RHB Bank's Business Term Loan - We "reviewed" it for you!

Written at: 02 Oct, 2025

You’re probably wondering how RHB determines fees, how long they take to respond, or how loans actually work. And you were searching online when you found this article. Sadly, as mentioned here, such details are only clear post-application. MAS has since released the Guidelines on Standards of Conduct for Digital Advertising Activities, but we think more needs to be done. In the UK, advertised rates or timing must apply to 51% of borrowers — a rule not yet followed here. What’s even more troubling is the rise of intermediaries creating leads for banks. And this is why you need to read this article.

With so many comparison websites claiming objectivity, we decided it was time to add our perspective.

Across markets from the U.S. to Australia, regulators highlight that comparison websites often prioritize results based on payments, not necessarily what’s best for the borrower. What looks like an unbiased comparison is usually a curated list bought by those who pay the most—many are nothing more than sponsored listing sites, serving the advertisers that pay them. So, you are actually browsing for advertisements.

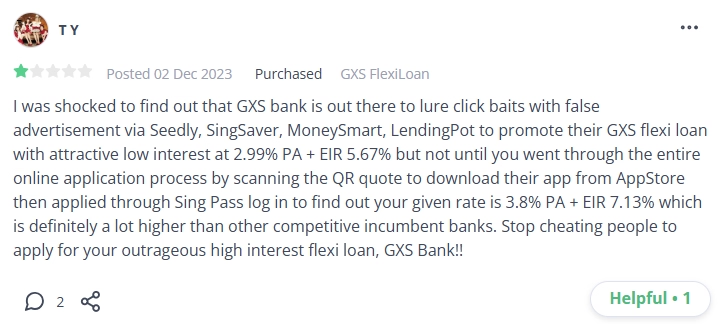

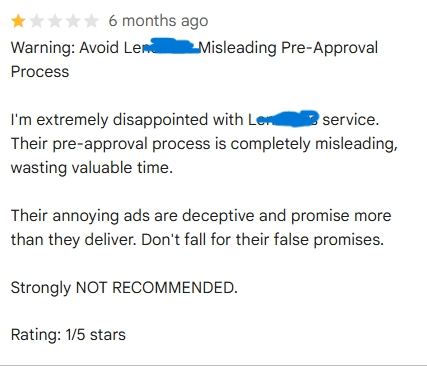

While information like credit card rewards is easy to verify, loan amounts and interest rates are highly personal. They differ for each person’s credit score & profile. The rates you see online are usually just teaser rates. And in many countries, regulators are suing these sites for clickbaiting consumers or issuing public warnings. Even some are "admitting" that they have been misleading consumers.

Credit: Head of Lendingpot. Ironically, Lendingpot seems to expose its own practices. For more of their contradiction, click the link to see or to join the conversation. After we pointed out conflicts of interest in lender-owned brokers, the same talking point appeared months later—even though they’re under IFS Capital & PhilipCapital. It could be independent thinking, but the resemblance feels a little too close.

Don't catch the irony? Let's make it more obvious:

These platforms often publish “this loan vs. that loan.” But can they really test ten loans by borrowing and repaying each one? A flashy 1% on $3,000 isn’t useful if your target is $15,000. In the U.K., laws requires 51% of consumers to qualify for the advertised rate. Singapore lacks this safeguard. Here’s the bigger problem: if you had taken a loan from a “comparison” platform’s suggestion without exploring further options, you might have lost thousands. Another bank could have been the cheaper choice. We’ve described exactly how this works in the article above.

And that’s why we built FindTheLoan.com, Singapore’s 1st loan marketplace. Instead of teaser rates or applying with multiple lenders separately, you can reach many lenders at once with your actual documents. They’ll make a full credit assessment as if you had gone in individually, then return with their real offer.

If something doesn’t seem right or you think we need stricter loan advertising laws, let us know your view on Facebook, Reddit, TikTok or LinkedIn. More voices increase the chance that policymakers finally act. Every comment, repost, or show of support counts. Analysis of Lendingpot, SingSaver, Lendela, and Roshi highlights how the lack of regulation lets such issues fester. Even loan brokers such as SmartLend & Smart-Towkay were caught providing false information to borrowers, evidenced by screenshots. MoneySmart alone claimed to have 60 million visitors across Southeast Asia. We cannot stop banks like RHB from working with them, making them richer and amplifying their reach and continuing the cycle. But we can call out misleading advertising, and we need your help.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

--

If you enjoyed this article, we’d love for you to share it. Even a quick like or comment here helps boost visibility so more people see it. Our goal is to deliver insights Big Finance doesn’t want promoted, and your support helps amplify our work. Sharing this article might just help another consumer from being clickbaited by the above and many similar loan intermediaries.

Subscribe to our LinkedIn newsletter here or on Medium here so you never miss an update! If you found this useful, read also Loan Brokers: 10 Insider Tips Every SME or borrower Should Know - Another category of loan intermediary where regulators have had to act on.

Give us a try — it’s free to get your personalized loan offers today!

Share on: