While integrations like Singpass or Xero reduce some manual data entry, they typically only provide a limited set of information — not enough for full credit assessment. Most lenders still require additional details beyond what these integrations supply to complete the underwriting process.

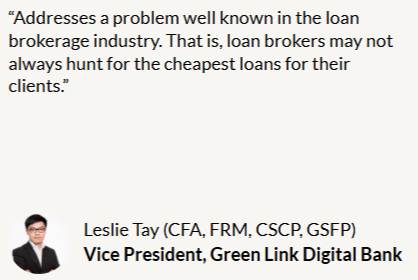

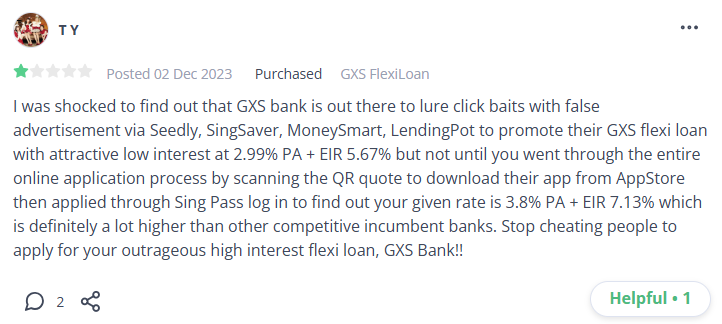

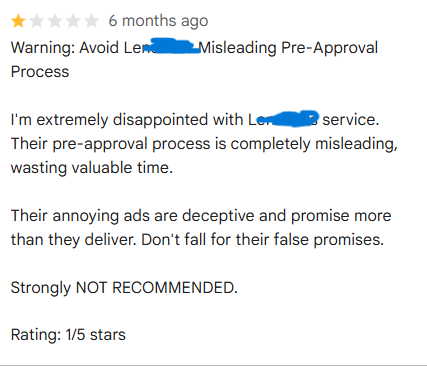

Websites claiming to offer “loan applications” entirely via such integrations may be using simplified underwriting, but without informing the customers that they might be paying more.

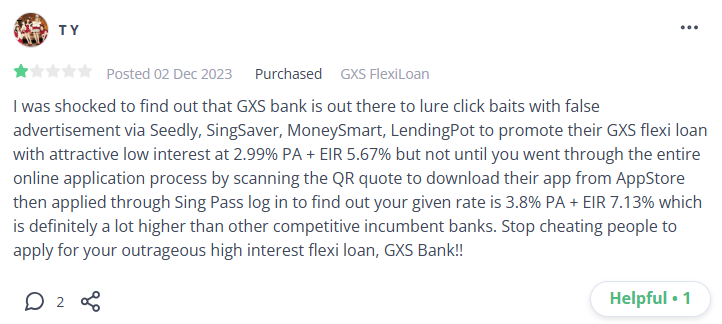

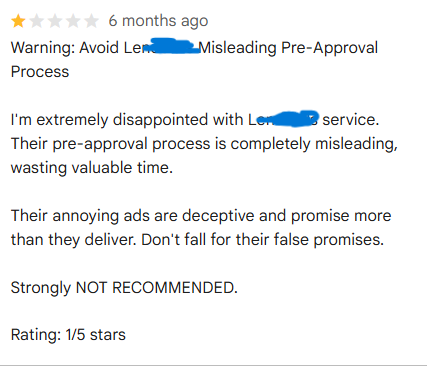

They could also be clickbait, giving you only an "indicative" offer where you head down to the lenders based on the indicative quote and, upon requesting your MLCB/CBS on the spot, have to turn you away due to your DSR. Or if their sole goal is to just get you into the door first, before asking for more documents, delaying your applications.

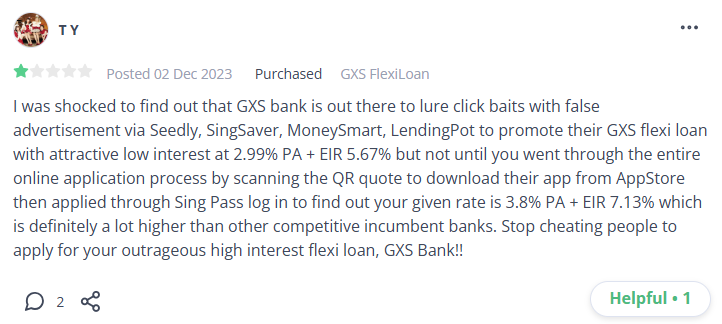

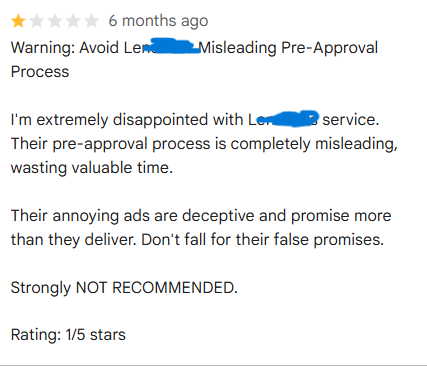

Credit:This is a publicly made comment that you can find on review websites like Google, Seedly, etc.

Many websites in the US have been sued for misleading "offers" and certain sales tactics. See examples of these incidents here and here.

That said, these integrations will still help reduce some manual field-filling on our platform, and we plan to integrate them soon.