Do MoneySmart really compare loans for you? See what their users and regulators are saying

Written at: 03 Oct, 2025

Not all review sites are what they claim to be—many are nothing more than sponsored listing sites, serving the advertisers that pay them, not you.

Across markets from the U.S. to Australia, regulators are finding that these platforms often prioritize results based on the highest payment, not on what’s truly best for the customer or consumer. And what you see isn’t always an unbiased comparison, but a filtered list bought by those who pay the most. From shopping comparison to insurance comparison, they are starting to come under scrutiny, and some Singaporeans have already found out the hard way.

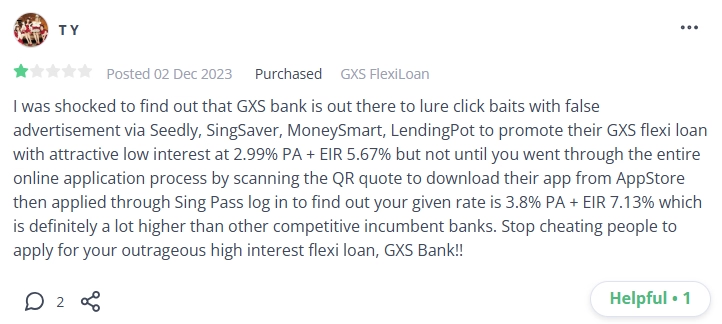

Credit: Public review found on Seedly, another so-called comparison website.

While general information, such as miles or points per dollar spent, is easy to research, loan amounts and interest rates are highly personal. They change from one borrower to another based on each individual’s credit score & profile. That rate they “reviewed” or “compared” for you is actually a teaser rate. Here’s how it works in detail.

Regulators in multiple jurisdictions have initiated legal actions or issued warnings against clickbaiting websites or advertising disguised as a comparison. In the article above, we’ve included examples—ranging from the U.S. FTC to Australia’s MoneySmart, their equivalent of Singapore’s MoneySense. And yes, it’s ironically called MoneySmart too!

But if you are pressed for time, you don’t have to read the article above; here is an image that says it all. One such comparison website accidentally called itself out by showing a TrustBank 2.22% teaser rate while condemning such rates as misleading!

Credit: Head of Lendingpot.

Still not sure if you should stop trusting comparison websites? Well, we think Trust Bank would at least think twice!

UK regulation enforces that 51% of customers get the advertised rate. Singapore hasn’t set such a standard. And rates alone don’t tell the story either—loan size and tenure matter too. A one percent loan rate sounds very attractive, but not if it’s only on $500 when you need $50,000, right? Or if only 1% of the borrowers actually get it. That means 99% of the customers would have wasted their time.

But the bigger problem is this: if you relied on a so-called loan “comparison” site and simply took the recommended option without checking elsewhere, you might have ended up paying thousands more. Another bank could have offered you a far lower rate. And again, we’ve explained in greater detail how this really works in the article above.

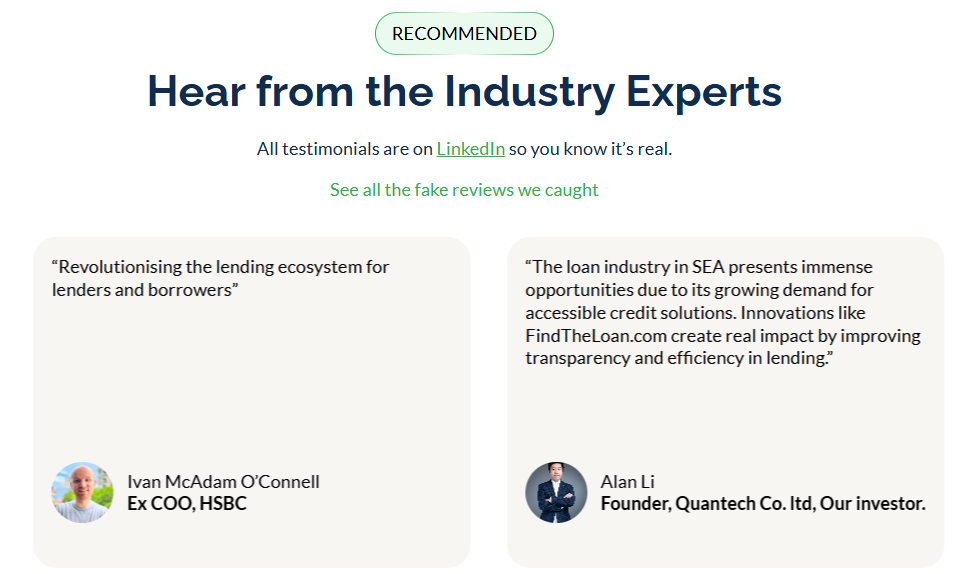

And thus we built FindTheLoan.com, Singapore’s 1st loan marketplace. Funded by Enterprise Singapore under the Startup SG Founder Grant - Instead of teaser rates or applying with multiple lenders one by one, you can reach multiple lenders at once with your actual documents, and they will make a full credit assessment as if you had walked in to them individually, and they will revert with their actual offer. The only difference is, you can do it in a few minutes instead of having to visit multiple lenders or their websites and furnish your details over and over again.

Don’t take our word for it—visit our homepage and check out the testimonials from industry leaders like the business transformation head of BNP Paribas to the Ex-COO of HSBC Singapore. All testimonials are also linked to their LinkedIn profiles, so you can verify they indeed left them.

Back to the UK regulation. Countries have regulated crowdfunding for at least a decade before us. Real estate agents not being able to represent both sides? A few. Loan brokers? The U.S. has had regulations on them for half a century! Singapore? None!

Our review of Lendingpot, MoneySmart, Lendela, Roshi, and SingSaver reveals how weak regulation here continues to let such problems thrive. As for loan brokers like Smart-Towkay & SmartLend, we even documented lies to borrowers with screenshots. We believe this systematic issue has persisted for far too long, across too many websites and entities. If you too agree that it is the case, we invite you to share your thoughts on this LinkedIn post or on our Reddit, TikTok, or Facebook post, if you prefer. We also exposed matters like fake reviews and other misleading claims, and we have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as more transparent advertising, greater consumer protections, and greater borrower protection. Weighing in there—and as more people share their thoughts—could finally catch their attention to do something about the industry and better protect borrowers. Every comment, repost, or show of support matters. It increases the chances that policymakers take notice and finally act. You can also help a friend or colleague from being misled.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

I mean, think about it: some of these companies have grown large enough to be listed companies. So think about how many borrowers they have served over the years this way?

--

Found this article helpful? Sharing it or leaving a quick comment here really helps us grow! Big Finance often drowns out smaller, independent voices like ours—but with your support, our message can reach further.

Follow us on LinkedIn here or Medium here to stay updated.

We’ve also covered loan brokers and what to watch out for when using them, highlighting the gaps between Singapore’s rules and global standards.

Share on: