Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.

You wouldn’t pick a loan blindfolded—so don’t.

Our blog helps you decode your options with real tips and insights.

Mastering Cash Flow: Avoiding the Top 10 Pitfalls That Stifle Business

23 Sep, 2024 BY Grof.co X FindTheLoan

This article is co-authored by Grof Singapore and FindTheLoan.com. Effective cash flow management is the lifeblood of any thriving business. Yet, even seasoned business owners often stumble into unexpected financial traps that jeopardise their company's future. By understanding the most common cash flow management mistakes and proactively implemen

Read MoreHow Smart Borrowing Can Drive Success

18 Sep, 2024 BY Daniel Tan

Debt often carries a negative connotation. Stories of crippling student loans, overwhelming credit card balances, and companies folding under financial strain dominate headlines. However, it's essential to recognize that all tools can be used the right way or the wrong way. When managed wisely, debt can serve as a powerful tool to achieve goals,

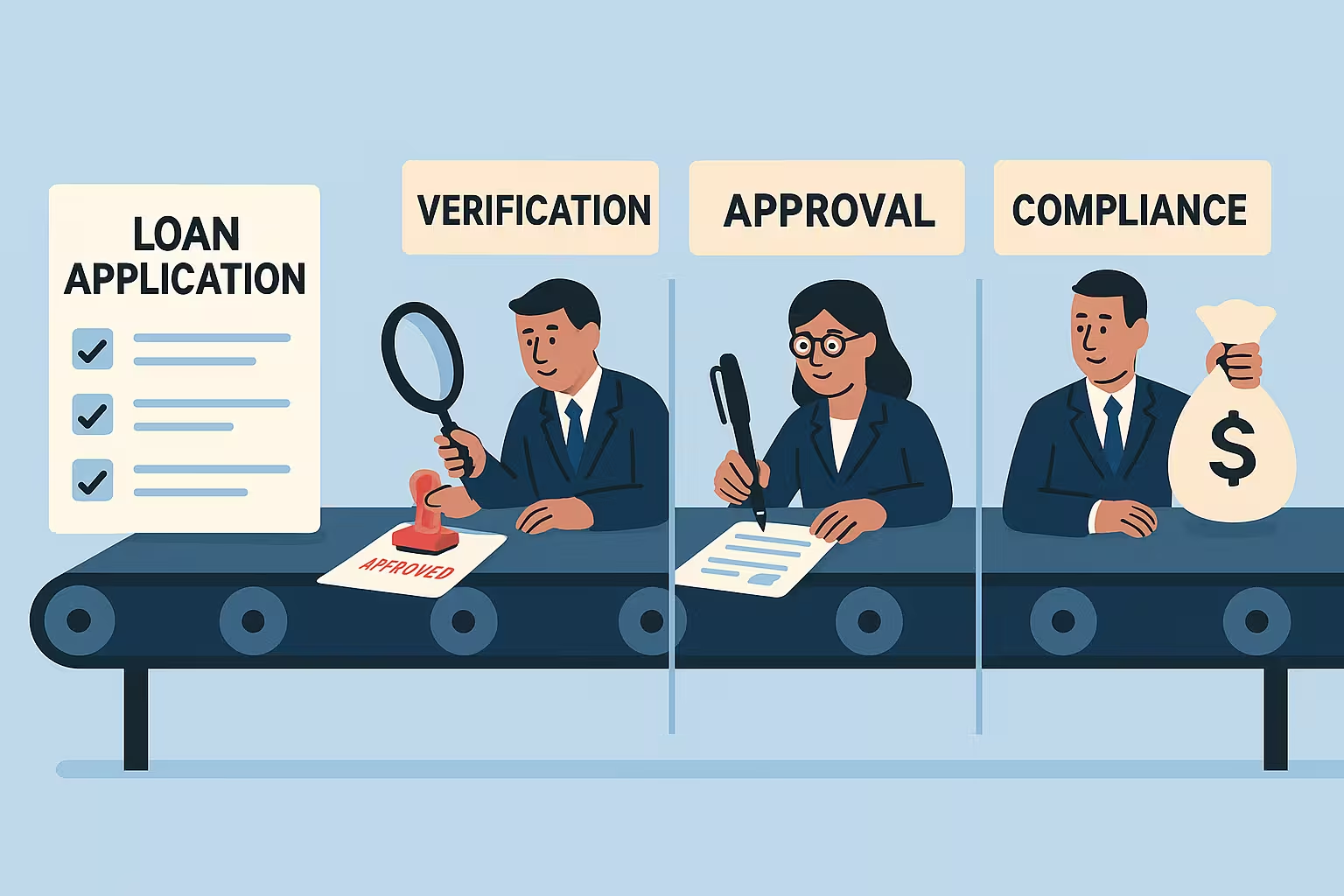

Read MoreWhy does the loan application process take so long?

11 Aug, 2024 BY Daniel Tan

Seen ads promising fast loan approval, and yet your experience is otherwise? Some lenders (especially the smaller ones) and especially brokers may care less about "misleading ads" (Singapore's advertising guidelines generally do not consider exaggeration as misleading, especially for non-healthcare products. Or if 1 hour applies only to a small su

Read MoreHow Personal Loans Impact Your Ability to Secure Business Loans And Vice Versa.

26 Jul, 2024 BY Daniel Tan

As a business owner, managing personal finances alongside business obligations is crucial, especially when it comes to securing additional loans. Understanding how personal loans affect your ability to obtain business financing, and vice versa, involves navigating through financial metrics like the Debt Servicing Ratio (DSR) and various lender poli

Read MoreIf a loan broker claims to be able to negotiate for you, walk away.

28 Jun, 2024 BY Daniel Tan

Program lending, also known as policy-based lending, formula-based lending, or checklist lending, involves providing loans based on criteria or guidelines set by the lender to help their credit officers make quick decisions and process large amounts of enquiries. Often brokers claim to be able to negotiate the interest rate for you to try to

Read MoreGrateful a loan broker was able to surprisingly help you get a loan when no one else was? You could be unknowingly participating in fraud.

30 May, 2024 BY Daniel Tan

Loan brokers originate, depending on the lender type, any where from 40% to even as high as 95% of a lender's sales in Singapore. In the US, they originate 65% of all home loans according to some surveys and is an industry that employs more than 400,000 people.Since a huge bulk of their sales come from them, apart from the lenders' salesforce and w

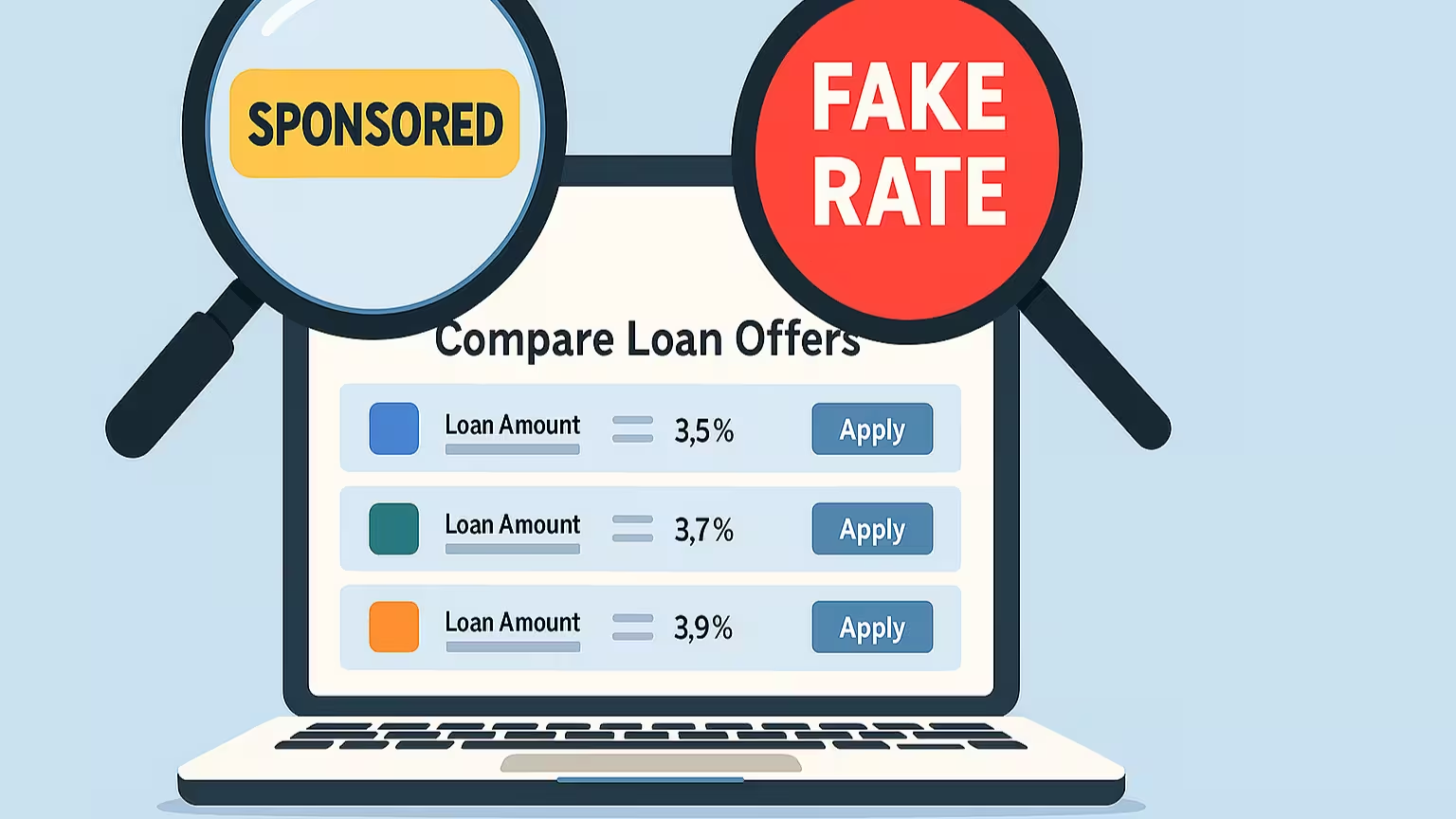

Read MoreOne Percent loan? Zero application fee? 50% storewide discount? Stop falling for clickbaits!

25 Apr, 2024 BY Lee Shuen Min

Recall the last time when you were drawn to a store with a sign "50% off" and you walked out shortly distastefully realising you were being clickbait? While there is the CPFTA & lemon law in Singapore, there are many loopholes, "dishonest" merchants are using to get around. Some retail stores get around this by offering huge discount

Read MoreThe inside out of invoice financing, PO, Contract and Project financing

05 Mar, 2024 BY Daniel Tan

The 4 loan types are covered together as they have similar features. You can jump to the specific part of the article by looking at the bolded keywords.1)You offered a client say 120 days credit terms, but as you need the cash flow now, you can take the invoice to a factor where they advance e.g. 90% (advance/finance percentage) for your cashflow n

Read MoreHow to improve on your credit score?

30 Nov, 2023 BY Daniel Tan

Tabulated by credit bureaus, a credit score or a credit report is a reflection of your financial behaviour and past payment history typically on your loan accounts, credit cards, and regular bills such as with telcos and utility companies, depending on the bureau and the relationship they have with the reporting companies. Depending on the loan ty

Read MoreWhy Reverse Factoring is the worst innovation for any business owner that offers credit terms to its customers

19 Nov, 2023 BY Daniel Tan

Reverse factoring is a type of supplier finance solution that companies/buyers can use to offer early payments to their suppliers based on approved invoices. Suppliers participating in a reverse factoring program can request early payment on invoices from the buyer or other financial institution, with interest or discount and with the buyer or supp

Read More