Stand Chart's SME loan. The review you wouldn't find anywhere else for a reason.

Written at: 02 Oct, 2025

We understand you may want to know more about how SCB's loans work, bank charges, or response times. And you were searching online when you found this link. Sadly, it doesn’t quite work that way as outlined here. MAS introduced the Guidelines on Standards of Conduct for Digital Advertising Activities in September, but in our opinion, they remain limited. In contrast, UK regulations require that any 1% or 1-hour loan offer apply to at least 51% of borrowers — something not yet practiced locally. More concerning are third-party intermediaries generating leads for banks. And this is why you need to read this article.

Stand Chart's SME loan. If you are looking for us to sing praise about it, you came to the wrong place. We are also not going to talk about the typical thing like "Standard Chartered PLC is a British multinational financial institution engaged in wealth management, corporate and investment banking, as well as treasury services." - because you have ChatGPT for that.

But rather we tell you how these reviewers really work and what they are doing to consumers.

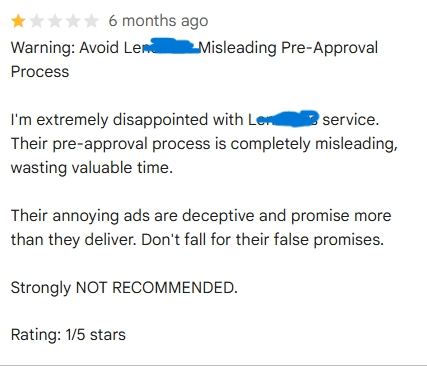

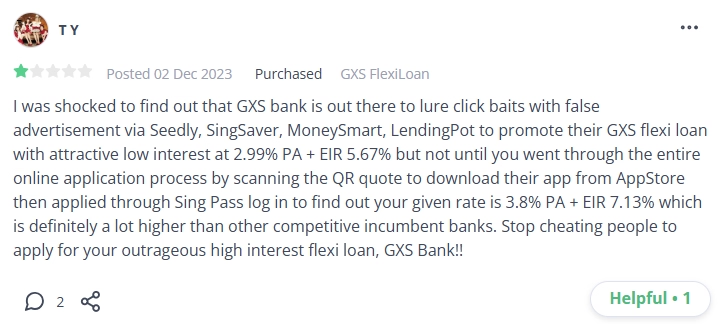

Credit: Public review found on Seedly and Google:

Starting to see the picture? Not all comparison websites are what they claim to be—many are nothing more than advert-driven portals, serving the advertisers that pay them. Not you.

Across markets from the U.S. to Australia, authorities are uncovering that these platforms often promote results based on payment, not on what’s truly best for the applicant or consumer. What you see isn’t always an unbiased comparison, but a ranked list bought by those who pay the most.

While general information, such as miles or points per dollar spent, is easy to research, loan amounts and interest rates are highly personal. They change from one applicant to another based on each individual’s credit score & profile. That rate they “reviewed” or “compared” for you is actually a teaser rate. Here’s how it works in detail. Read the link above to understand the definitions and mechanics. Regulators worldwide have started suing platforms for misleading ads and clickbait, while others have issued public advisories. We’ve included such examples in the article—from the US Federal Trade Commission to Australia’s MoneySmart, the equivalent of our MAS’s MoneySense. The amusing twist: it’s literally named MoneySmart.

But if you busy, you don’t have to read the article above - here is an image that says it all.

Credit: Head of Lendingpot. Strangely enough, Lendingpot appears to be exposing its own practices. We raised the concern of brokers owned by lenders. Later, they repeated almost the same argument—while being owned by IFS Capital & PhilipCapital. Perhaps it’s parallel thinking and not plagiarism… but the number of overlaps makes you wonder. For more of their contradiction or to join the conversation, click here. From fake reviews from the ex-head of CIMB to other lies, we exposed them in great details!

And does that mean our content is so good that even subsidiaries of listed companies are copying us? Then you must surely subscribe to our newsletter!

Every now and then, you’ll see these advertisers, like Singsaver and Moneysmart, write comparisons like “this loan vs. that loan.” But think about it—if they claim to compare 10 loans, did they really take all 10 and pay interest on each one? Could they have just been copying the information from somewhere only? So was there any real comparison done?

In the UK, advertised rates need to be real for at least half of borrowers. Singapore? No such rule. And even when rates are truthful, you must ask—what about the amount or term? 1% on $500 hardly matters if you require $5,000. Or for only a week when you need to borrow $50,000, how are you going to service it within a week?! Another issue is what happens when you accept the recommended loan from a “comparison” site without looking further. That decision alone could cost you thousands more, since another bank may have been ready to offer you a better deal. We’ve detailed how this works in the article above.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

If you think something doesn’t look right, we invite you to share your thoughts on this LinkedIn post or on our Reddit, TikTok, or Facebook post, if you prefer. However, we have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections. Weighing in there, and as more people share their thoughts there, could finally catch their attention to do something about the industry and better protect borrowers. Every comment, repost, or show of support matters — it increases the chances that policymakers take notice and act. Because this pattern isn’t unique — it’s part of a broader problem we’ve seen across several loan-matching sites, including MoneySmart, Lendela, Roshi, Lendingpot and SingSaver.

Stop falling for clickbait rates. And instead use FindTheLoan.com, Singapore’s 1st loan marketplace. Funded by Enterprise Singapore under the Startup SG Founder Seed Capital, instead of teaser rates or applying with multiple lenders one by one, you can actually reach multiple lenders at once with your actual documents, and they will make a full credit assessment as if you had walked in to them individually, and they will revert with their actual offer.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Curious about loan brokers instead and how to avoid common pitfalls? See our full article here.

Give us a try — it’s free to get your personalized loan offers today!

Share on: