PropertyGuru Finance - We checked it out for you

Written at: 06 Oct, 2025

PropertyGuru Finance is the mortgage arm of PropertyGuru Group, one of the most well-known property platforms in Singapore. It focuses primarily on home loans and refinancing, offering borrowers a way to secure mortgage packages while browsing property listings on the same site. In that sense, PropertyGuru Finance acts as a natural extension of the property search experience — helping users move from shortlisting a home to arranging their financing, all under one brand.

What makes it interesting is how it positions itself: independent of banks yet staffed by a mix of ex-bankers, and powered by tools that allow instant in-principle approvals. In theory, this combination of human expertise and automation should give borrowers both speed and clarity. But it also raises the same questions that apply to every broker — who actually benefits most from each recommendation?

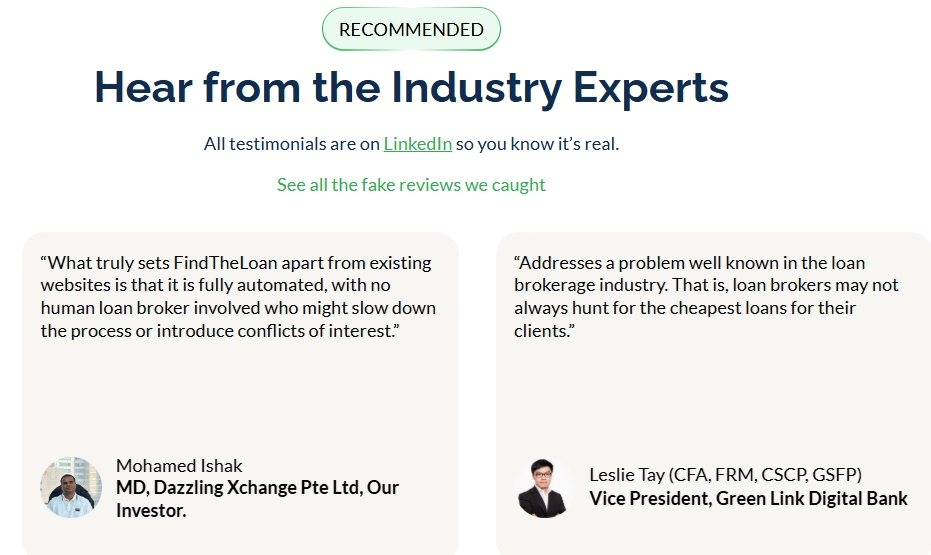

PropertyGuru’s integration gives it visibility and volume few standalone mortgage advisers can match. While the firm advertises wide lender coverage, that doesn’t automatically mean every case is run across every bank. Like all brokers, efficiency often means narrowing down options based on lender fit, incentives, or operational ease. That’s not unique to PropertyGuru Finance, but it’s something every borrower should understand before relying solely on any one broker’s recommendations - Example our reviews of Lendela, SingSaver, Roshi, MoneySmart, and Lendingpot show that the lack of clear oversight allows these issues to persist. For loan brokers such as SmartLend & Smart-Towkay, we even caught evidence of misinformation with screenshots.

Regulation elsewhere has shown why these questions matter. After the 2008 financial crisis, the United States amended its Truth in Lending Act through the Dodd‑Frank reforms, banning broker compensation structures that rewarded steering borrowers toward costlier loans. Even with such laws, lawsuits continue to surface — such as the 2024 class‑action against United Wholesale Mortgage, alleging collusion with brokers to favor certain products. Singapore doesn’t yet have a specific licensing regime for mortgage brokers, so transparency relies heavily on each firm’s internal ethics and disclosure practices.

For borrowers, the key is awareness. Always ask which lenders were actually approached for your case — and why some might have been excluded. Likewise, don’t assume the adviser’s incentives are fully aligned with yours. Some lenders pay higher commissions or offer faster processing, both of which can quietly shape the recommendations you receive because history has repeatedly shown that brokers' loyalty can be towards lenders, not borrowers . We touched on that in this article here.

None of this means PropertyGuru Finance is untrustworthy. On the contrary, its combination of visibility, digital infrastructure, and professional advisers gives it a strong foundation. But even with credible players, borrowers should engage with eyes open — knowing that what looks like a comparison might still involve unseen filters and depending on who from within the company that you meet.

If you already have a trusted mortgage adviser, there’s no harm staying with them. But for those who prefer direct comparisons, you can also try our loan marketplace. It lets you reach multiple lenders with a single application — and receive actual offers and not some teaser rates like pre-qualification or IPA, which can be rather misleading at times, which we explain here.

—

If you found this article helpful, consider sharing it with others who might benefit. Even a simple like or comment here helps the algorithm push borrower‑education content to more readers. You can also subscribe to our LinkedIn newsletter here or follow us on Medium for more unbiased breakdowns like this.

Share on: