HSBC Working Capital Loan - the review you were not expecting.

Written at: 02 Oct, 2025

HSBC Working Captial Loan - the review you were not expecting. Know why we wrote it this way? Because you were probably expecting some "neutral" website to review and write about it so you don't have to do your research?

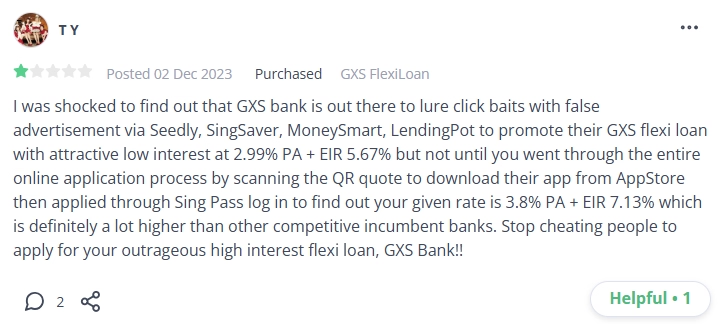

It’s natural to want to know how their loans work, how HSBC charges, or how soon they can respond. Unfortunately, as explained here, those answers only come after applying. Although MAS released the Guidelines on Standards of Conduct for Digital Advertising Activities in September, they’re still not comprehensive enough. In the UK, advertised “1%” or “1-hour” loans must apply to at least 51% of borrowers. That’s not yet the standard here — and intermediaries unaffiliated with banks remain a bigger concern. And that is why you should still read this article.

You were probably expecting a review writing things like "HSBC (The Hongkong and Shanghai Banking Corporation) operates as a British universal bank and financial services group. Though its global headquarters are in London, its heritage and business ties remain closely linked to East Asia. Today, it stands as Europe’s largest bank by assets." blah blah blah right?

Well, not us. Because across markets from the A.U. to the U.K. to the U.S., their regulators are actually highlighting that comparison or review websites often prioritize results based on payments, not necessarily what’s best for the borrower. What looks like an unbiased comparison is usually a curated list bought by those who pay the most.

While information like credit card rewards is easy to verify, loan amounts and interest rates are highly personal. They differ for each person’s credit score & profile. The rates you see online are usually just teaser rates. Discover what these terms really mean and how they operate in the article above. Across many countries, regulators have taken action against sites—suing them for clickbait practices or issuing warnings to the public. You’ll find those examples in the same article piece. From the US’s FTC to Australia’s MoneySmart (similar to Singapore’s MoneySense), the article above contains direct links to these cases. And yes, the irony is there—Australia’s watchdog is also called MoneySmart.

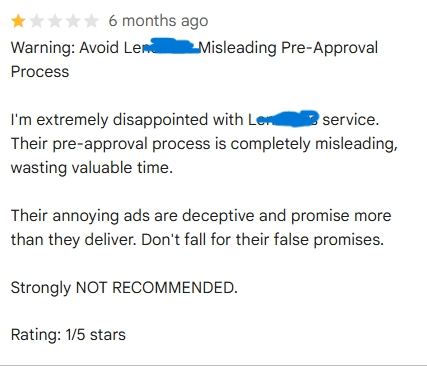

Or, just hear it from those that have managed to discover the truth. Your fellow Singaporeans.

Still not enough? How about a self-admission by one of the top loan comparison websites in Singapore?

Credit: Head of Lendingpot. Ironically, Lendingpot seems to expose its own practices. For more of their contradiction, see the LinkedIn conversation that has received the attentions of over 100 Singaporeans. When we called out conflicts in lender-owned brokers. Months later, the same narrative came from them—though they themselves are owned by IFS Capital & PhilipCapital. Coincidences happen, but repeated ones start to look like blindly doing copy-paste, right?

These platforms often publish “this loan vs. that loan.” But can they really test ten loans by borrowing and repaying each one? I mean, MoneySmart is rich, so they probably can. But did they really? Try asking them on their posts and let us know?

In the UK, consumer law requires at least 51% of borrowers to enjoy the quoted rate. Singapore offers no such assurance. And even if the rate is accurate, the loan details matter. What use is a 1% loan if it’s capped at $500, when your need is $5,000? Or for just one week? What’s worse is if you relied solely on a “loan comparison” website and went ahead with its suggestion. That could mean losing thousands unnecessarily—money you could have saved by applying with a different bank offering a lower rate. The teaser rate article above explains how the process really works.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

These aren’t isolated findings — they mirror issues seen across various loan intermediaries such as Roshi, Lendela, Lendingpot, and SingSaver too. From fake reviews to fake loan types, we have seen it all and written about them. Thousands of Singaporeans, SMEs, and borrowers use these sites each week. MoneySmart, by their own claims, served 750k consumers across SoutheastAsia in the last 2 years. If what these sites are doing doesn’t seem right, give your feedback on Facebook, Reddit, TikTok or LinkedIn where we have posted about this issue. Every comment, repost, or show of support counts. More voices increase the chance that policymakers finally act in Singapore too. We tagged many MPs on LinkedIn too. Those that have spoken up on better borrower or consumer protection.

--

If you enjoyed this article, we’d love for you to share it. Even a quick like or comment here helps boost visibility so more people see it. Our goal is to deliver insights Big Finance doesn’t want promoted, and your support helps amplify our work.

Subscribe to our LinkedIn newsletter here or on Medium here so you never miss an update! We also explained the risks of working with loan brokers and what to watch out for when using them

And that’s why we built FindTheLoan.com, Singapore’s 1st loan marketplace. Instead of teaser rates or applying with multiple lenders separately, you can reach many lenders at once with your actual documents without intermediaries that have been proven by regulators times and times the conflict of interest they bring. They’ll make a full credit assessment as if you had gone to them individually, and they return with their real offer. Give us a try — it’s free to get your personalized loan offers today!

Share on: