Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.

You wouldn’t pick a loan blindfolded—so don’t.

Our blog helps you decode your options with real tips and insights.

Where Momentum Is Lost. The Quiet Problem of Coordination. Introducing our new product MeetWithMe.AI!

23 Jan, 2026 BY Daniel Tan

Most teams don’t lose momentum because of bad decisions. They lose it in the gaps between decisions. At FindTheLoan.com.com, we deal with complex, time‑sensitive conversations every day—borrowers, lenders, partners, investors, and internally, teammates. The actual work is rarely the problem. What quietly slows everything down is coor

Read MoreWhen AI Makes Content Publishing Easy, Financial Accuracy Becomes Hard

14 Jan, 2026 BY Daniel Tan

As artificial intelligence dramatically lowers the cost and effort required to produce written content, the volume of explanatory material now circulating online has grown at an unprecedented pace. This shift is often celebrated as a democratization of knowledge. Yet in practice, it also introduces a quieter but more serious risk: the widespread no

Read MoreWhat is a Credit report, and can you really get a loan without it?

26 Nov, 2025 BY Daniel Tan

A credit report is a comprehensive record of an individual’s or company’s credit history and financial behaviour (or lack thereof), compiled by credit reporting agencies using information from lenders, creditors, and other financial institutions. When determining if you are eligible for a loan or at what quantum or interest rate, lende

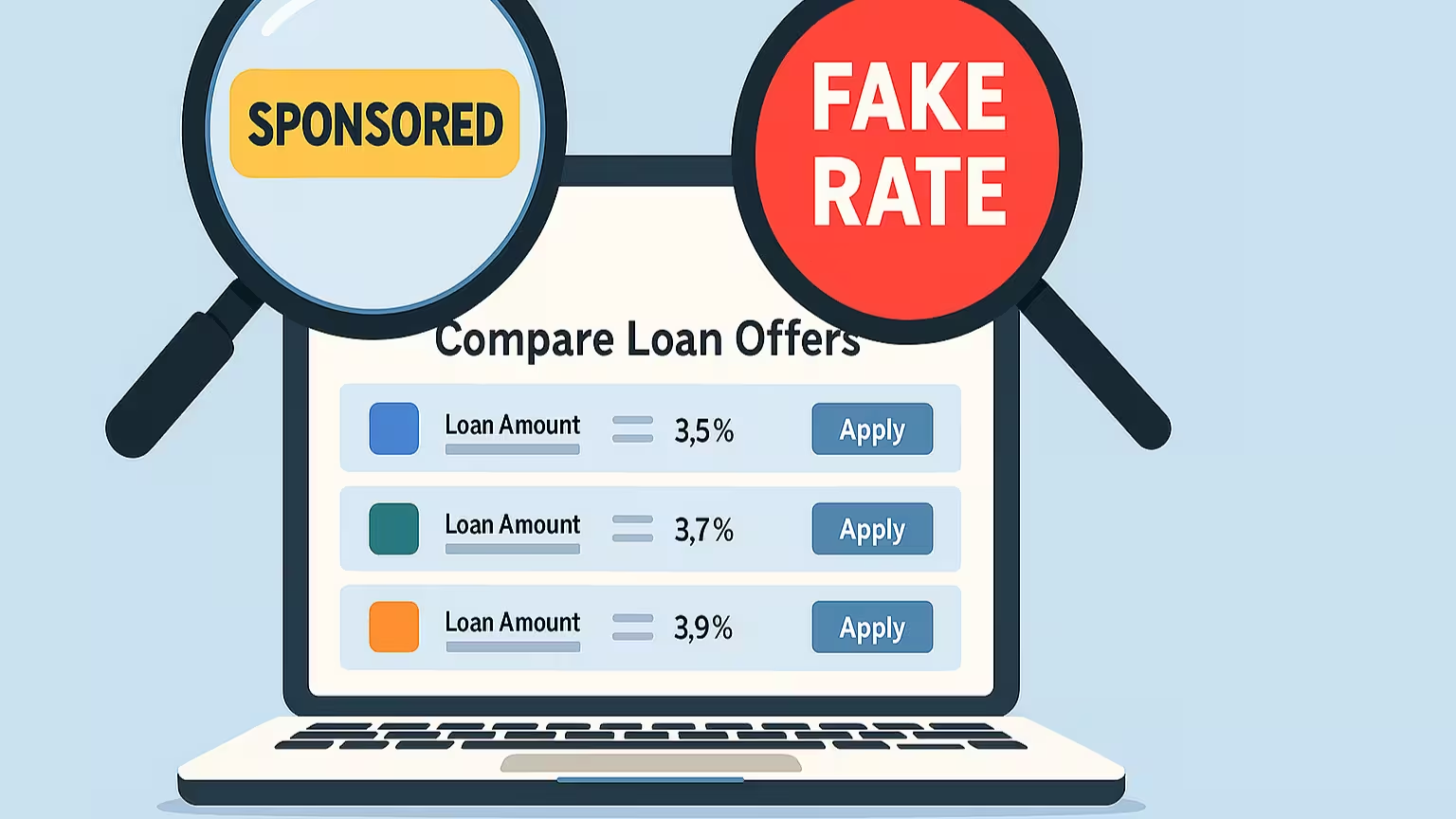

Read MoreBorrowers Are Being Misled at Scale. (And Why We Need Your Help to Stop Them)

20 Nov, 2025 BY Daniel Tan

The loan market is getting more confusing, and the public can no longer tell who’s being honest. We need your help, because this affects you more than you think. We started FindTheLoan.com with a simple goal. The subprime mortgage crisis and the many laws and lawsuits that regulators from the UK to the US have taken since then all point to t

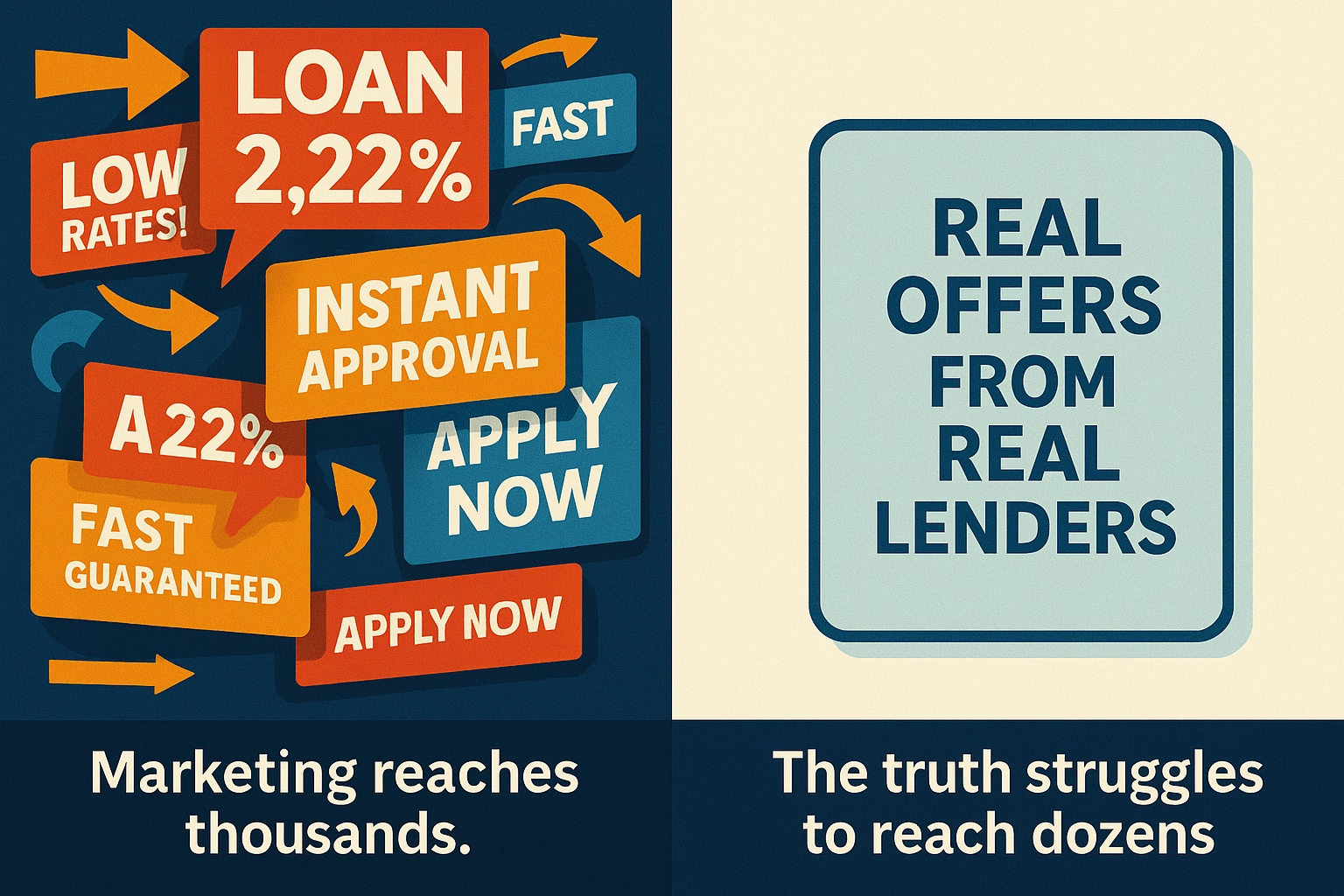

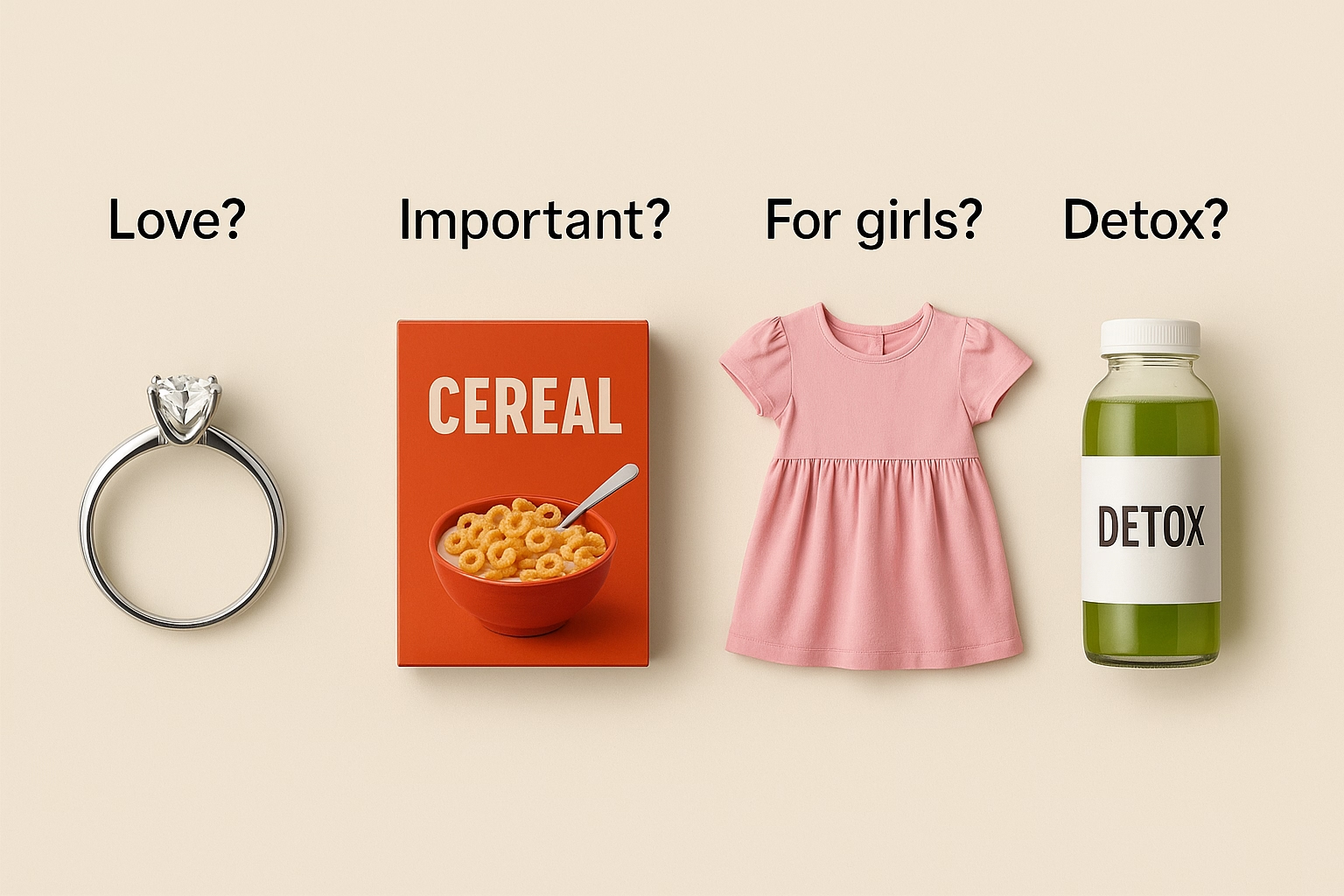

Read MoreFrom Lobsters to Loans: How Marketing Turns Myths Into ‘Reality’

18 Nov, 2025 BY Chen Huimin

Industries have always shaped what we think is normal, valuable, or "the way things have always been." Sometimes it’s harmless. Other times, it changes entire markets, behaviours, and spending patterns. One of the clearest examples is lobsters: once considered poor man’s food and even served to prisoners, they only became a luxury after

Read MoreWhy We Build Our Own AI Tools — And How You Can Use Them Too For Free

17 Nov, 2025 BY Daniel Tan

At FindTheLoan, we’ve always believed that AI shouldn’t just power products — it should make everyday work easier too. Over the past months, we’ve quietly built small internal tools that solve real problems our team (and many others) face daily. A few have proven useful enough that we decided to make them public for free. A

Read MoreWhy MAS’s New Digital Advertising Rules Matter — and Why Borrowers Should Pay Attention

30 Oct, 2025 BY Celest Teo

The Monetary Authority of Singapore (MAS) has released its new "Guidelines on Standards of Conduct for Digital Advertising Activities." They sound technical, but here’s why they matter: these rules are meant to ensure that ads for financial products — from bank loans to investment platforms — are fair, clear, and not misleading.

Read MoreWhen Banks Say No.

13 Oct, 2025 BY Celest Teo

When SMEs and borrowers think about business financing, banks are often the first to come to mind. But non-bank lenders are now playing an increasingly important role in filling the funding gap that traditional banks can’t always meet. 1. Non-banks serve businesses that banks can’t Banks are bound by strict lending frameworks. They pr

Read MoreFrom ChatGPT to Custom GPTs to AI agents, difference and how to take advantage of it now.

10 Oct, 2025 BY Celest Teo

Most ChatGPT Users Are Missing Its Best Feature Millions of people rely on ChatGPT daily to brainstorm ideas, write posts, or summarize reports. Yet, most never realize that ChatGPT can become something far more personal — a tool shaped entirely around your own tone, workflow, and goals. No coding required. That’s where Custom GPTs

Read MoreChatGPT Plus vs ChatGPT Team for your business.

13 Sep, 2025 BY Celest Teo

When people read up on ChatGPT Plus and ChatGPT Team (Business), the conversation often gets stuck on billing, usage limits, or access to agents like Deep Research or Codex. But here’s the truth: both Plus and Team already include those advanced agents. The real difference lies in collaboration — how work is shared, organized

Read More