Roshi – Once you see what we uncovered, you wouldn’t want to use it.

Written at: 30 Sep, 2025

Introduction

After we called out loan brokers like SmartLend, Smart Towkay, and Lendingpot for fake reviews and basically accidentally admitting that they had been misleading consumers and borrowers for years in one of our LinkedIn posts - industry players like investors and lenders have been asking us to evaluate if a website is “legit.”

We thus decided that doing a review instead would not just allow us to send an article instead of responding to each query back and forth, but also help educate the wider public on what to look out for should they wish to use Roshi.

Mission vs Reality

Their mission claims to make loan comparisons transparent. But let’s look at the reality.

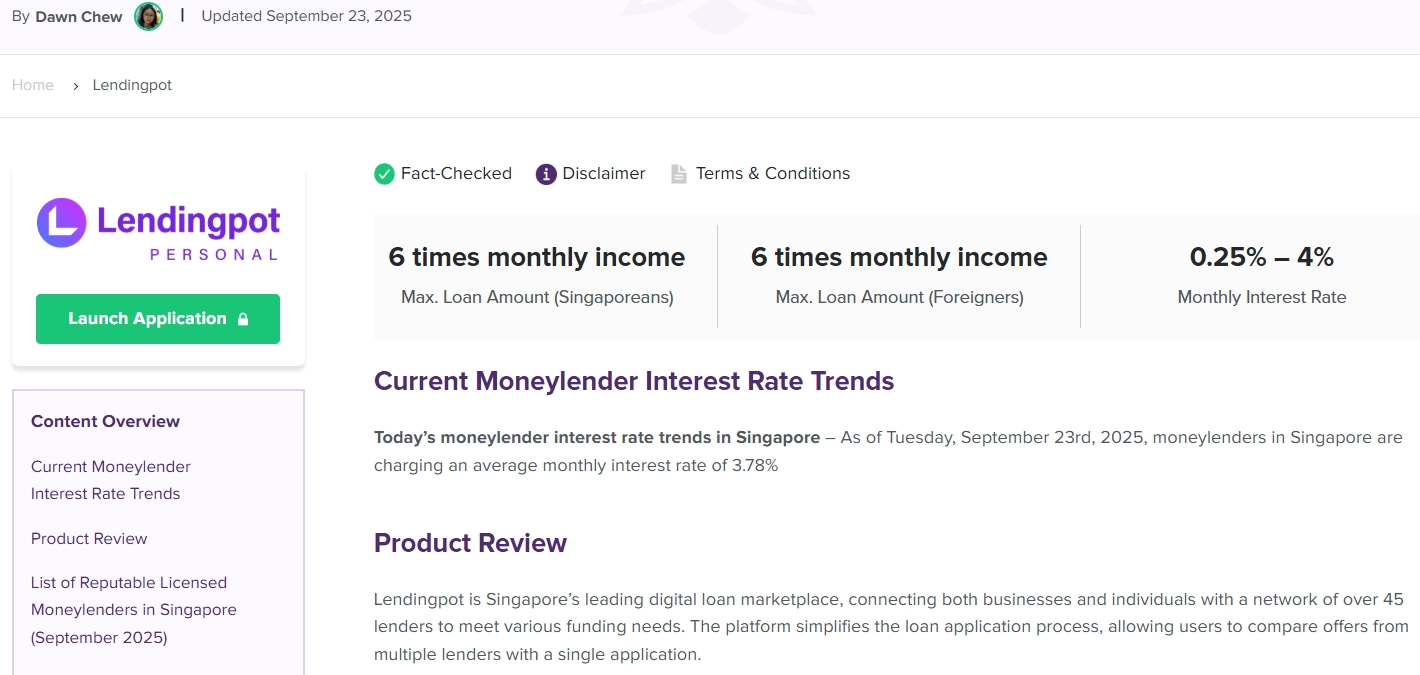

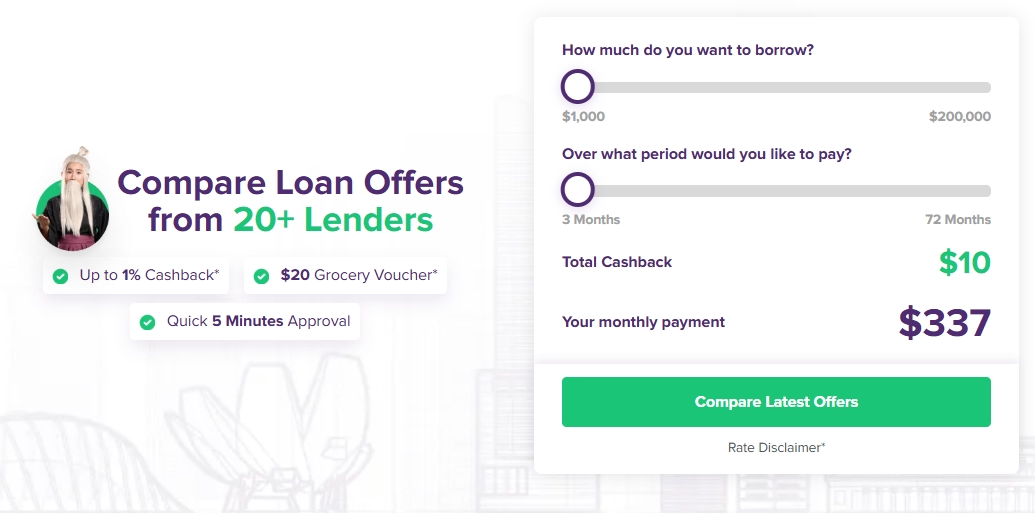

While it is the norm, from an SEO strategy, or when doing Google Search ads, to bid for keywords of competition so that when someone searches for certain keywords such as Lendingpot, your ads may appear, they seem to be giving the impression that you can also apply with Lendingpot, etc., via them too.

Their landing page gives the impression you can apply with those competitors via Roshi, with a launch application button clearly under Lendingpot’s logo— yet every button redirects to Roshi’s own sign-up page. Does that really look transparent or clickbaiting?

Marketplace or Broker?

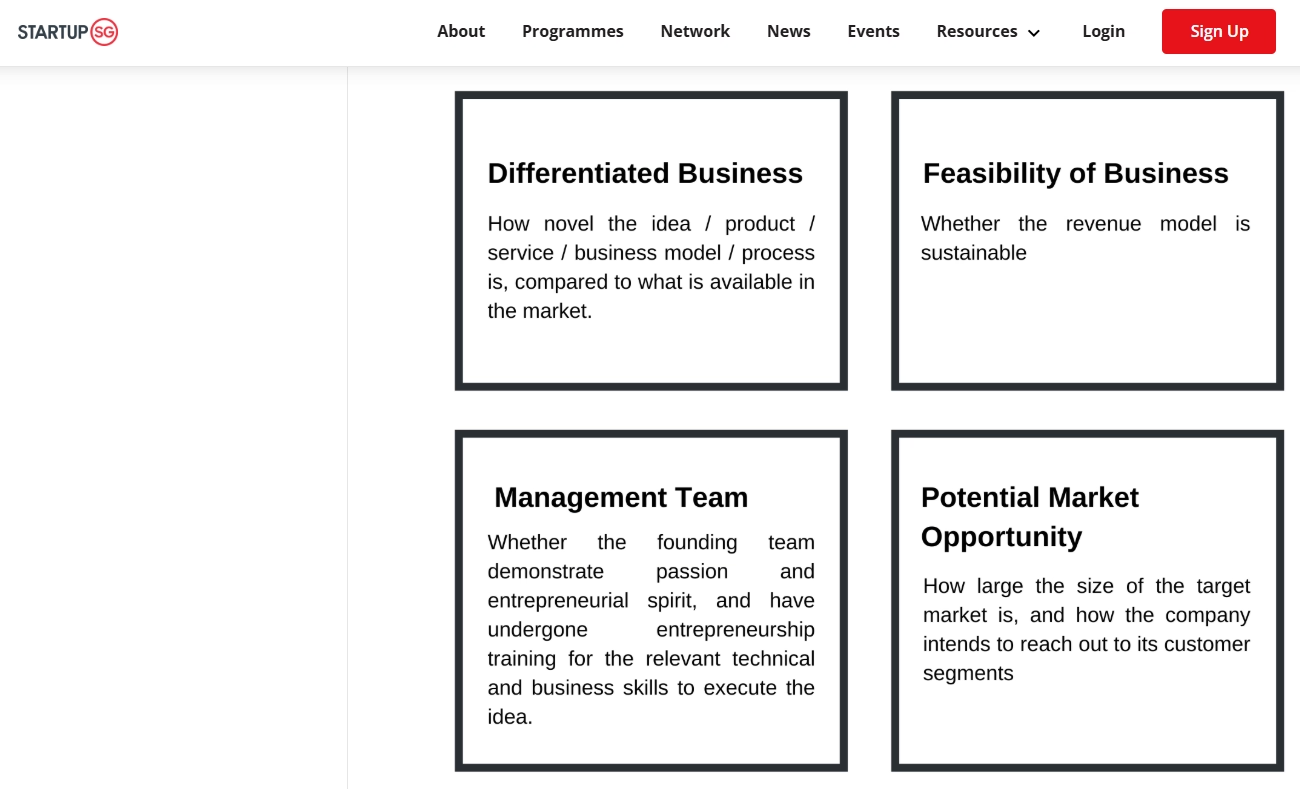

At one point in time they were counted among the five platforms that claimed to be a loan marketplace — or even the “first” in Singapore — like us. We won’t argue semantics; instead, we’ll let you determine what a genuine marketplace really is. What we can say with certainty is that when Enterprise Singapore awarded us the Startup SG Founder Grant, they did so because our solution offered something new. Since innovation is a key criterion for the grant, we know our platform is not only distinct but also validated from the very start.

Roshi have since changed to stating they are Singapore’s “favorite” marketplace, but on their homepage, they clearly forgot to remove the claim of being the original.

Out of the many “platforms” that have claimed to be Singapore’s 1st loan marketplace, Lendingpot and Lendala actually started before 2022. So clearly, Roshi is not the original.

There are tools to see the changes of a homepage and its previous versions. They started as a loan broker, then later claimed to be a loan marketplace, and then the first/original. Make of it what you will, but can you trust a loan intermediary to help you find the best loan when they are constantly flip-flopping on who they are? That ought to be a question you ask yourself first.

But if you consider them as a loan broker, here are some things you need to know.

The Problem with Brokers

At first glance, working with a broker sounds convenient. Why go through the hassle of visiting multiple lenders when someone else can do it for you?

But that convenience comes with risks. Brokers may not just prioritize whichever customer or lender benefits them most, not you, they’re the number one source of loan fraud—and you could be implicated without even knowing. After the 2008 mortgage crisis, the US passed the Dodd-Frank Act to rein in such abuses.

In Singapore and much of Southeast Asia, brokers remain unregulated. That’s why we created FindTheLoan.com—to replace conflicted middlemen with technology that connects you directly to multiple lenders yourself.

The 5-Minute Approval Claim

In this article, we explained why the loan approval process takes the time it needs. To minimize the risk of fraud (especially if the information was handled by a broker) and ensure that they have accurate information, lenders must verify the details you provide in your application. This can involve contacting your employer, reviewing bank statements, and checking credit reports. The verification process is crucial to ensuring that the information is correct and that the loan offer is based on a true representation of your financial situation.

As of 2022, the adoption rate of machine scoring is just 3% worldwide. So perhaps that is a small percentage of lenders that can revert immediately? In the UK, by law, if a certain low interest rate or approval time is advertised, at least 51% of borrowers must receive it. While not exactly illegal here, again, it is not very transparent, is it, to use a very tiny fraction of users’ experiences — if there are even any — as a key selling point?

But ask yourself, have you ever seen a bank advertising 5-minute approval? If a bank cannot even do it for their own customer, what makes a 3rd party able to do it if they have to first get the information from someone else first? And from multiple parties?

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurer were trying to out match each other and they increased the projections on their benefit illustration until it got to a point it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in. But it is not unheard of, even today, that an insurance agent, might try to pass it off as guranteed as either 5 or 9%, instead of projections, and you know what we are trying to say here.

From fake reviews to misleading claims, this is the unfortunate norm in Singapore and across much of Southeast Asia, where brokers remain unregulated. That’s why FindTheLoan was created — to cut out the middleman entirely. Borrowers can now apply directly to multiple lenders at once, instead of one by one, and without depending on someone who may not act in their best interest.

If you believe brokers should finally be regulated in Singapore, share your views on our LinkedIn post or on Reddit, TikTok, or Facebook. We’ve tagged MPs on LinkedIn who have spoken in parliament about stronger consumer protections. More public voices can compel them to act on broker regulation.

Remember the last screenshot from their homepage? The one with 5-minute approval, and they asked you not to be a fool? That wasn’t just cheeky marketing — it was a clear example of how borrowers are mocked while being misled. Well, if we’re really not fools, then the smart thing to do is speak up and push back against these tactics?

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

Join the conversation and weigh in through our social media channels: Facebook. Tik Tok. IG. LinkedIn. We have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections and more transparent advertising. If more people weigh in publicly, MPs may be compelled to act on loan broker regulation and borrower protections.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Share on: