Make Honest Loans The Norm - Sign our petition to call for regulation to protect consumers.

Written at: 05 Aug, 2025

Last Updated: 14 Nov, 2025

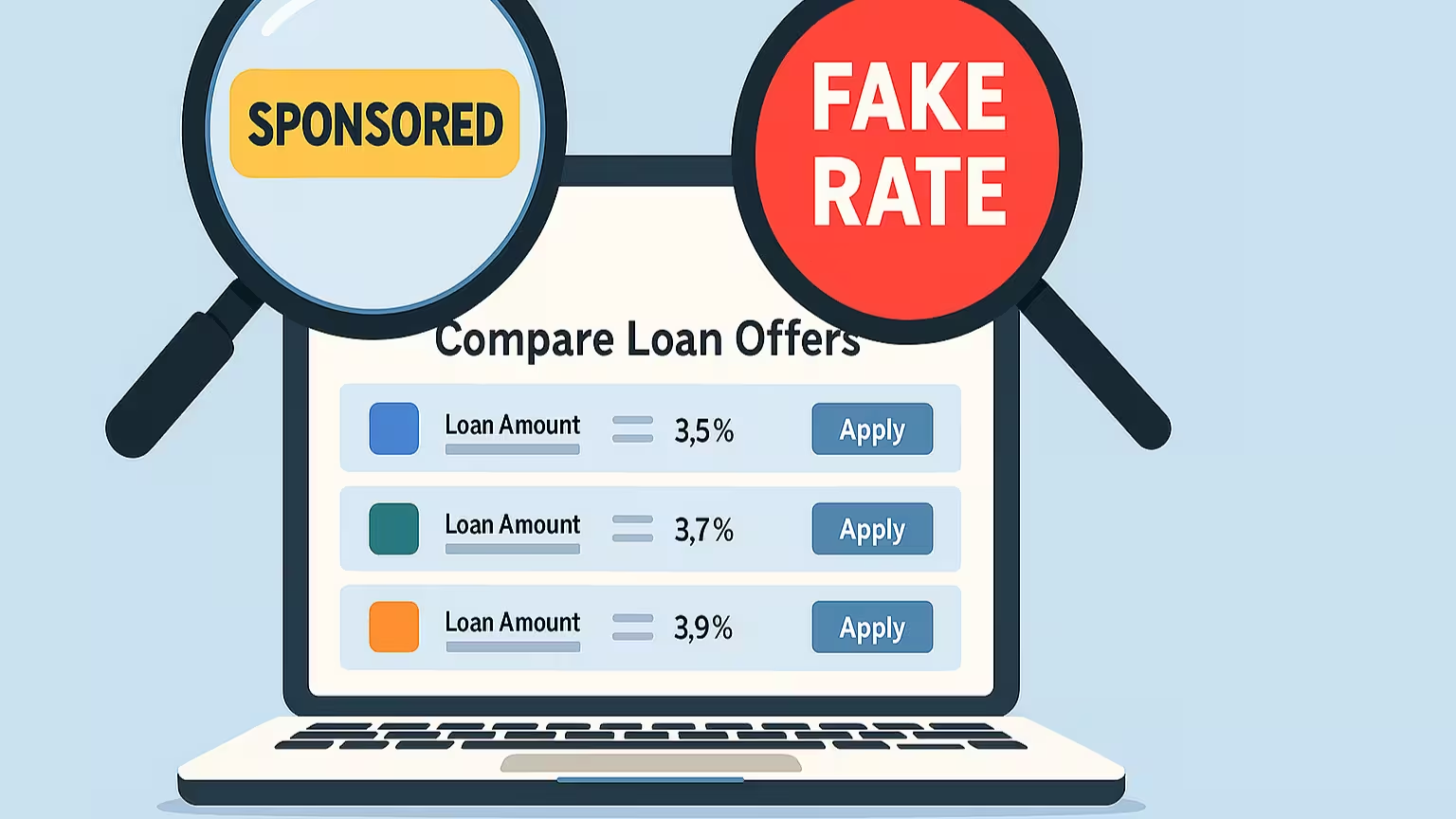

Ever been promised bold claims by a broker or clicked on an ad promising “low interest rates, or claiming to be “officially appointed by chambers”? You’re not alone. These clickbait tactics aren’t just marketing— they’re the frontline in a larger, unregulated war for your trust (and your wallet).

If we can even catch the ex-head of CIMB's smartlend/smart-towkay posting fake reviews, what do you think others with less to lose and no reputation to uphold are doing behind closed doors?

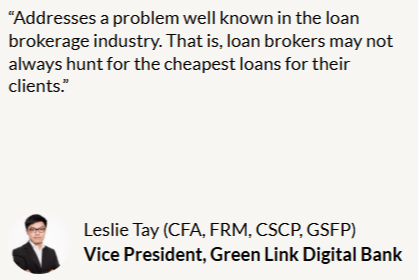

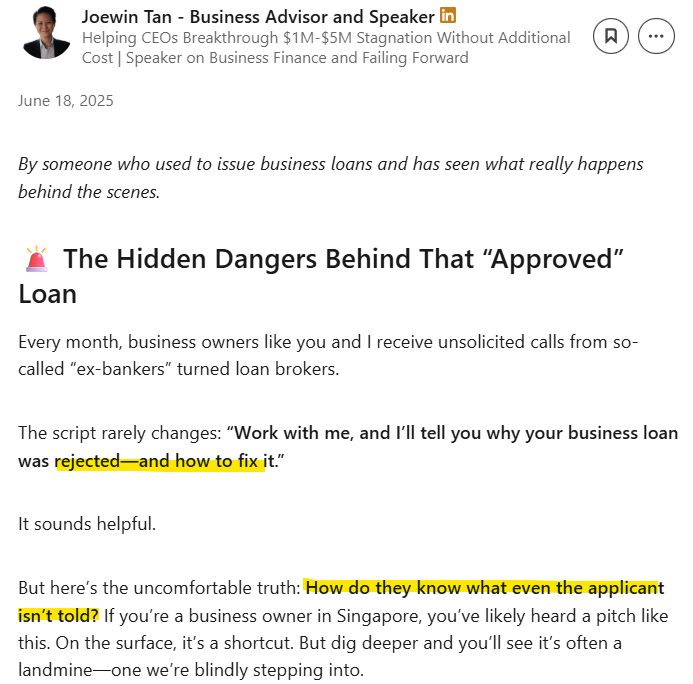

Even lenders that rely on them for sales are speaking up against them.

(This is a LinkedIn post made publicly available)

From misleading borrowers to broker frauds. We’ve spent 2 years arming borrowers with guides and insider tips to engaging a broker. But even the most vigilant consumer can be caught in a web of too-good-to-be-true promises. Why? Because in Singapore, loan brokers operate in a wild west with no real rules—no licensing, no training, no accountability. No one should need to be a CFA or industry insider to avoid being misled. The system should be designed so that ordinary borrowers are protected—by default.

It’s uncertain if our articles were blindly copied. But here’s something really interesting:Lendingpot itself admitted those offers were misleading—yet had been showing them for years and even left one up while calling it out. If a broker being a subsidiary of a listed lender is not a clear conflict of interest to you, what about the following and various contradictory claims we found?

But despite being called out, none of these companies have issued a public apology. In fact, SmartLend/Smart-Towkay — run by the ex-head of CIMB — doubled down and tried to manipulate the reviews further, while Lendingpot, last we checked, is still showing these offers despite the hypocrisy.

credit: Head of Lendingpot.

And why would they need to stop? The few borrowers who catch on are outweighed by the many who can’t spot the difference — making it all too easy for brokers to carry on as if nothing is wrong. Maintaining the image of being consumer champions, even as they quietly exploit borrowers and continue the same misleading practices.

Unlike tangible services where dissatisfaction is obvious, loan brokerage misconduct is harder to detect. If a borrower never knew a lower rate or better terms were possible, how would they know to complain? If they have no idea how the process works, how do they know they have been shortchanged or misled? This information asymmetry allows unethical actors to operate under the radar, leaving victims unaware that they've been exploited at all.

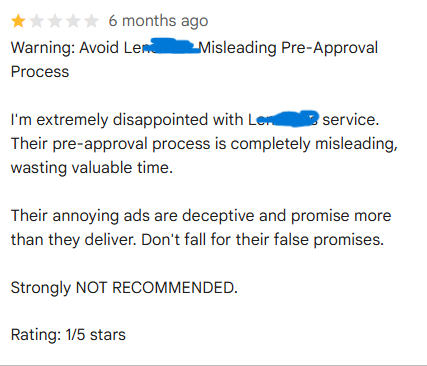

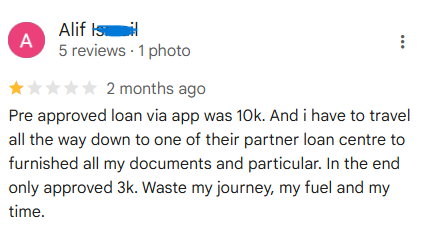

Even when the truth is in plain sight, borrowers who don’t understand how the process really works are just happy to get a loan — leaving positive reviews that end up burying the truth.

Credit:These are publicly made comments that you can find on Google.

Why Everyone Should Care: Beyond Individual Loss

This issue isn’t rare or hypothetical. 73% of SMEs and 1 in 3 Singaporeans have taken a loan at some point—which means millions could be at risk of overpaying or being misled by unregulated brokers.

Unchecked loan broker practices drive up borrowing costs, erode trust in the financial system, and hurt businesses and families across Singapore. When brokers earn bigger commissions for steering you into higher-interest loans or tack on hidden fees, borrowers end up paying more than they should. Without transparency or accountability, there’s no pressure for brokers to find you the best deal—only the deal that pays them most. This isn’t just a niche problem—it’s a threat to everyone’s financial well-being and to our country’s reputation as a safe place to do business.

The Broken System Behind the Bait

Unlike the US, UK, or Australia—where laws require brokers to be licensed, transparent, and act in your best interest—Singapore’s market lets anyone become a broker overnight. No oversight means fake reviews and bait-and-switch offers run wild. And while MAS and CEA have cracked down on car dealers, property agents, and employment agencies, loan brokers remain untouched—despite influencing life-changing financial decisions.

Even in tightly regulated industries like property agency, conflicts of interest and self-serving behavior still occur. For example, a Singapore property agent was fined $30,000 and suspended for 12 months for faking offers to earn a larger commission—a case reported by the Straits Times (source). In the world of loan brokering, where there’s no licensing, oversight, or even an opposing party for borrowers to check with, the risks are even higher. Borrowers can only meet who they are introduced to—making them far more vulnerable to abuse that might never be uncovered.

Even in places with regulation, the risk doesn’t disappear entirely. In 2024, United Wholesale Mortgage—the largest US mortgage lender—was sued for allegedly working with brokers to steer borrowers into more expensive loans, costing consumers billions in excess fees.

History shows just how costly loose oversight can be. During the US subprime mortgage crisis, loan brokers were heavily scrutinized for steering borrowers into high-interest, risky loans that contributed to the collapse. As a result, the Dodd-Frank Act was enacted, banning broker compensation tied to loan terms and requiring full disclosure to protect borrowers. If it took a financial meltdown to spark regulation elsewhere, it’s a clear warning for Singapore: the absence of rules leaves borrowers wide open to harm.

That is why we created Singapore's 1st loan marketplace; you apply to multiple lenders directly yourself.

What Needs to Change

Personal vigilance isn’t enough. Here’s what true reform looks like:

-

Mandatory licensing and ethical training for all loan brokers

-

Full disclosure of conflicts and commission structures

-

Enforcement against fake reviews, fake partnerships

-

Written, auditable KYC for every recommendation (so that both borrowers and regulators can see what advice was given, just like in banking or insurance). This prevents brokers from making misleading promises without accountability and ensures a paper trail if anything goes wrong.

Your Role in Shaping an Honest Loan Landscape

This isn’t just about you protecting yourself. It’s about standing up for a system where honesty is the default, not the exception. Sign our petition. Or share this article. Let’s demand a level playing field—so Singapore’s loan market works for everyone.

#StopClickbait #SGloan

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.