Illegal Moneylenders in Singapore: A Threat Closer Than You Think

Written at: 10 Dec, 2024

Last Updated: 26 Sep, 2025

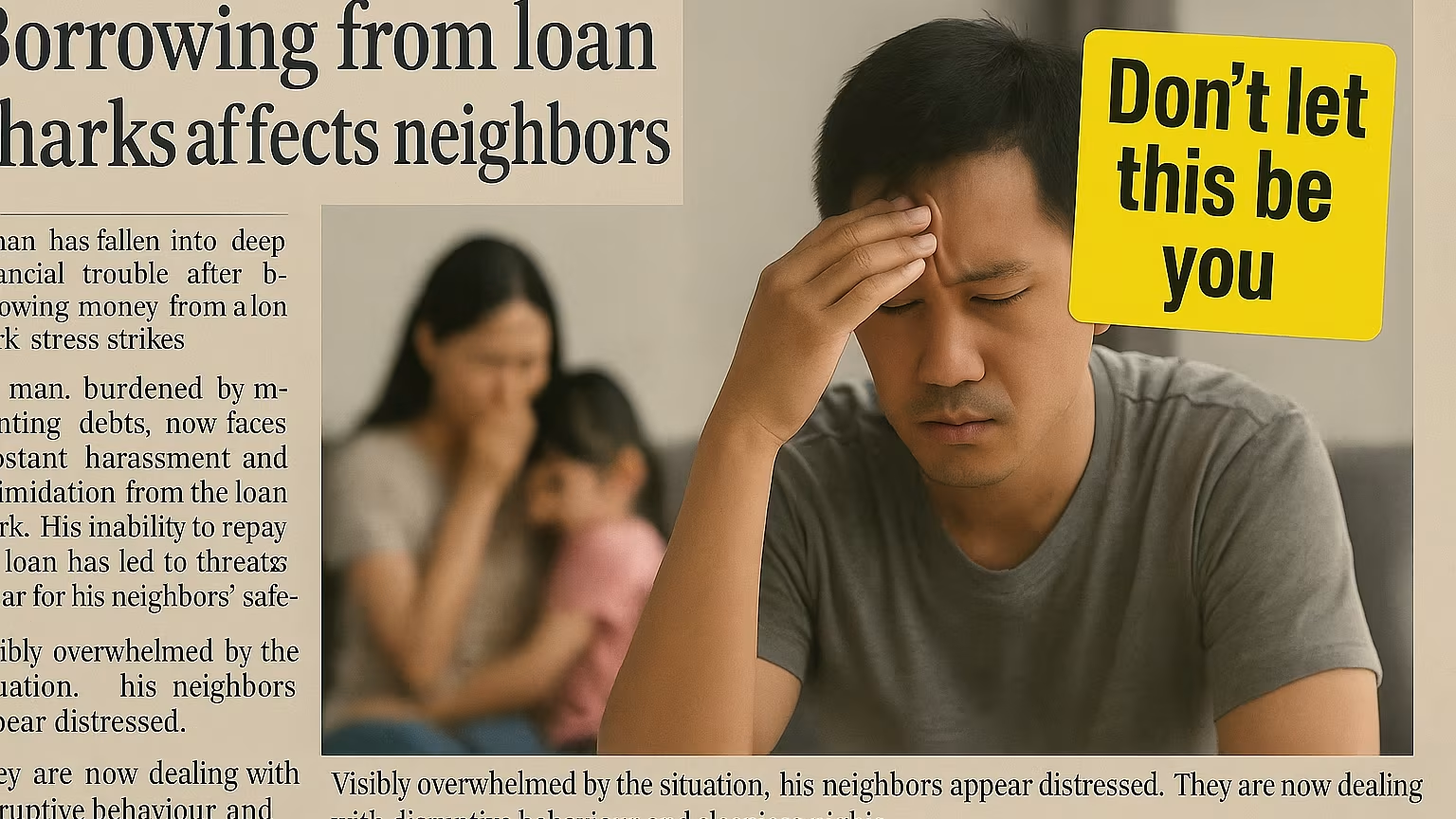

Very often, people may overlook the threat of illegal moneylenders, assuming they are too wise to fall into their trap. However, when a neighbour or a domestic worker borrows from such lenders, the trouble can still land at your doorstep.

Such is the case for Mr Alan, who received 120 calls over three days from various unlicensed money lenders when his employee was the one who borrowed from them, as reported in this CNA article. In fact, it was reading the post of a Venture capitalist, on social media - where his domestic worker borrowed from 5 unlicensed moneylenders and threatened his wife and 2 young daughter’s safety while he was overseas and he was so helpless about it that sparked this article to educate the public and spark more conversations about how easily these threats can seep into our homes and communities if left unchecked.

Illegal moneylenders often don't just target the borrower and their methods often involve harassment tactics that affect entire communities. From splashing paint on doors to making repeated nuisance calls, these actions create stress and fear for neighbours and other innocent parties.

Some individuals turn to unlicensed moneylenders despite the risks due to a combination of personal circumstances, financial desperation, and lack of viable alternatives. For instance:

People with bad credit scores may face rejection from licensed lenders, leaving them with no other option. Unlicensed moneylenders often provide loans quickly, with minimal documentation or background checks, making them appear convenient.

This is where FindTheLoan.com can help. By allowing borrowers to connect to multiple vetted lenders through a single application, we greatly improve their chances and speed of obtaining a legitimate loan.

Often, borrowers may not fully understand the consequences of dealing with illegal lenders—such as exorbitant interest rates or illegal recovery methods—or may not even realize they’re borrowing from an illegal moneylender.

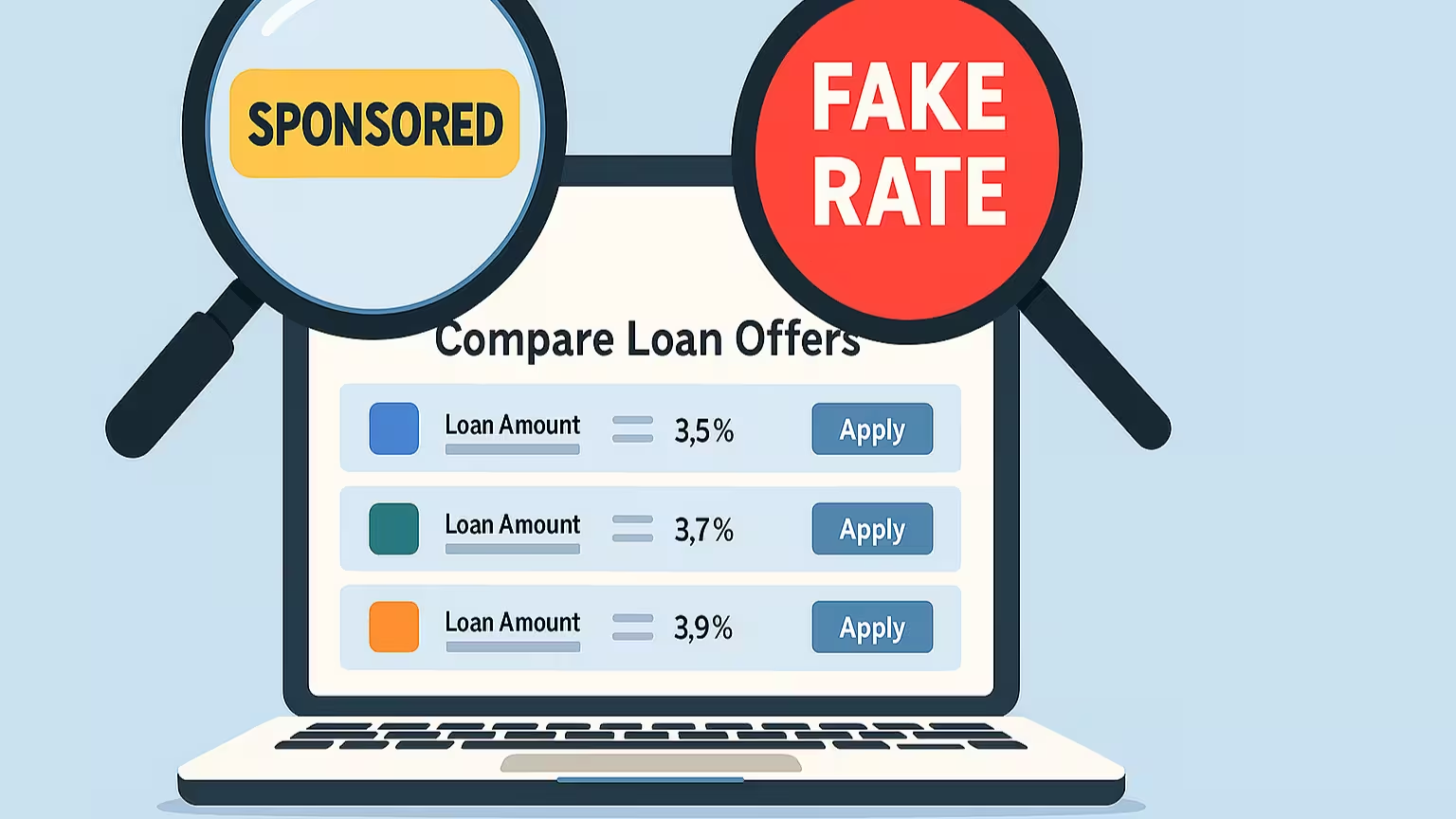

Here are some telltale signs of posts or advertisements by illegal moneylenders:

According to Section 16(3) of the Moneylenders Act (Cap. 188), moneylenders are not permitted to advertise on social media and are permitted to advertise their moneylending business only in the following media:

a. Business or consumer directories in print or online media;

b. Internet websites belonging to the licensee; and

c. Advertisements placed within the approved place of business, or on the exterior side of the wall, door, shutter, gate or window of the approved place of business.

Moneylenders in Singapore are not allowed to share mobile numbers in any advertisement, nor are they permitted to advertise outside their licensed retail outlets.

So, if you come across one doing so, it’s a strong indicator they are unlicensed and operating illegally.

Yet a simple search on Facebook or Telegram using keywords like “quick cash” or “moneylender” reveals hundreds of groups—many with hundreds of members. Alarmingly, many respondents appear to be Malaysians, migrant workers, and foreign domestic workers, who are among the most vulnerable.

The number of people engaging with these posts is deeply concerning. We’ve tried to do our part by reporting these groups and websites to Facebook, Telegram, and the police, but they often reappear just as quickly as they’re taken down.

We’ve also seen dubious websites with cookie-cutter designs—no clear company information, no explanation of how your data is handled—just a lead form collecting personal details. While we can’t say with full certainty that all of them are illegal, it’s possible some licensed moneylenders are trying to skirt regulations by advertising in grey areas, knowing enforcement can’t keep up with how fast these sites and groups emerge.

Responding to suspicious loan advertisements can lead to falling victim to loan scams too. These scammers often lure individuals with promises of quick and easy loans, only to impose hidden fees, ask for upfront payments, or use aggressive tactics to collect repayment. In many cases, the loan terms may be deceptive, with exorbitantly high interest rates or impossible repayment conditions, putting borrowers in a cycle of debt. Loan scams can also work by offering attractive interest rates and requiring a borrower to send a huge amount to them before the loan can be processed or stealing your banking credentials which we touched more on, here.

Licensed moneylenders, which operates very differently from loansharks and which we share more about in this article, must on the other hand, adhere to strict laws regarding how they word their contracts and ensure that borrowers have a clear understanding of the terms of the loan.

Together, we can combat the spread of illegal moneylending. Be alert to suspicious behavior, such as frequent visits by strangers or unusual activity in your neighbourhood. If you suspect illegal moneylending, report it to the authorities or platforms like Facebook and Telegram where such advertisements proliferate.

Every small action contributes to a safer community. If this issue concerns you as much as it concerns us, help us push for real accountability. We’ve launched a petition calling on Meta to take action against these illegal Facebook groups.

👉 Sign the petition here and help us protect vulnerable communities in Singapore.

You can also consider sharing this article so more can be educated on spotting illegal moneylending activities and scams.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.