Trust Bank's Working Capital Loan. We "reviewed" it for you!

Written at: 02 Oct, 2025

We know you’re curious about how Trust Bank determine charges, how fast they can respond, or how loans work. And you were searching online when you found this article. But it doesn’t work that way, as covered here. MAS rolled out the Guidelines on Standards of Conduct for Digital Advertising Activities in September, but they’re still somewhat limited. In the UK, 1% or 1-hour loan ads must apply to at least half of borrowers, yet that’s not the case here. Of greater concern are intermediaries not owned by banks but feeding them leads. And this is why you need to read this article

You were probably expecting someone to write about how good Trust Bank's Working Capital Loan is, and blah blah blah. As we have seen so many “comparison” review sites or bloggers reviewing it, we thought we’d let you know how it works instead.

Not all review sites are what they claim to be—many are nothing more than sponsored listing sites, serving the advertisers that pay them.

Across markets from the U.S. to Australia, regulators are finding that these platforms often prioritize results based on payment, not on what’s truly best for the customer or consumer. What you see isn’t always an unbiased comparison but a filtered list bought by those who pay the most.

While general information, such as miles or points per dollar spent, is easy to research, loan amounts and interest rates are highly personal. They change from one customer to another based on each individual’s credit score & profile. That rate they “reviewed” or “compared” for you is actually a teaser rate. Here’s how it works in detail. They are rates that you may or may not get, and in many countries, regulators are either suing them for clickbaiting consumers or publishing warnings on them.

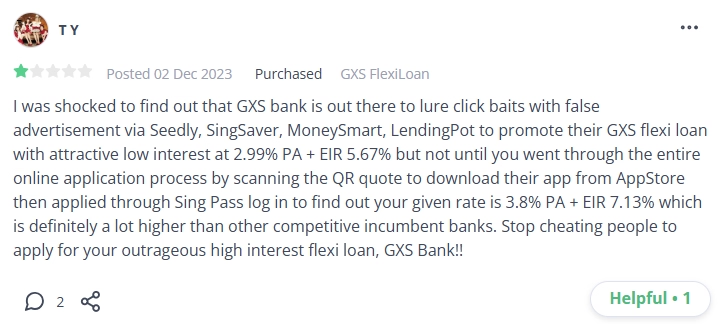

But if you are pressed for time, and you don't want to have to read the article above - here is an image that says it all.

Credit: Head of Lendingpot. Strangely enough, Lendingpot appears to be exposing its own practices. For more of their contradiction or to join the conversation, click here.

Instead of teaser rates or applying with multiple lenders one by one, with FindTheLoan.com, you can reach multiple lenders at once with your actual documents, and they will make a full credit assessment as if you had walked in to them individually, and they will revert with their actual offer. And thus we could talk about certain ill practices. We also flagged the conflicts tied to lender-owned brokers. Strangely enough, they echoed the same idea months later—despite being owned by IFS Capital & PhilipCapital. Perhaps they just drew inspiration from our articles, but the overlap keeps raising eyebrows.

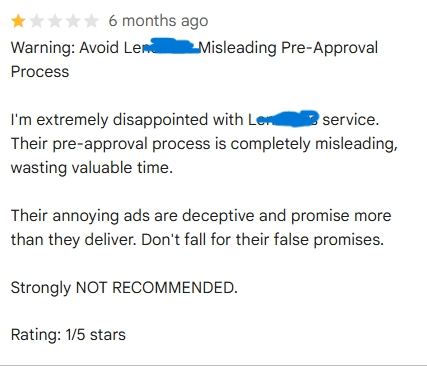

Credit: Public review found on Seedly and Google

Our review of Roshi, Lendela, Lendingpot, and SingSaver reveals that the lack of clear oversight allows such misleading behaviour to persist. We also uncovered that loan brokers like Smart-Towkay & SmartLend have misled borrowers — with screenshots to prove it. Every now and then, you’ll see them write comparisons like “this loan vs. that loan.” But think about it—if they claim to compare 10 loans, did they really take all 10 and pay interest on each one? Surely, even if they can afford to, no single staff member can qualify for all 10, right? And if 10 staff applied individually, it wouldn't be a fair comparison, as each individual has their own respective credit profile affecting how much they are charged or offered.

In the UK, consumer law ensures 51% of borrowers really get the rate advertised. Singapore has no such rule. And even if the rate is authentic, the loan amount and tenure matter. What good is 1% on $500 if your need is ten times that? However, the core issue is that trusting a “loan comparison” site can cost you heavily. By following their recommended loan without checking alternatives, you could be paying thousands more than necessary. Another bank might have offered much cheaper terms. The article above explains the mechanics of this in detail.

And thus we built FindTheLoan.com, Singapore’s 1st loan marketplace. Loans made easy with loan comparison 2.0 Instead of teaser rates or applying with multiple lenders one by one, you can reach multiple lenders at once with your actual documents, and they will make a full credit assessment as if you had walked in to them individually, and they will revert with their actual offer. Not some clickbait rates that you may not qualify for.

If you think something doesn’t look right, we invite you to share your thoughts on this LinkedIn post or on our Reddit, TikTok, or Facebook post, if you prefer. MoneySmart alone claimed to have 60 million visitors across Southeast Asia. We cannot stop lenders like Trust Bank from working with them, making them richer and amplifying their reach. Or venture capitalists investing money into them. But we can call out misleading advertising, and we need your help. However, we have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections. Weighing in there, and as more people share their thoughts there, could finally catch their attention to do something about the industry and better protect borrowers. Every comment, repost, or show of support matters — it increases the chances that policymakers take notice and act.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles! e.g, Find out more about how loan brokers operate and the red flags to watch for. Click here to read.

Give us a try — it’s free to get your personalized loan offers today!

Share on: