When Banks Say No.

Written at: 13 Oct, 2025

Last Updated: 22 Oct, 2025

When SMEs and borrowers think about business financing, banks are often the first to come to mind. But non-bank lenders are now playing an increasingly important role in filling the funding gap that traditional banks can’t always meet.

1. Non-banks serve businesses that banks can’t

Banks are bound by strict lending frameworks. They prioritize borrowers with established credit histories, long operating track records, and strong collateral positions. This leaves younger or fast-growing companies — especially those without years of audited statements — out of reach. Even when qualified, the process can be slow. Approval cycles may stretch for weeks, requiring repeated documentation and manual review. By the time a decision arrives, the business opportunity might have passed.

Non-bank lenders, on the other hand, often specialize in serving SMEs or newer entities that fall short of those criteria. They may offer faster approvals, more flexible documentation, or loan structures tailored to niche needs. For SMEs, time is often more valuable than rate. A delayed disbursement or missed financing window can cost far more than a few percentage points of interest. That’s where non-bank lenders helps — bridging cashflow gaps and offering speed, flexibility, and adaptability. Borrowing from non-banks and repaying their loans, also help to build a credit profile that can help to, later on, show the banks you are a credible paymaster.

2. They include fintechs and alternative financiers

Some non-bank lenders are finance companies, fintech platforms, or specialized financial institutions that provide credit through data-driven risk models, revenue-based financing, or invoice factoring. These are not moneylenders but are still regulated and compliant. Their presence increases competition and broadens funding options for SMEs.

It’s important to distinguish between licensed moneylenders (who cater to smaller, short-term needs) and broader non-bank lenders like fintechs, finance companies, or revenue-based financing platforms. These are regulated under different frameworks, with many operating under MAS supervision or exemptions. We explain more:

3. Licensed moneylenders are just one segment of the non-bank ecosystem

Licensed moneylenders hold specific licenses under Singapore’s Moneylenders Act, and they typically cater to smaller ticket sizes or urgent needs. However, many non-bank entities operate under other regulatory frameworks — for example, finance companies governed by MAS or fintechs registered under business lending exemptions or as excluded moneylenders. Actually many fintech lenders also hold moneylender licenses so that they can serve certain business profiles. We explain more here. In fact, a number of fintech companies began as moneylenders first.

4. The inclusion of non-banks promotes a healthier lending landscape

Non-bank lenders don’t exist to replace banks. They complement them. Many borrowers eventually return to banks once their profile matures but rely on non-banks for growth stages, project-specific funding, or when timing is critical.

Singapore’s lending ecosystem benefits from variety. When both banks and non-banks coexist, SMEs gain flexibility during downturns or policy shifts. Diversity in credit sources prevents overreliance on any single channel — a healthier, more resilient system overall.

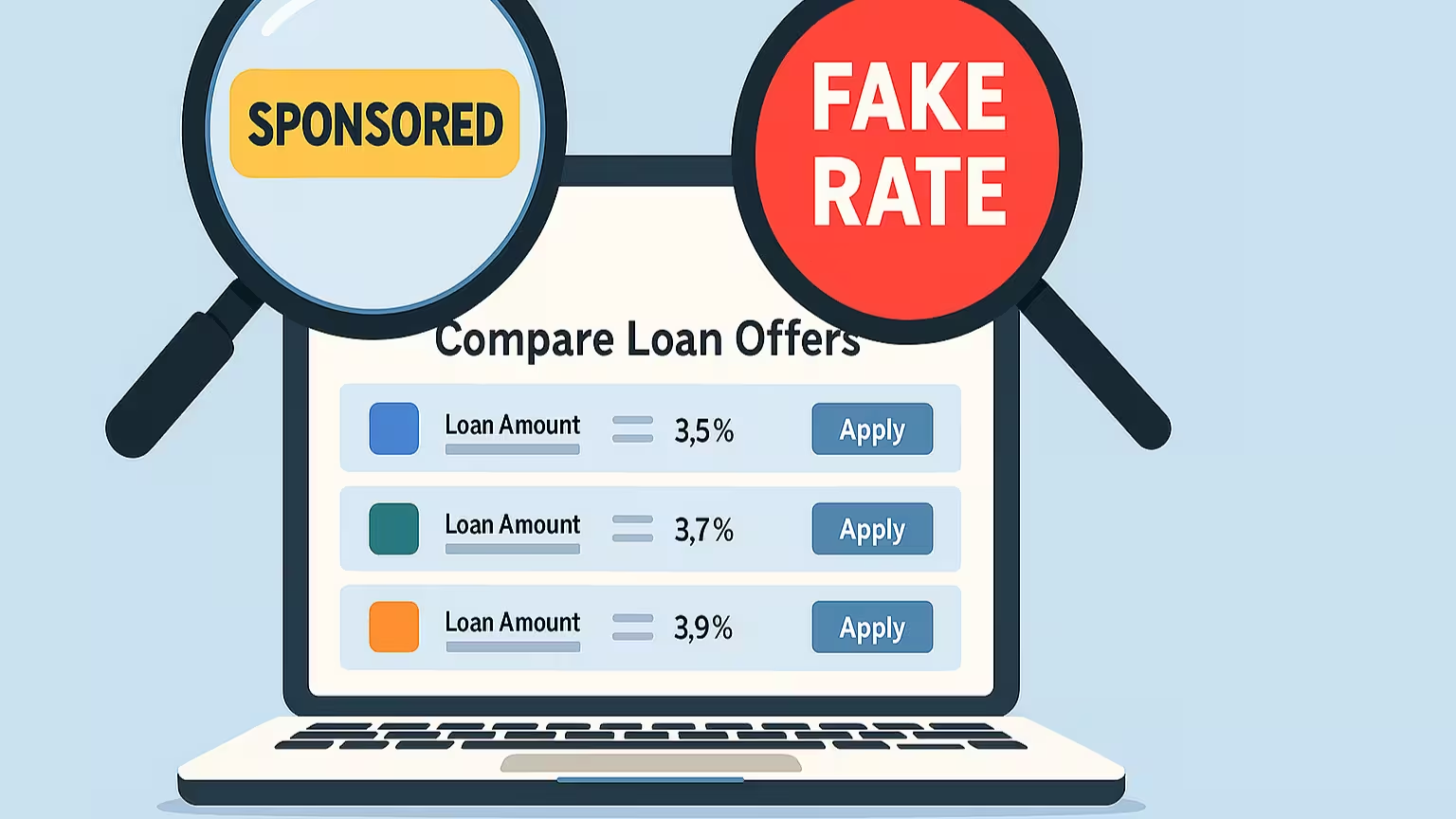

By connecting borrowers to a wider range of financing options, FindTheLoan helps level the playing field and promote competition among lenders to offer competitive rates to borrowers. Funded by Enterprise Singapore's Startup SG Founder, borrowers can compare offers across banks, fintechs, and licensed moneylenders — ensuring that each individual or business finds the right fit rather than being excluded by conventional criteria. And all these without the use of loan brokers or comparison websites and the problems they bring. Many countries have regulated them for decades, and unfortunately Singapore has not. So, it might be prudent to know how they work in the respective articles so you may know better how to protect yourself.

Not every business fits a bank’s lending profile—and that’s okay. The role of non-bank financing partners is to make sure those businesses and individuals still have access to legitimate, transparent, and fair funding options. And just as FindTheLoan includes licensed moneylenders to keep users away from unlicensed ones, including legitimate non-bank financiers ensures borrowers explore safe, regulated alternatives. Every partner is verified and licensed (or exempted) to operate in Singapore. You can learn more about how we work and how are we different from loan brokers or comparison websites here

Learn how we keep our content accurate in our Editorial Policy.

Share on:

Blog Highlights

Recent Posts

Pinned Posts

We believe in sharing knowledge freely. Anyone — whether a company, website, or individual — may republish our articles online or in print for free under a Creative Commons license. (This applies to full republishing, not just casual sharing on social media — feel free to use the share buttons as you like!)

- All hyperlinks must be retained, as they provide important context and supporting sources.

- You must include clear credit with a link to the original article.

- If you make edits or changes, please note that modifications were made and ensure the original meaning is not misrepresented.

- Images are not transferable and may not be reused without permission.