SmartLend/Smart-Towkay – You wouldn't use it after reading this.

Written at: 30 Sep, 2025

Introduction

Unlike our review of Lendingpot, this is a complicated one, and even we are confused about what is happening or what they really are. For ages, Smart-Towkay has claimed to be a loan platform or a loan marketplace. But recently, they managed to rope in the ex-head of CIMB to start a new “platform,” and now they are saying that they want to disrupt bad brokers, and thus the formation of a new platform — SmartLend. Does that mean they themselves have been making false claims previously, and that they have always just been brokers? Otherwise, wouldn’t it be a duplicate platform?

The Problem with Brokers

First, let's talk about what problems can arise when it comes to using brokers. Why not if you have a good one you can trust? I mean, why go through all the trouble of visiting the lenders (or their websites) one by one, when someone can do the legwork for you?

However, that may bring you more issues than it is worth. It is an industry-known fact that loan brokers may not just cherry-pick which customers to prioritise, they may also cherry-pick which lenders' offers to show you, especially if they are owned by a lender, which some are. Brokers are also the number one source of loan fraud, and they could be committing fraud in your name. This is why countries such as the US introduced the Dodd-Frank Act, due to the unethical conduct that contributed to the 2008 mortgage crisis.

However, many Southeast Asian countries, such as Singapore, still do not regulate brokers, and we believe that using tech to remove them entirely from the equation is the better way to go — and thus the purpose of FindTheLoan.com.

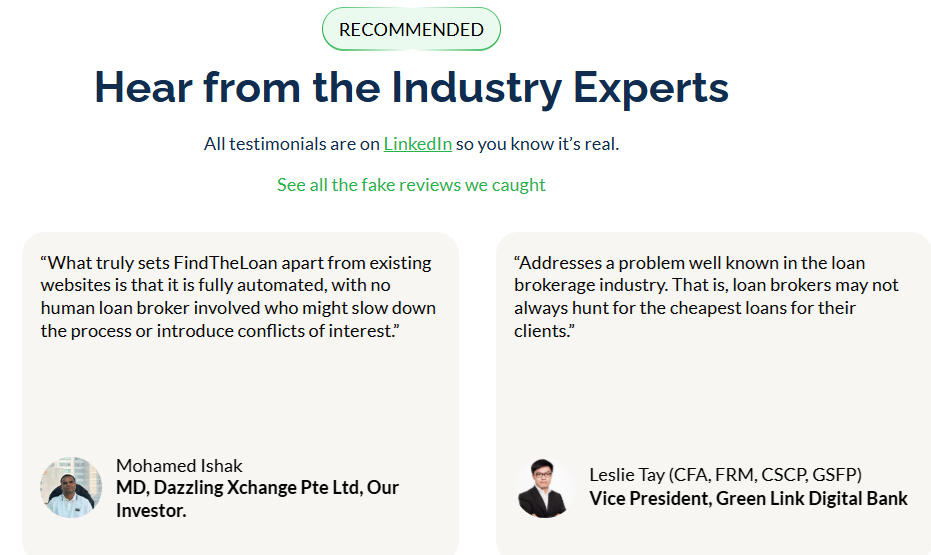

And it seems like others are trying to follow in our footsteps of disrupting loan brokers.

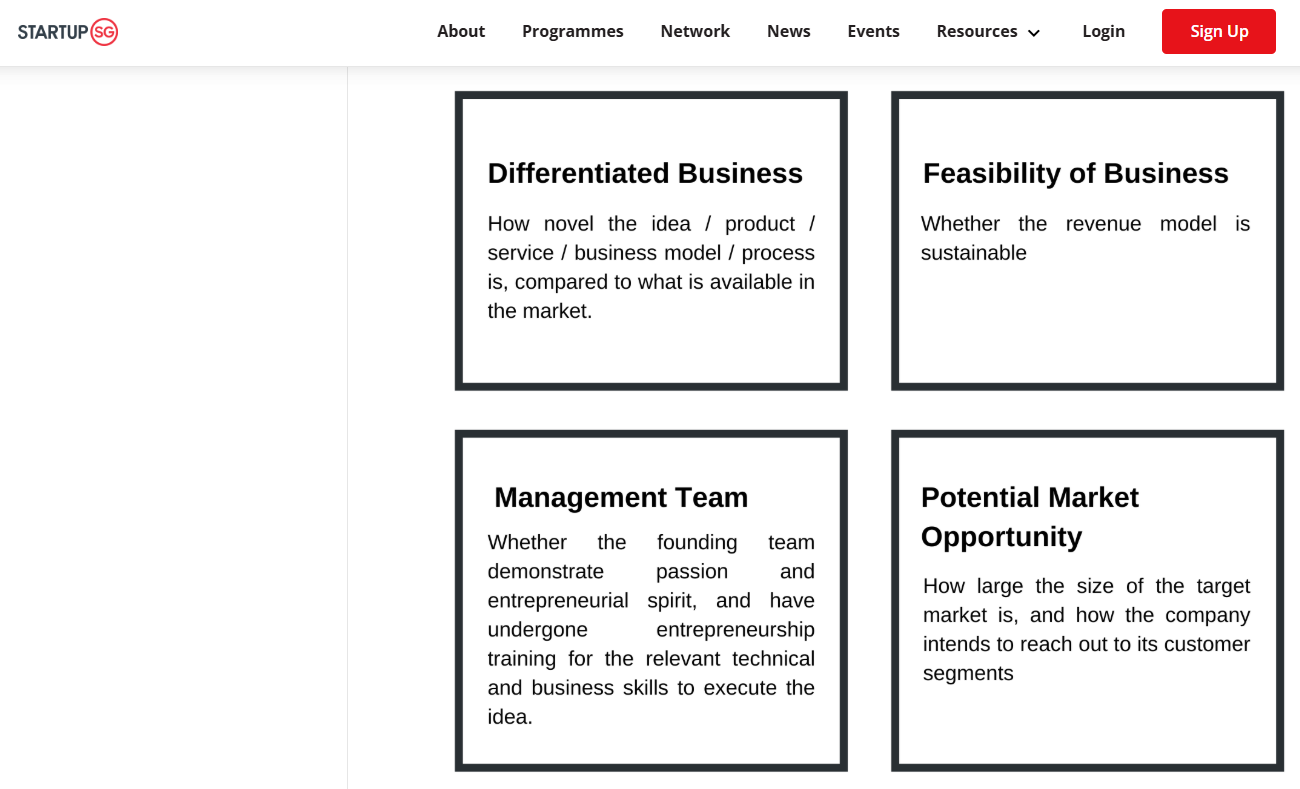

Or are they? At one point in time, they were one of the five other platforms that claimed to be a loan marketplace or Singapore’s first loan marketplace, like us. But we let you decide what a marketplace is instead. As a recipient of Enterprise Singapore’s Startup SG Founder Grant, where we received a seed capital to start the platform, we are at least confident that our platform is unique, as one of the criteria for recipients is that it must be a new innovation.

Of course, any good idea worth copying will eventually be copied. And given the bane that brokers can be, we welcome others to join in the fight to disrupt them. But what are they really? A platform to disrupt bad brokers, or is this a tale of a wolf in sheep’s clothing, or lipstick on a pig?

But honestly, we don’t know. Because they are constantly changing their stories.

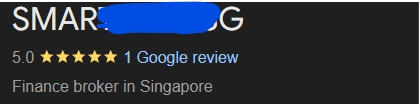

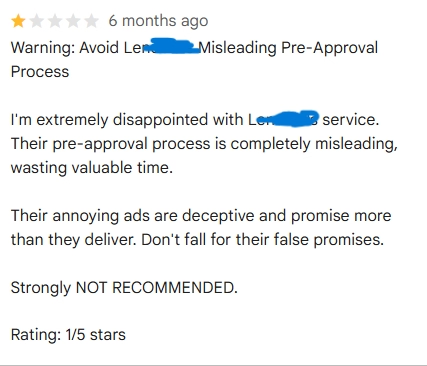

Fake Reviews and Damage Control

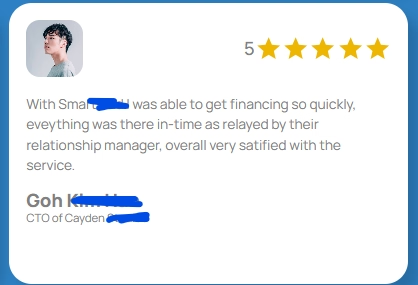

After we called them out for fake reviews on this LinkedIn post. Touting over a hundred 5-star reviews (there was only one on their Google review page, and even then, we doubted its authenticity) despite having just launched, seems dubious. The reason we decided to check them out and investigate is because a borrower reached out and asked how we are different, as he had actually used them and didn’t want to deal with another broker. In an attempt at damage control, they later clarified on their homepage that they used the reviews from their sister company because the same team is behind it. (Wait, how does that help? Wouldn’t that make 2 companies that you cannot trust?) Valid explanation or guilty conscience — we let you decide. We had hoped such a senior banker from CIMB would have more integrity than that and at least apologize to the public. But it seems like doubling down was the choice they made.

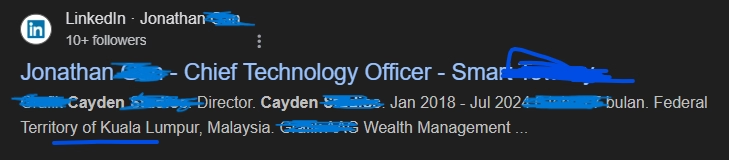

But even then, that doesn’t justify using their own staff name to write a glowing review. People are saying that with AI, websites will be flooded with fake reviews. Honestly, we think AI would have been much smarter than to use their own staff’s name. Someone based in Malaysia, no less, when lenders do not do cross-border loans for SME loans.

(When we first collected these screenshots, we didn’t want to name the company outright until they doubled down instead of making a public apology and taking a dig at us for the amount of information we needed to collect.)

And we found more things. They claimed Singpass login was all you needed to apply with multiple lenders. At this point in time, Singpass might be able to furnish some basic information, but it simply doesn’t allow a platform to pull all the information a business lender needs to make a proper credit assessment — unless it is only for a personal loan's simplified assessment, which means you may be paying more interest than you need to. We explain it here.

Credit:This is publicly available information that you can find on Google Reviews for some of these sites that tout fast approval or minimal documentation, such as Lendingpot, Roshi, and Lendela

Final Thoughts

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurer were trying to out match each other and they increased the projections on their benefit illustration until it got to a point it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in. But it is not unheard of, even today, that an insurance agent, might try to pass it off as guranteed as either 5 or 9%, instead of projections, and you know what we are trying to say here.

If we can even catch an ex-head of a bank posting fake reviews and making questionable claims, what do you think other brokers with less to lose and no reputation to uphold are doing behind closed doors? Transparency matters, and that’s why FindTheLoan was built — to remove brokers from the equation entirely. A tool built to take the middleman out of the question, borrowers can apply to multiple lenders directly themselves, instead of one by one, or having to rely on someone who may or may not work in the borrowers’ best interest.

If you think brokers ought to be finally regulated in Singapore, we invite you to share your thoughts on the LinkedIn post above or on our Reddit, TikTok, or Facebook post, if you prefer. We have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections. If more people weigh in publicly, MPs may be compelled to act on loan broker regulation and borrower protections.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Share on: