Maybank Business Term Loan

Written at: 02 Oct, 2025

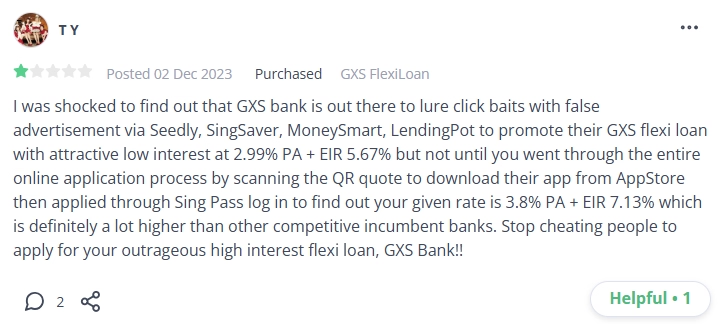

You might be hoping to understand how Maybank's loan works, what they charge, or how soon you’ll hear back. And you were searching online when you found this article. Sadly, as outlined here, it doesn’t work that way — much of it can only be confirmed once you apply. Although MAS has introduced the Guidelines on Standards of Conduct for Digital Advertising Activities, they seem to remain insufficient. Unlike in the UK, where a one percent loan or 1-hour claim must apply to 51% of borrowers, Singapore’s standards still fall short, especially with unregulated lead generators involved.

Not all loan comparison platforms are what they seem — and regulators in different countries have started to notice.

Across markets from the U.K. to the U.S. to AU, their regulators have highlighted that comparison websites often prioritize results based on advertisers' payments, not necessarily what’s best for the borrower. What looks like an unbiased comparison is usually a curated list bought by those who pay the most. Singaporeans have already spoken up. But their reviews are being buried by those leaving positive reviews because they don't know what happened to them, and they could have paid more for actually not comparing.

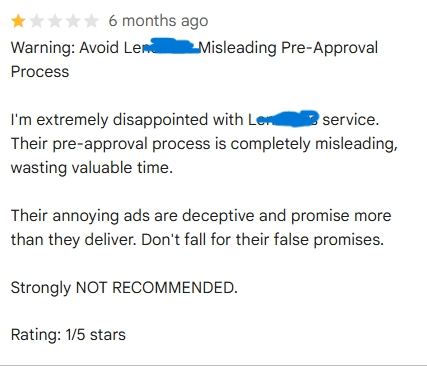

While information like credit card rewards is easy to verify, loan amounts and interest rates are highly personal. They differ for each person’s credit score & profile. The rates you see online are usually just teaser rates. Learn what they mean and how they work in the link above. And, in many countries, regulators are suing sites for clickbaiting consumers or issuing public warnings. See those examples in the same article. From the US's FTC to Australia's MoneySmart, the equivalent of our MAS's MoneySense, we have linked such examples in the article. And yes, ironically, it is called MoneySmart.

Even one comparison website has "owned up" that they have been misleading borrowers. See if you can spot the other irony.

Credit: Head of Lendingpot. Ironically, Lendingpot seems to expose its own practices. For more of their contradiction, see the conversation. When we raised conflicts of interest with brokers owned by lenders, they echoed it months later — despite being owned by IFS Capital & PhilipCapital!

These platforms often publish “this loan vs. that loan.” But can they really test ten loans by borrowing and repaying each one?

In the U.K., 51% of borrowers must actually qualify for an advertised rate. Singapore does not. Beyond the rate, the loan’s size or duration matters. A shiny 1% offer on $500 isn’t helpful if you need $5,000. The bigger danger lies in blindly following a loan “comparison” site’s recommendation. Without comparing across banks, you might miss out on far better deals—potentially paying thousands extra. We’ve laid out the mechanics of this problem clearly in the article above.

From our analysis of Roshi, Lendingpot, SingSaver, Lendela, and MoneySmart, it’s evident that regulatory gaps have let these issues endure. Meanwhile, loan brokers like Smart-Towkay & SmartLend were caught making fake reviews and making false claims to borrowers—proven through screenshots. If this shouldn't be continued, give your feedback on Facebook, TikTok, Reddit or LinkedIn. More voices increase the chance that policymakers finally act. Every comment, repost, or show of support counts.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

If you enjoyed this article, we’d love for you to share it. Even a quick like or comment here helps boost visibility so more people see it. Our goal is to deliver insights Big Finance doesn’t want promoted, and your support helps amplify our work.

Subscribe to our LinkedIn newsletter here or on Medium here so you never miss an update! e.g Learn what every SME should know before engaging a loan broker. Read the full post.

And that’s why we built FindTheLoan.com, Singapore’s 1st loan marketplace. A startup funded by Enterprise Singapore, under the Startup SG founder program - Instead of teaser rates or applying with multiple lenders separately, you can reach many lenders at once with your actual documents. They’ll make a full credit assessment as if you had gone in individually, then return with their real offer. Give us a try — it’s free to get your personalized loan offers today!

Share on: