Lendela – you wouldn't use it after you see what we found.

Written at: 01 Oct, 2025

Lendela presents itself as a loan matchmaking platform that connects borrowers with multiple lenders, streamlining the loan application process. Users can browse and select from a range of personalized offers, with its intuitive interface making the journey quick and straightforward.

You were probably searching for things like, "Is Lendela safe or legit to use?" Well, "legit" or "safe" can be subjective, but here's what we found.

On Facebook, they boldly claim, “Lendela is Singapore's only platform for personal loan comparison. 100% legit, 100% simple, 100% transparent.” But is that really the case?

Other players — Lendingpot, SmartLend, and Smart-Towkay — have all positioned themselves as loan platforms, and they started around the same time as Lendela. (You can check the business entity's start date using https://opengovsg.com/corporate/201801220D.) While SmartLend and Smart-Towkay focus on business loans, Lendingpot does both. And let’s not forget websites like MoneySmart and MoneyHero.

So, is Lendela being untruthful, or are they simply so confident — perhaps even arrogant — that they dismiss all the other platforms?

Well, perhaps it's how one defines what a platform is. After all, there is no official definition of one. (This is how we define them, as well as what separates us from them.) But note that Lendingpot touts the exact same method, too. Log in using Singpass, and they can help collect your information to send to multiple lenders, from whom you can compare and find the best loan offer.

That looks like strike one to us. But what is important to you is next. Read on to see what their users are saying.

Speaking of Singpass, one of Lendela’s key selling points is that you can compare with multiple moneylenders, and all you need is Singpass(or at least some point in time). But do you know that for an accurate credit assessment, moneylenders actually need your MLCB/Moneylenders Credit Bureau report? That is not something that Singpass can furnish. It is a credit report controlled by the Ministry of Law. One would have to actually download it themselves. Though Singpass is what you use to sign in, it is a totally different website.

Just like you would look at a few things before you lend a friend money, any lender, bank, or moneylender would need to look at the “character” of the borrower when making a loan offer. We explain what character means in this article, along with the other 5Cs that a lender looks at when evaluating a borrower. But in a nutshell, just like you would assess if your friend is trustworthy or how heavily they are already in debt, lenders would need your CBS or MLCB, depending on the type of lender they are, to assess how much debt you have with other lenders. I mean, you can make $50,000 a month, but if you owe other lenders half a million, you are still going to have a hard time repaying the new lender, right?

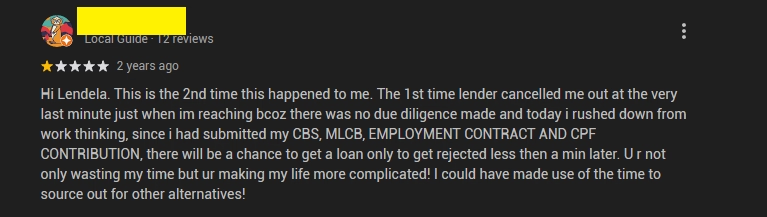

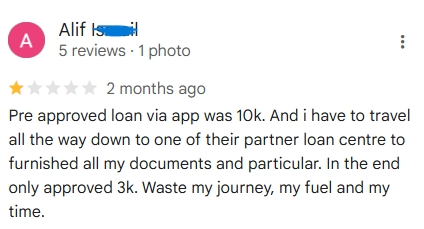

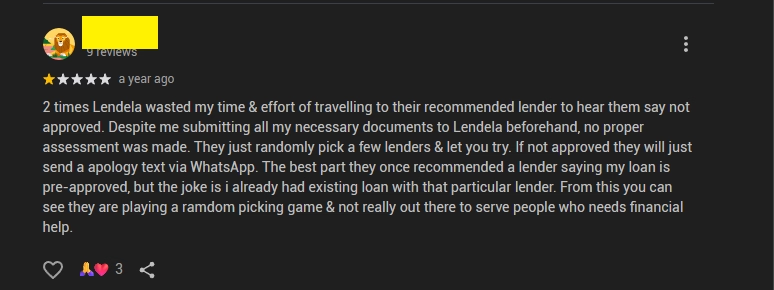

Take a look at these screenshots that you can find on their Google reviews, from their actual users.

Many users are saying the loan offers they got were not personalized at all, unlike what Lendela is claiming with their splashy TV ad on national TV. That is because the lenders did not receive their full documents to make an assessment? So, are those just some random numbers pulled from the sky? Just what is really happening? Well, in many countries, such processes or advertising methods are considered clickbait or misleading, and a number of them have already been sued. You can see those examples here.

Should that be strike 2? We’ll let you be the judge. Scroll through their reviews and you’ll find plenty of similar ones — only buried beneath the many positive ones left by users who didn’t fully understand how the platform works.

Many users are praising them for their help, and that when the 1st lender failed, they were successfully able to help them reach out to another. So, perhaps you might still be able to get a loan. But were you really comparing? And isn’t that why you used their platform?

Or were you just happy to get a loan? If you really want to compare and Find The Loan you need, consider us instead. We collect all the documents that a lender needs, and yes, you have to download and attach your credit report.

If you like to, you can also consider the other platforms we mentioned above. But from being caught for fake reviews to accidentally admitting that they have been misleading borrowers for years, you might want to check out what we found on this LinkedIn post first.

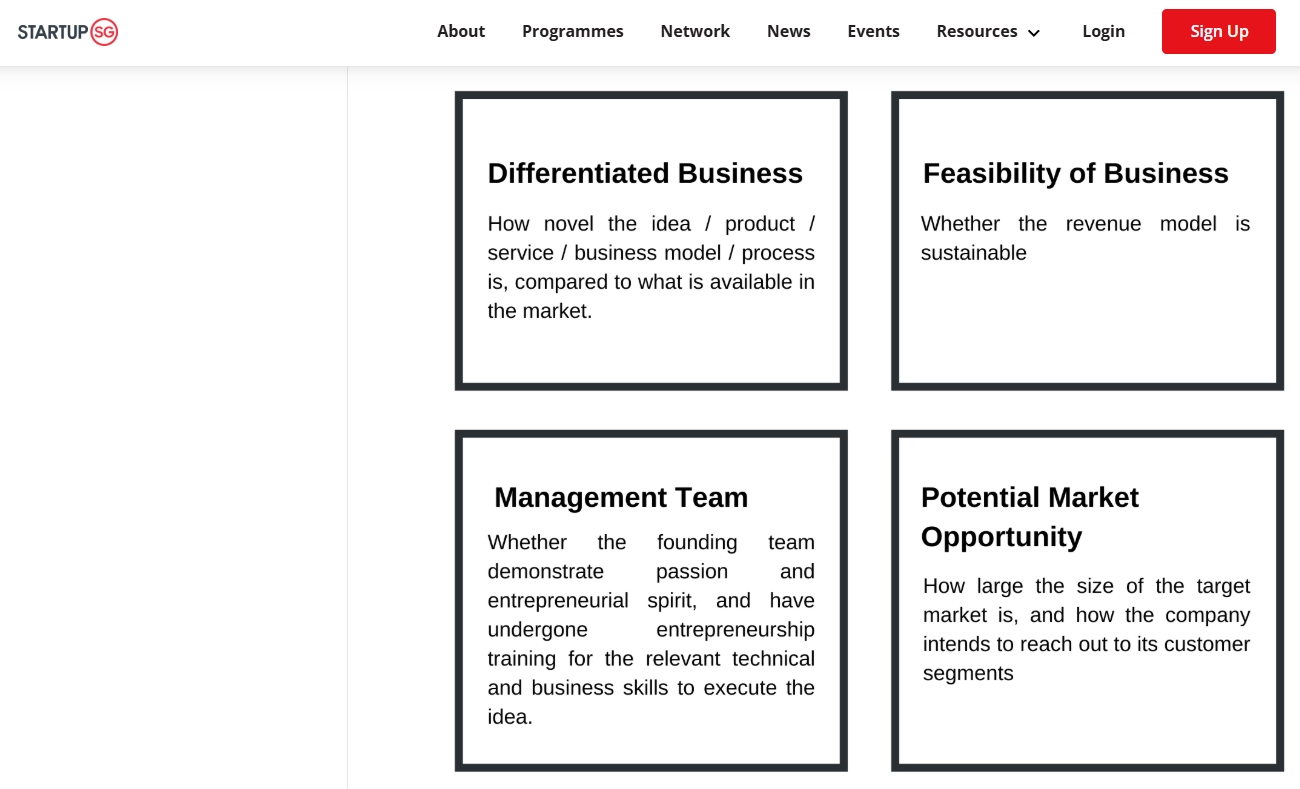

Are we the true platform and first loan marketplace in Singapore? Well, that depends on how you define what a platform or a marketplace is? All we can say is we received the Startup SG Founder Grant from Enterprise Singapore, which gave us seed funding to kickstart the platform. Since one of the requirements is that recipients must bring forward a new innovation, we know our platform is truly unique.

From testimonials from the ex-COO of HSBC to the Business transformation head of BNP Paribas. You can see them on our homepage.

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurer were trying to out match each other and they increased the projections on their benefit illustration until it got to a point it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in. But it is not unheard of, even today, that an insurance agent, might try to pass it off as guranteed as either 5 or 9%, instead of projections, and you know what we are trying to say here.

And if you believe these platforms are misleading and more people should speak out, we welcome you to share your thoughts on any of our posts on Facebook. Tik Tok. IG. LinkedIn where we posted about it. If multinational companies and subsidiaries of listed companies can be flagged with such practices, what do you think is the state of loan advertising in Singapore, and what are the smaller players willing to do? We have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections. If more people weigh in publicly, MPs may be compelled to act on loan broker regulation and borrower protections.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Share on: