Lendingpot – Once you see what we uncovered, you wouldn’t want to use it.

Written at: 30 Sep, 2025

Introduction

Lendingpot claims to be a leading loan marketplace in Singapore. We dug deeper into their origins, ownership, and claims so you don’t have to.

Ownership and Origins

Lendingpot is a subsidiary of IFS Capital, a non-bank lender that specializes in secured property loans. IFS also has other subsidiaries, such as one that specializes in invoice financing. The end-to-end process for a borrower or applicant is more tech-focused rather than speaking to a relationship manager from IFS. And as such, they are more keen to deal with smaller invoices rather than rejecting them.

The move to create multiple subsidiaries was due to a new CEO, one coming from a tech background and wishing to change the culture of the company, who encouraged the company to use tech to improve its process — a commendable and strategic move. Though at the point in writing, we are seeing varying success across the various subsidiaries, and some have even closed down or changed CEOs at the subsidiary level.

The reason why we are so familiar with Lendingpot’s origin story are that their founder, Eric, actually approached our founder to help build it. Given that tech resources are still shared and housed under IFS, and without someone with tech know-how, our founder believed it would be like trying to do a renovation without an interior designer, while coordinating directly with carpenters and electricians who have no accountability towards the outcome of the product. But of course, there’s more to why he turned it down and started FindTheLoan.com instead — read on to find out and why you should be concerned.

Being under the company of a parent and grandparent, which are both listed companies, has definitely allowed them to more easily reach out to banks and lenders to work with.

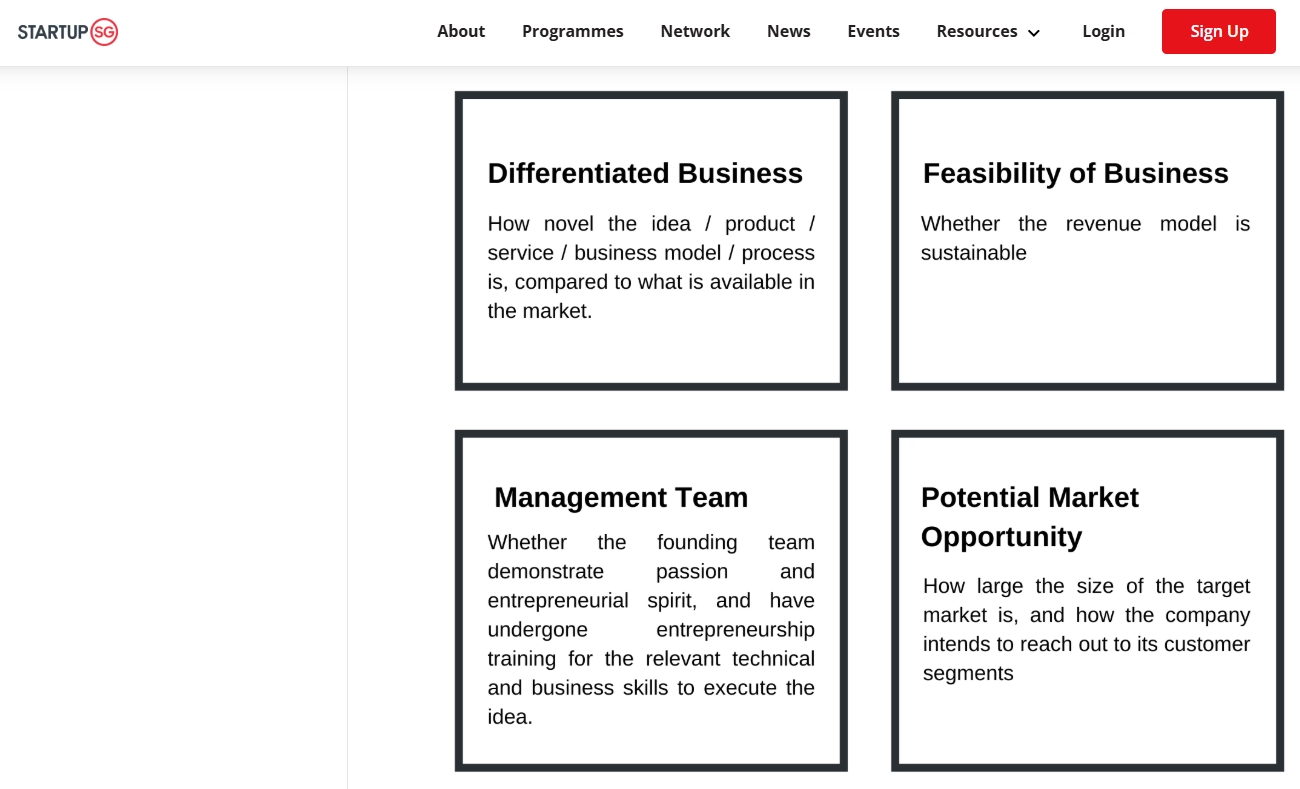

At one point in time, they were one of the five other platforms that claimed to be a loan marketplace or Singapore’s first loan marketplace, like us. But we let you decide what a marketplace is instead. As a recipient of Enterprise Singapore’s Startup SG Founder Grant, where we received seed capital to start the platform, we are at least confident that our platform is unique, as one of the criteria for recipients is that it must be a new innovation.

Whether they are brokers or falsely claiming to be a marketplace, one very concerning fact is that they are owned by a lender, and their independence in looking for the best rate for you becomes harder to ensure, because a platform tied to a lender may not always be able to act with full neutrality in the borrower’s best interest. IFS Capital’s shareholders also include Philip Capital, which also operates a moneylender business.

And this is the reason, despite multiple lenders wanting to invest in us, we turned them down and actually had to take another year before we finally found investors not from the lending space. In fact, multiple lenders shared with us that they contemplated setting up a loan brokerage themselves, but were worried about the optics of the conflict of interest. If “your’ broker is owned by Lender X, do you think they’ll really push Lender Y’s cheaper loan 1st or?

While lenders that decide to work with us often lament that when the borrower’s information reaches them, it can be 1-2 weeks later, we have no direct evidence of that being the case from borrowers yet. But it could also be because we seldom talk to our users, since our loan marketplace is a tool built to take the middleman out of the question, and borrowers can apply to multiple lenders directly themselves, instead of one by one or having to rely on someone who may or may not work in their best interest — and users usually only contact us when they face an issue with using the tool.

But here is some more info that we found, since they have a new CEO after Eric left to join PwC, that you may want to take into consideration if you are keen to try out Lendingpot.

Contradictions

credit: Head of Lendingpot.

We have no idea why Lendingpot is calling itself out. But for more of their contradictions, click here! (LinkedIn post) Interestingly, they even echoed our articles about the conflicts of interest, despite being owned by IFS Capital themselves, while IFS has another subsidiary that is another lender, called Friday Finance.

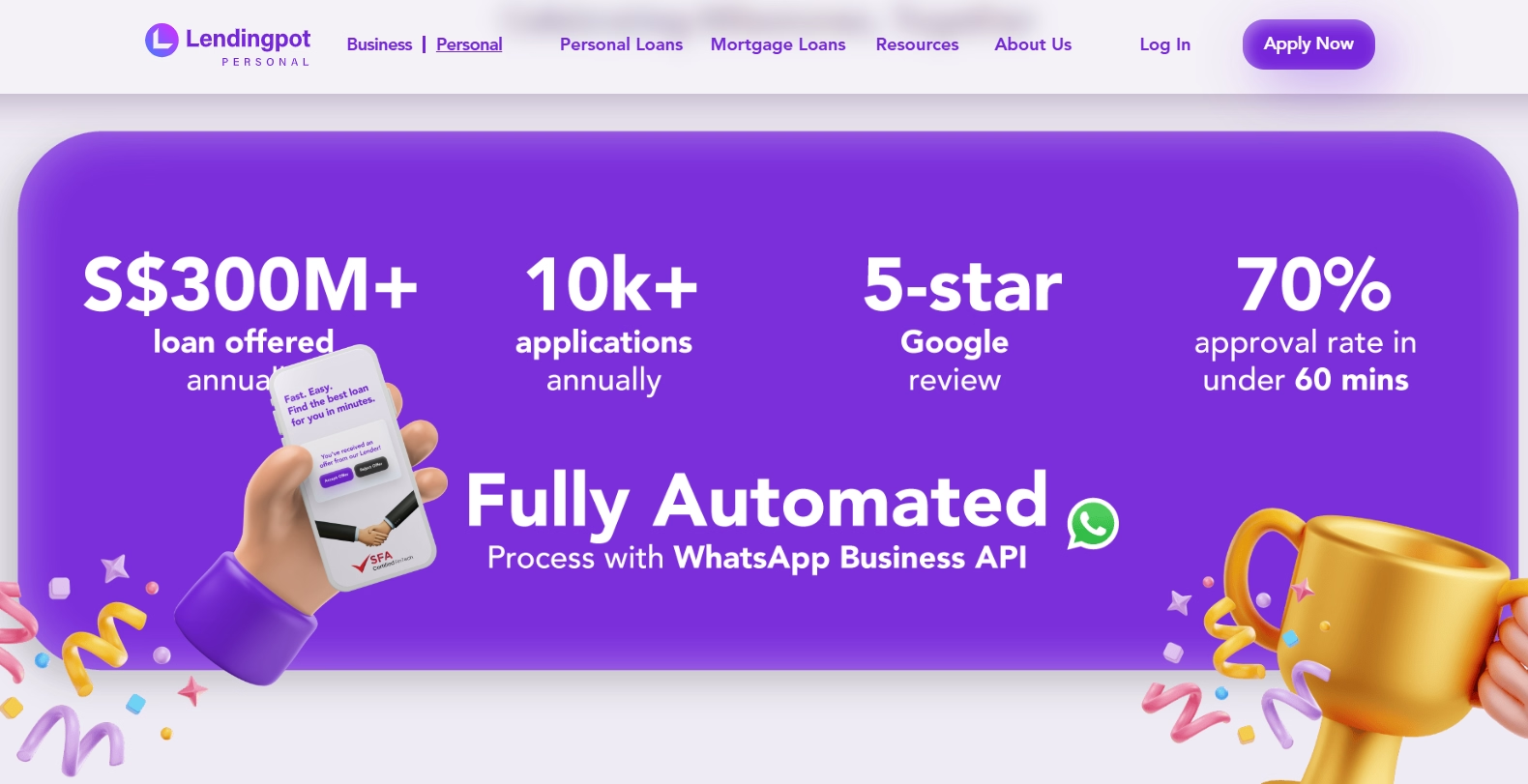

On their website, they also touted that 70% of their users get a loan within an hour.

In this article, we shared in detail the loan process and why it takes the time it takes. Perhaps lenders pay them special attention? But if you think about it, even if just 30% of the people apply after office hours, that is as good as saying 100% of the users get a loan within an hour. And that is not even including weekends.

Final Thoughts

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurer were trying to out match each other and they increased the projections on their benefit illustration until it got to a point it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in. But it is not unheard of, even today, that an insurance agent, might try to pass it off as guranteed as either 5 or 9%, instead of projections, and you know what we are trying to say here.

If you think something doesn’t look right, we invite you to share your thoughts on the LinkedIn post above or on our Reddit, TikTok, or Facebook post, if you prefer. However, we have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections. Weighing in there, and as more people share their thoughts there, could finally catch their attention to do something about the industry and better protect borrowers. Every comment, repost, or show of support matters — it increases the chances that policymakers take notice and act.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

And until then, if you are thinking of using a loan broker, we suggest reading this article to arm yourself with the know-how to protect yourself and ensure that they are working in your best interest.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Share on: