Licensed Moneylenders vs Loan Sharks

Written at: 16 Apr, 2025

Last Updated: 04 Oct, 2025

Sometimes, you need money fast. Whether it's for a sudden emergency or a cash flow for your business, turning to a moneylender might be the way to go when borrowing from banks isn’t feasible.

Here is a quick snapshot between the 2 :

|

Criteria |

Bank Loans |

Licensed Moneylenders |

|

Interest Rates |

Typically offer lower interest rates, especially to borrowers with strong credit profiles. |

Interest is generally higher, as these lenders often serve borrowers with weaker or no credit history. |

|

Loan Amount & Duration |

Usually provide larger loan sums with longer repayment tenures—suitable for big expenses or extended payment plans. |

Loan amounts are generally smaller with shorter repayment terms, but approval is often quicker and criteria more flexible. |

|

Fees & Penalties |

Charges may include processing fees, late payment penalties, and early repayment fees. |

Fees are regulated by law but still apply—such as processing charges and late fees. Always review the breakdown before proceeding. |

|

Approval Criteria |

Require stronger credit scores and financial documentation, making approval harder for those with poor credit. |

More lenient with credit checks and income proofs, offering access to those who might not qualify for bank loans. |

|

Which to Choose? |

Ideal if you have a good credit score, need a large amount, and prefer structured repayment with lower interest. |

Better suited for those needing fast access to smaller funds or those with limited access to traditional banking options. |

While some may feel a stigma about licensed moneylenders, many popular and reputable fintech companies and even neo-banks acquire such licenses to legally serve individuals or businesses which are not considered "Local Company". (Under ACRA Singapore, what we generally refer to as companies are separated between "Local Company" and "Business Entity").

In Singapore, you generally only need to be a legally registered company to offer B2B loans as an excluded moneylender. However, to offer loans to individuals or some company structure, one would typically need a banking or moneylending license. Many popular and reputable fintech companies and even neo-banks acquire such licenses to legally serve individuals or businesses which are not considered Local Companies, such as sole proprietors which is a business entity, but not a Company.

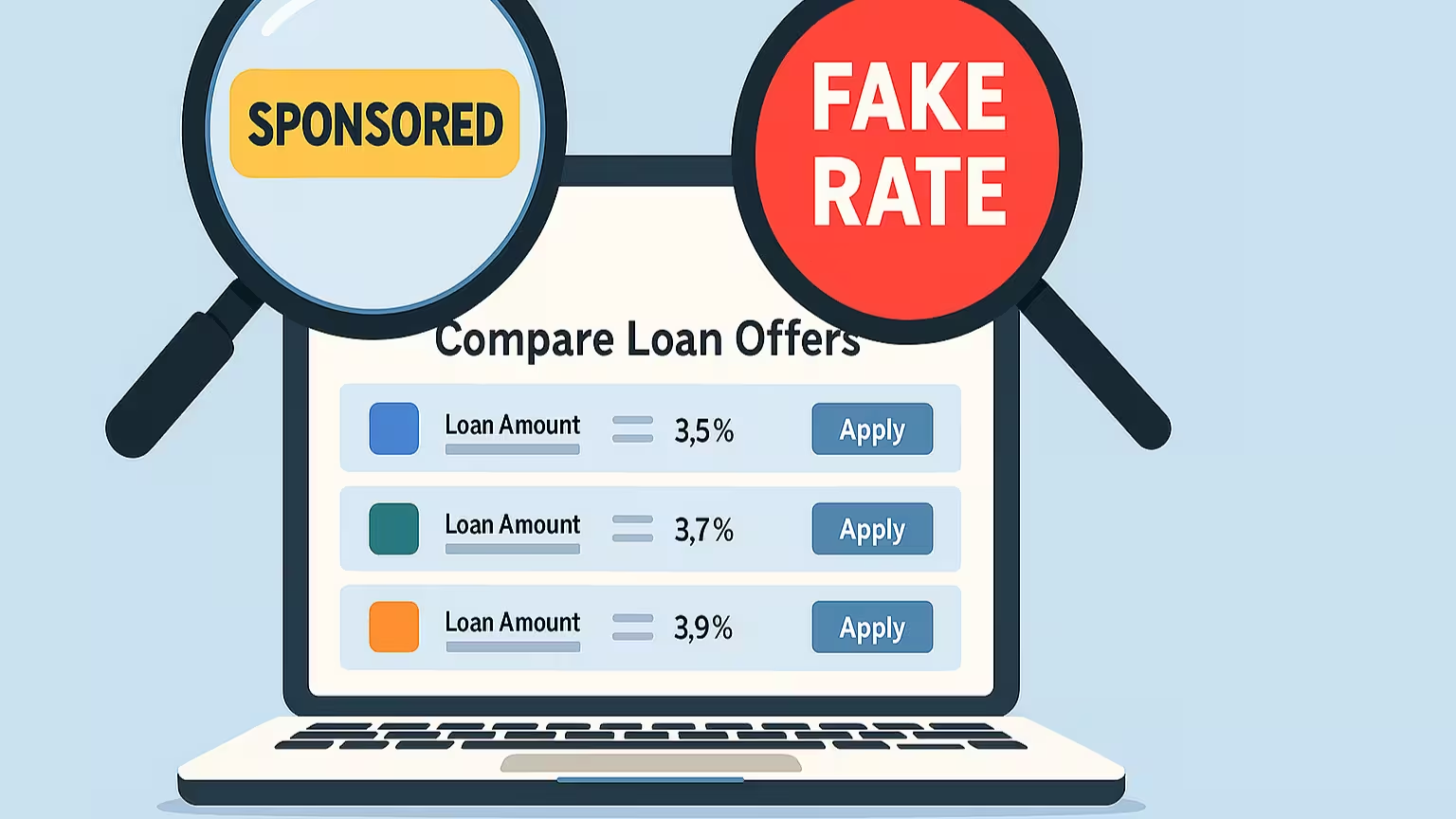

But not all lenders are created equal. Before you commit, know how to separate licensed professionals from illegal loan sharks.

There’s a stark contrast between licensed moneylenders and unlicensed lenders or commonly known as loan sharks. Licensed moneylenders are regulated by the Singapore government and must follow strict rules when offering financial services. Such laws are introduced to transform the industry and to allow them to play a valuable role in the credit ecosystem.

On the other hand, loan sharks operate illegally, often using threats or harassment to recover debts.

The strict regulations imposed on licensed moneylenders in Singapore serve one core purpose: protecting borrowers from exploitation and ensuring fair lending practices. By setting legal limits on interest rates and enforcing transparent fees, the government helps prevent predatory behavior and financial abuse. But when a neighbour or a domestic worker borrows from such lenders, the trouble can still land at your doorstep. Read this article if you'd like to learn more about what happened to this venture capitalist!

Recommended next read : If a loan broker claims to be able to negotiate for you, walk away.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.