Real Estate, Insurance, Loans - How Commission-Based Advice Can Work Against You

Written at: 06 Jun, 2025

Last Updated: 26 Sep, 2025

Whether you're buying a home, taking a loan, or getting insured — Do your advisor or agent recommend what’s best for you — or what pays them more?

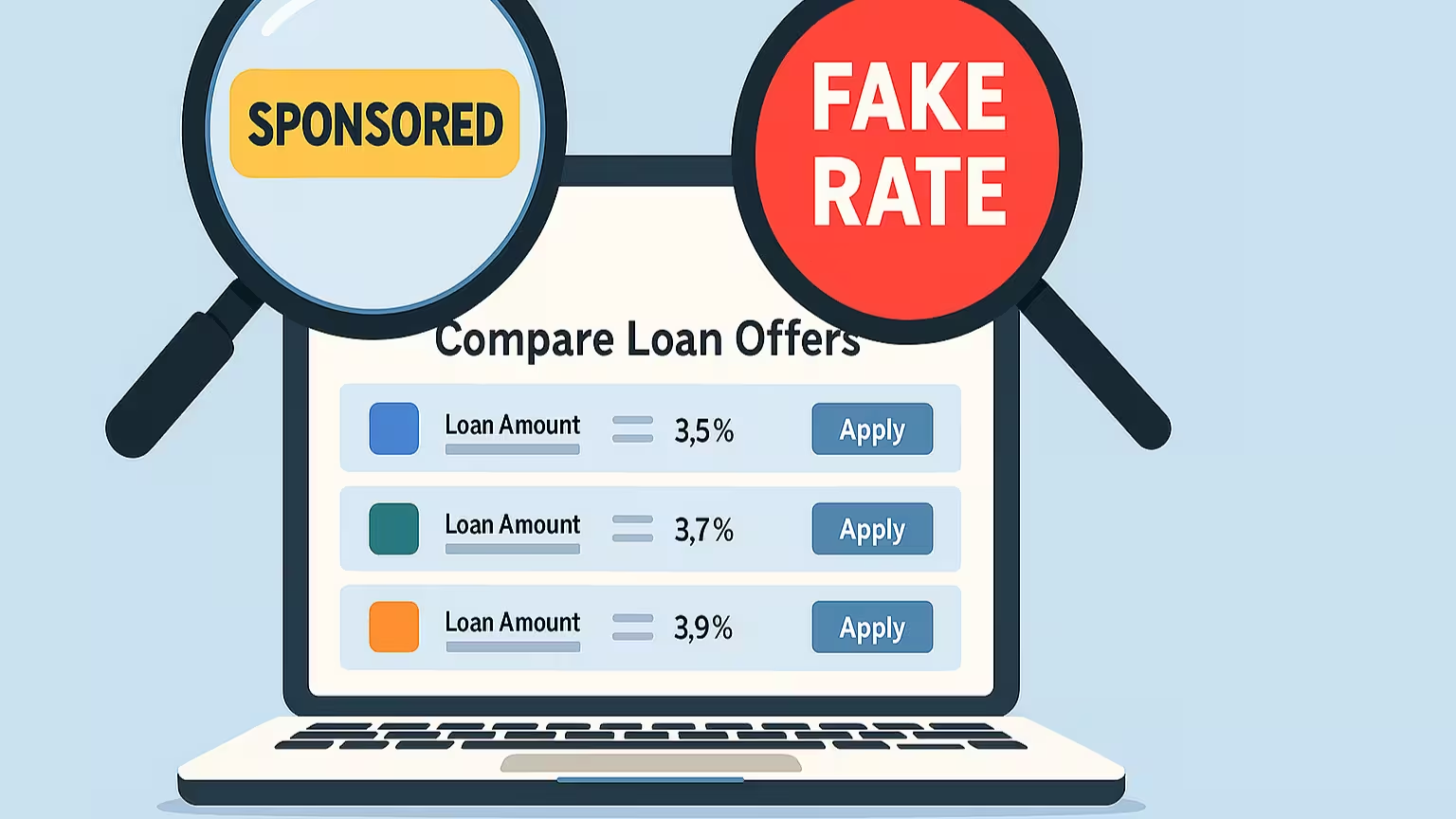

In many industries — including loans, insurance, and real estate — loan brokers and agents can earn different commissions depending on which product or provider they recommend. This creates built-in bias that may not always align with your best interest.

Across real estate, insurance, and financial planning, brokers often operate with hidden loyalties. While some act ethically, others choose profits over transparency.

Real-World Examples of Conflicted Advice

1. UK Motor Finance Scandal In the UK, a recent court case revealed that car finance brokers were secretly receiving large commissions for steering borrowers toward specific lenders. In many cases, the customer had no idea these commissions existed.

“The Court of Appeal ruled that brokers owe a fiduciary duty to customers... the commission is 'secret' and disclosure is required for informed consent.”

— Reuters, 2024

This case could open the door to mass claims from borrowers who were unknowingly charged more because of broker bias.

2. U.S. Mortgage Brokers Steering Clients to a Single Lender In 2024, United Wholesale Mortgage (UWM) was sued for allegedly orchestrating a scheme with mortgage brokers to direct borrowers exclusively to its loans, regardless of better options elsewhere. The lawsuit claims that brokers, under restrictive agreements with UWM, directed nearly all their business to the lender, compromising their independence and potentially leading consumers to more expensive loans.

“United Wholesale, according to the complaint, ‘corrupted a large swath of ‘independent’ brokers’ — using them essentially as employees who could steer borrowers to United Wholesale mortgages that were not in the best interest of the consumer.”

“United Wholesale imposes an ‘onerous and restrictive’ agreement on brokers... preventing brokers from presenting clients with the best mortgage deal.”

— Reuters, April 2024

3. Real Estate Dual Agency In property sales, some agents represent both buyer and seller — a setup known as "dual agency."

“In dual agency situations, the agent cannot fully advocate for both parties simultaneously.”

— Luxury Presence

The conflict? An agent gets double commission if they handle both sides — which might make them push a buyer toward in-house listings over better deals elsewhere.

4. Insurance Brokers and Commission Bias It doesn’t stop at property. Insurance brokers also face this dilemma. In Australia, for instance, brokers may be tempted to push high-commission policies.

“Insurance brokers who earn commissions... might guide their clients towards policies that bring them higher amounts.”

— Matrix Insurance

How to Protect Yourself

1. Request transparency:

Demand clear explanations for any recommendations made in writing. A credible professional will comfortably justify their choices without vague language.

2. Explore multiple options:

Don't rely solely on one advisor. Use independent platforms or marketplaces that send your application to several providers, ensuring a broader range of unbiased offers.

3. Read fine print carefully:

Scrutinize documents for disclosures about commission structures, affiliations, and exclusivity agreements that might limit your options.

4. Ask about affiliations:

Before trusting someone’s advice, ask if they’re tied to or owned by any of the companies they recommend. These relationships may influence what you’re offered — even if not disclosed upfront.

5. Be careful with exclusivity:

If someone asks you to sign an exclusivity agreement, ask what happens if you find a better deal on your own or what if they are not actively serving you after locking you in. You could be locking yourself out of better alternatives.

6. Don’t assume “more options” means actual effort:

Just because they say they know many providers doesn’t mean they’ll approach all of them. Ask where your profile or application is actually being sent.

Summary: Next time someone promises the "best deal," arm yourself with questions. Transparency isn’t just a preference — it’s your right. True peace of mind comes from knowing exactly who your advisor truly serves.

Why It Matters in Loans

When it comes to business or personal loans, these conflicts can cost you. A higher interest rate, hidden fees, or unsuitable loan term can make or break your financial goals. But if your broker is paid more for selling that type of loan, they might not tell you. Often they get your contact after a bank has rejected you and they appear to help you look else where. But it is exactly this relationship that creates a built-in incentive for brokers to favor certain lenders' RMs — not necessarily the best one for you.

At FindTheLoan.com, we’ve had lenders offer us higher commissions if we agreed to channel all applicants to them. We said no. Because the moment you accept that kind of deal, you're not a neutral platform or advisor anymore. You're a sales agent.

That's why we built a true loan marketplace. Your application is sent to multiple lenders, and they come back with real offers. You compare, you choose. No steering. No commissions. No hidden loyalties.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.