One Percent loan? Zero application fee? 50% storewide discount? Stop falling for clickbaits!

Written at: 25 Apr, 2024

Last Updated: 26 Sep, 2025

Recall the last time when you were drawn to a store with a sign "50% off" and you walked out shortly distastefully realising you were being clickbait?

While there is the CPFTA & lemon law in Singapore, there are many loopholes, "dishonest" merchants are using to get around. Some retail stores get around this by offering huge discounts on extremely selected items that nobody would want, and what you would decently want is still at full price. So technically they are not lying.

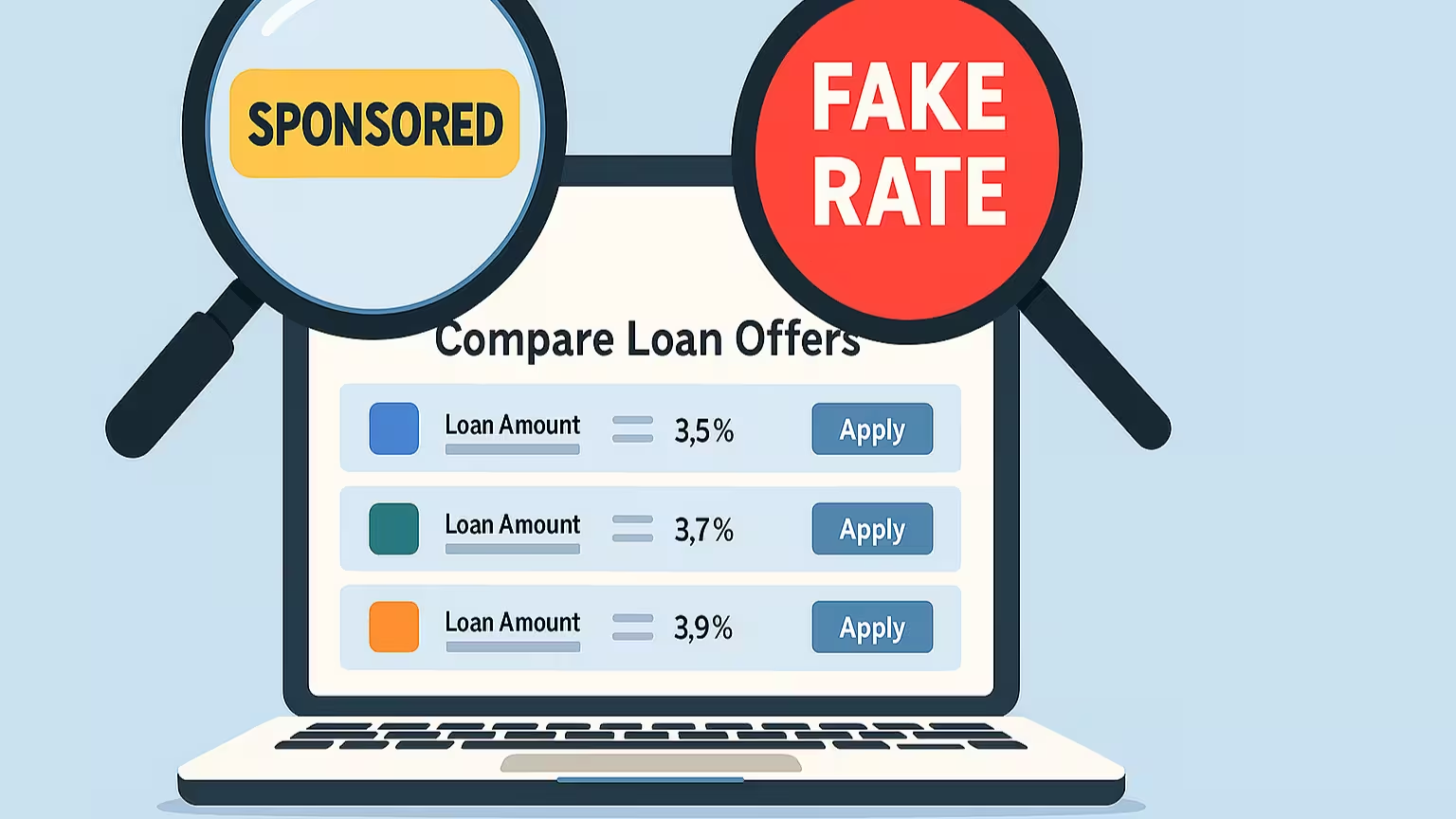

Here is how some comparison websites, brokers and lenders "could be clickbaiting" you too.

“Up to $$$” and “as low as 1%” mean nothing if they do not apply to you.

Taking your time applying for a loan and waiting days to know that you are being rejected is no fun, especially when you need the money urgently. While it is not as extreme as this where they touted pre-approved and were fined millions for “who wasted time applying for these credit cards and to stop making these types of deceptive claims” - we think such practices are worse as loans are a lengthier and a more serious need than applying for a credit card.

But enforcing it can be difficult as even just 1 person out of a thousand qualifies for a loan at $1 million or 1%, technically if it is true.

Not the complete picture. Even if you indeed can get a loan that was advertised at 1%, what about the tenure or quantum or fee? What is the purpose of getting a loan at 1% if the tenure is only 1 week or the quantum is minuscule and hardly helps you? For those adverts, where admin fees or such fees are waived, what if they just simply charge you more interest? Or claiming a 0% processing fee but charging you a higher monthly interest rate instead and your net cost is still the same(Though you will receive a larger loan amount upfront).

Simple vs reducing interest. Do you know a 4% simple interest over a long enough tenure is at times 8% reducing? While not necessarily a clickbait as simple interest are often used at times simply because it is easier to calculate, we still want to point it out to you, so that you do not go for a "cheaper" loan mistakenly because you did not compare them the right way or forgot to include the fees. To learn how to compare loans, click here.

Fancy loan types. Sometimes smaller or newer lenders may advertise, for example, medical loans to catch the attention of those from the medical sector. If you look closer, it is often still the same basic products such as overdrafts, working capital loans, invoice financing etc. So, if you see terms such as Startup Loan, Hiring financing, Marketing financing and E-commerce Seller Financing, they do not necessarily mean an actual loan type. You will likely find that you are being assessed the same way and being offered the same rate and the loan mechanism is the same. Brokers are another group of culprits serving these "clickbait". Unfortunately, as more brokers engage in false advertising, others feel compelled to follow suit, leading to a race to the bottom in terms of industry transparency. This situation ultimately disadvantages borrowers, who are sent on a wild goose chase, applying for "non-existent loan types" multiple times.

Want to see more fancy loan types and just how ridiculous they can be? Check it out here.

#StopClickbait #SGloan

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.