SingSaver. Objective loan comparison? Here’s what regulators have to say.

Written at: 03 Oct, 2025

Many so-called loan comparison websites or platforms present themselves as neutral guides for consumers. They claim to simplify choices and help borrowers identify the 'best' loan or financial product. But dig deeper, and the picture is often far less objective. In practice, what many consumers see is not a fair playing field, but often, advertising disguised as comparison. Around the world, from the U.K. to the U.S. and Australia, regulators have flagged this issue repeatedly. Their investigations reveal that what is marketed as a helpful service often hides commercial arrangements that distort results.

In the U.S., the Federal Trade Commission (FTC) has pursued websites that steered traffic toward advertisers under the pretense of independent reviews. Similarly, in Australia, the Australian Securities and Investments Commission (ASIC) has warned that so-called 'comparison' portals sometimes operate on a pay-to-play model. And in the U.K., the Advertising Standards Authority (ASA) has intervened when promotional content blurred the line between impartial advice and paid placement. These cases illustrate a consistent theme: Instead of being shown an objective list of loan options, customers are presented with a curated display determined by which lender pays for visibility.

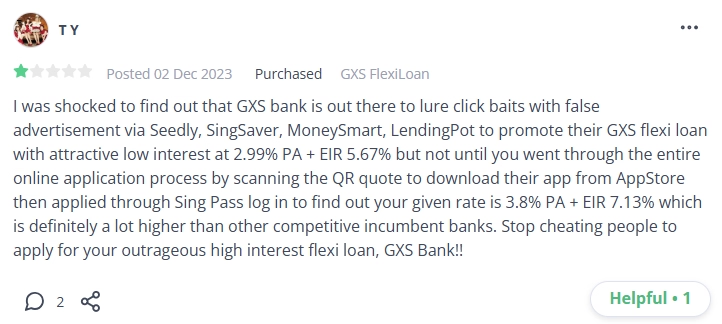

And some Singaporeans are already calling them out.

Credit: Public review ironically found on Seedly, another so-called comparison website.

Loans raise even more serious concerns than products like credit cards or insurance because the terms are deeply personal. Two borrowers with similar profiles might receive very different rates depending on subtle details in their credit history. That’s why seeing a single rate advertised online can be misleading. It may not reflect what most applicants will actually get. In fact, the rate you see is often just a promotional figure, commonly referred to as a teaser rate. These teaser rates are designed to attract clicks, but they rarely represent the actual loan terms you’ll qualify for. Regulators in multiple jurisdictions have sued or issued warnings against sites that rely heavily on such practices. And while a frequent defense is that the fine print discloses the limitations, most consumers never notice it until it’s too late.

Context is critical. Loan pricing depends heavily on each applicant’s credit score & profile. Without knowing your actual financial standing, any advertised figure is just theoretical. A 1.5% loan interest splashed across a banner might apply only to top-tier borrowers with near-perfect histories. For the average consumer, the reality could be double or triple that rate. And because these sites rarely clarify who really qualifies, borrowers are left believing that what they see is what they’ll get. The bigger issue however, is failing to compare with another bank that advertised a higher rate but could have offered a lower rate, and borrowers end up paying thousands extra. We explain in the 1st article above why banks advertise the rates they do.

Consider Lendingpot, another loan comparison platform. Ironically, exposing themselves and the issues at hand.

Credit: Head of Lendingpot. See more things we caught about them in the posts below.

Still not sure if you should stop trusting comparison websites? Well, we think Trust Bank would at least think twice!

Another of their common feature is side-by-side loan comparisons, like 'Bank A vs. Bank B.' At first glance, this seems useful. But ask yourself: can any platform truly borrow ten different loans simultaneously and pay interest on each just to verify their claims? The answer is no. These comparisons are often assembled from promotional material, not real-life experience. That means borrowers may be basing decisions on content designed for marketing rather than rigorous analysis. And when financial stakes are this high, that’s not good enough.

In the U.K., consumer protection standards attempt to address some of these gaps. For instance, regulators require that at least 51% of borrowers must actually qualify for any advertised rate. This ensures that the number presented isn’t just a cherry-picked figure. Singapore, by contrast, has no such rule. And beyond the headline rate, details such as loan tenure and quantum matter just as much. Imagine being enticed by a 1% rate only to discover it applies to a $1,000 loan with a one month term. That’s irrelevant if your true need is $20,000 spread over three years right? Without transparency, borrowers are left in the dark about what really matters and some countries have already started to enforce that such details are included

This lack of clarity is exactly why we created FindTheLoan.com, Singapore’s first loan marketplace. Instead of browsing teaser rates or applying one by one to multiple lenders, borrowers can upload their documents once and reach many lenders simultaneously. Each lender performs a full credit assessment, just as if you had walked into their branch in person. The difference is efficiency and transparency: you save time, avoid guesswork, and most importantly, receive actual offers rather than marketing promises. By putting lenders in competition for your real application, borrowers gain leverage they wouldn’t have if approached them individually.

Our reviews of Lendela, Roshi, MoneySmart, and Lendingpot show that the lack of clear oversight allows these issues to persist. For loan brokers such as SmartLend & Smart-Towkay, we even caught evidence of misinformation with screenshots. If you agree borrowers deserve better, add your voice on LinkedIn. Or if you prefer, join the discussion on Reddit, TikTok, or Facebook. However, on LinkedIn, we have also tagged Members of Parliament who have previously raised consumer protection issues. The more feedback and engagement appears on these posts, the harder it becomes for regulators to ignore. Every share or comment helps push the issue forward.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

Don’t miss our updates—subscribe on LinkedIn here or on Medium here. You might also like our piece about loan brokers and what to watch out for when using them

Share on: