance objectively, regulators from the U.S. to Australia are uncovering a different reality: many of these so-called "comparison" websites are paid to show you what they want you to see. And we are not the only ones speaking up about it:

credit: Head of Lendingpot. (We have no idea why Lendingpot is calling themselves out. Are they blindly copying our articles? We aren't sure. But for more of their contradiction or to join the conversation, click here! Interestingly, when we wrote about the conflict of interest if a broker is owned by a lender, they wrote the same, a few months later, despite being owned by IFS Capital & PhilipCapital! ) Multiple brokers are also owned by lenders, and that can raise serious questions about how ‘neutral’ their recommendations can be and again, if you are really shopping for the best rate. And in Lendingpot's case, they are owned by not 1 but 2 lenders, with a 3rd one being a sister company.

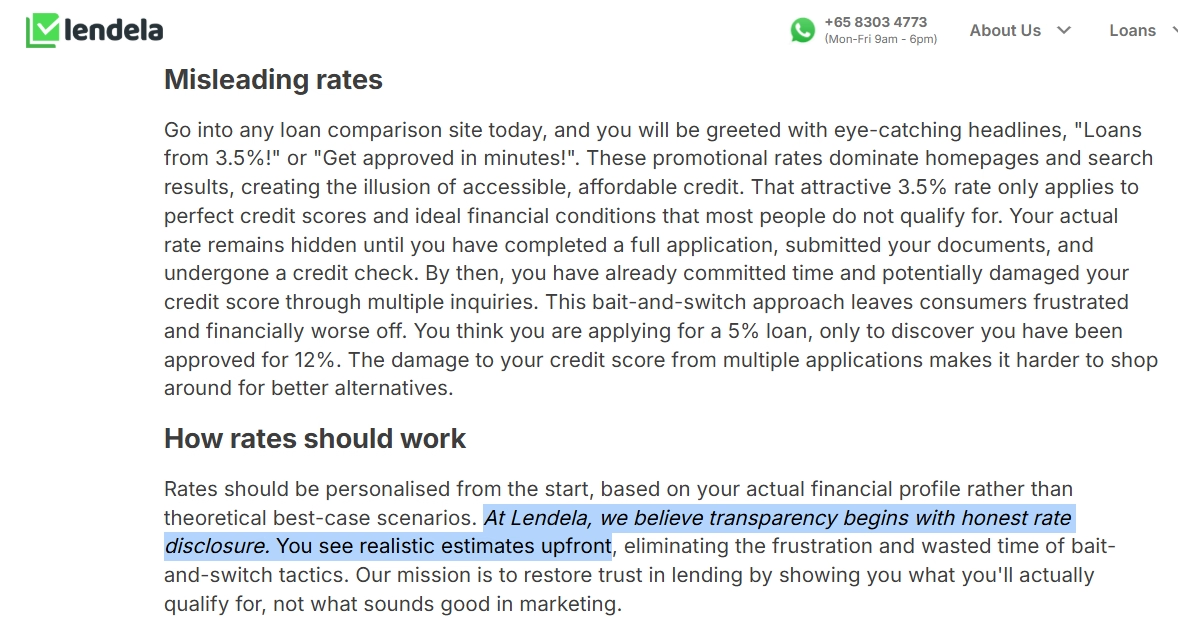

The strange thing? Lendela is doing the same.

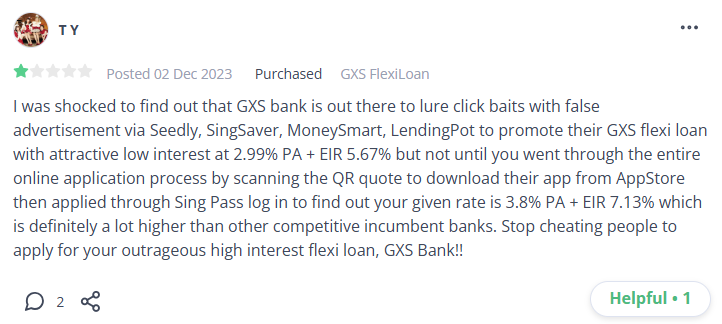

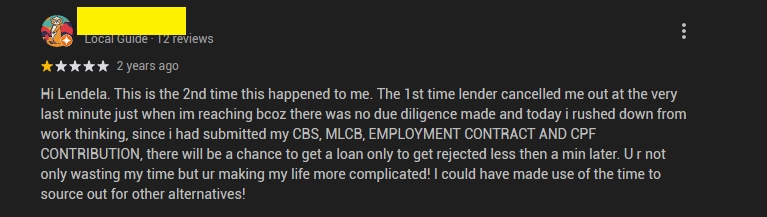

But yet this is what users of such sites are saying

Credit:This is a publicly made comment that you can find on review websites like Google, Seedly, etc.

At FindTheLoan.com, we call ourselves Singapore’s first loan marketplace for a reason: we don’t show you teaser rates that waste your time or worse, a false sense of comparison. We are a tool that allows you to send your application to multiple lenders directly yourself. That way, you don’t waste time and money chasing biased suggestions.

Comparison websites often show static info or "starting from" rates — but those rates aren't tailored to you because these platforms don't collect your full profile or pass your application to lenders. What you see are just advertisements — and even if the interest rate is accurate, what about the loan amount or tenure?

In fact, regulators in multiple countries have already taken action:

1. U.S. Federal Trade Commission (FTC) vs. LendEDU

"LendEDU told consumers that its financial product rankings were based on objective and unbiased information... but in fact LendEDU sold its rankings to the highest bidder."

2. Consumer Financial Protection Bureau (CFPB) on Steering Practices

"Operators of digital comparison-shopping tools can violate the prohibition on abusive acts or practices if they distort the shopping experience by steering consumers to certain products or services based on remuneration to the operator."

The FTC is a hybrid agency combining what CASE and CCS regulate over broad commerce. The CFPB is for consumer finance. In Singapore, MAS covers finance, while CASE covers consumer matters outside finance. Though it appears that the current matter might not be on either's radar, as loan intermediaries are not regulated in Singapore.

3. Australian Securities and Investments Commission (ASIC) vs. Choosi

ASIC sued Choosi for misrepresenting itself as a broad comparison tool while mostly promoting just one insurer:

"Comparison websites must provide a meaningful comparison service — not simply operate as a sales channel or distribution platform for companies."

— ASIC media release, June 2025

4. Even MoneySmart is warning about biased comparison websites

The Australian Government’s equivalent of our MoneySense, MoneySmart (yes, ironically), advises that many comparison sites are actually commercial businesses that get paid to feature or prioritize lenders, meaning users might not see the full picture.

Conclusion: You can’t compare offers that were never made.

Many so-called comparison sites only show teaser rates that may not apply to you. Think about it: if one lender or bank were cheaper than the others for all borrower profiles, wouldn’t the rest have closed shop? What looks like choice is often just advertising dressed as comparison. And even if the interest rate is accurate, what about the loan amount or tenure? In the US, such companies have also been sued for wasting consumers’ time, as many didn’t even end up getting a loan at all.

Some banks intentionally advertise higher rates as part of a controlled risk appetite strategy. These institutions aren’t trying to compete on price – they’re protecting their loan books by attracting a more stable, less price-sensitive segment of borrowers. By displaying higher advertised rates, they deter risky applicants who are purely rate-shopping and instead filter in customers who value speed, brand trust, or bundled services. So there isn’t anything inherently wrong. That is why you see them fluctuating from time to time. Did you think a bank suddenly got more competitive the next month? If your risk profile is good, even if Bank A advertised a higher rate, you might actually get a lower rate than what Bank B chose to advertise.

But when websites present these rates as "compared" offers, it can mislead borrowers into a false sense of comparison, as they fail to apply with banks that may actually give them a lower rate despite the higher advertised rate—causing consumers to pay extra.

Review and comparison websites have undeniably helped consumers move faster in decision-making, which explains why many loan intermediaries try to present themselves as such. But here’s the problem: your financial health is like your personal health. Several patients can see the same doctor and get different diagnoses. How much you are offered and at what rates depends on your credit profile. Think about it: would you lend a millionaire friend the same amount you would lend your own colleague? So how did this never raise questions, just because it was packaged as different shops selling at different prices?

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurers were trying to outmatch each other, and they increased the projections on their benefit illustration until it got to a point where it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in, and you know what we are trying to say here.

In 2010 the US enacted the Dodd-Frank Act to address the conflicts of interest that loan intermediaries such as loan brokers present and how they contributed to the mortgage crisis. However, despite that, a class lawsuit was filed just in 2024, where United Wholesale Mortgage (UWM) was sued for allegedly orchestrating a scheme with mortgage brokers to direct borrowers exclusively to its loans, regardless of better options elsewhere, resulting in 35 billions in excess fees. And that is with regulation. So, what do you think can be the case when there isn't?

We aren't talking about smaller players here, but listed companies or subsidiaries of listed companies where thousands of Singaporeans visit each day. So imagine what the smaller players are doing? They highlight a systemic issue within the loan industry, also evident among intermediaries like MoneySmart, Lendela, Roshi, and SingSaver. We are pushing for industry regulation to regulate loan intermediaries, including us - to ensure transparent loans ads and protect consumers. Add your voice here. Or sign our petition here. Many already have.

#Transparency #ConsumerProtection #YourVoiceMatters

Surely if a hair in your cai png is enough to make headlines on Stomp or Reddit, and if a wrongly‑made bubble tea order can spark a viral TikTok rant, then the way ‘comparison’ sites manipulate what you see deserves far greater outrage, no?

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.