FinanceGuru -We checked it out for you.

Written at: 06 Oct, 2025

FinanceGuru is one of the few loan brokers in Singapore that offers a wide range of financing options — from home and personal loans to SME and renovation loans. On paper, it seems to be a convenient, all-in-one solution for borrowers who prefer dealing with a single point of contact rather than multiple banks. But as we’ve seen across our earlier reviews, convenience and neutrality rarely go hand in hand.

The company’s branding, with its upbeat tagline “Pay Less, Live More,” paints a friendly, customer-first image. Its team comprises a mix of ex-bankers and financial consultants who claim to offer unbiased advice based on comparisons across several lenders. That sounds reassuring. But the question borrowers should always ask is — what exactly is being compared, and how are those comparisons made?

Unlike brokers that focus solely on one loan category, FinanceGuru’s multi-loan approach allows it to tap into multiple revenue streams — home loans, personal loans, and SME loans.

The real challenge is brokers like FinanceGuru can still operate in an ecosystem that rewards volume, not transparency. The more deals closed, the more commissions earned. Even with the best intentions, advisers may find themselves influenced by lender incentives or faster turnaround cycles. These patterns aren’t unique to Singapore — they’re the same structural weaknesses regulators around the world have spent decades trying to address.

In the US, the Dodd-Frank Act amended the Truth in Lending Act (TILA) in 2010 after the mortgage crisis to prohibit brokers from steering borrowers toward costlier loans for higher commissions. Yet, even with these safeguards, issues persist. In 2024, a Reuters report revealed that United Wholesale Mortgage (UWM) was sued in a class-action case for allegedly conspiring with loan brokers to direct borrowers solely toward its products — costing consumers billions in excess fees. And that’s in a market with robust regulations.

Singapore, by contrast, has no dedicated framework governing loan brokers. While licensed moneylenders and financial advisers fall under MAS and MinLaw oversight, loan brokers sit in a grey zone. That’s why borrowers must be especially vigilant. A “best rate” claim might be technically correct but misleading without context — tenure, lock-ins, legal fees, repricing paths, or whether alternative lenders were even considered.

We’ve documented this pattern repeatedly. Our review of Lendingpot, MoneySmart, Lendela, Roshi, and SingSaver reveals how weak regulation continues to let such problems thrive. As for loan brokers like Smart-Towkay & SmartLend, we even documented lies to borrowers with screenshots.

While FinanceGuru doesn’t make false claims that we have managed to discover so far, the structural incentives behind most brokers remain the same. What matters isn’t just what’s said, but what’s left unsaid — which lenders were approached, which weren’t, and how “recommendations” are internally prioritized.

Even if the firm is well-intentioned, its business model depends on borrower volume. And when a consultant is juggling multiple cases, a larger deal may naturally take precedence over a smaller one. That’s not corruption — it’s human behaviour shaped by an unregulated commission model. The risk is subtle but real: when you can’t see how decisions are made behind the scenes, neutrality becomes an assumption rather than a fact.

For those new to borrowing, it’s worth reading our full breakdown, Loan Brokers: 10 Insider Tips Every SME or Borrower Should Know. It explains how to identify red flags, interpret “free advisory” offers, and understand why brokers tend to recommend certain lenders over others. Knowledge doesn’t eliminate risk, but it makes you harder to mislead.

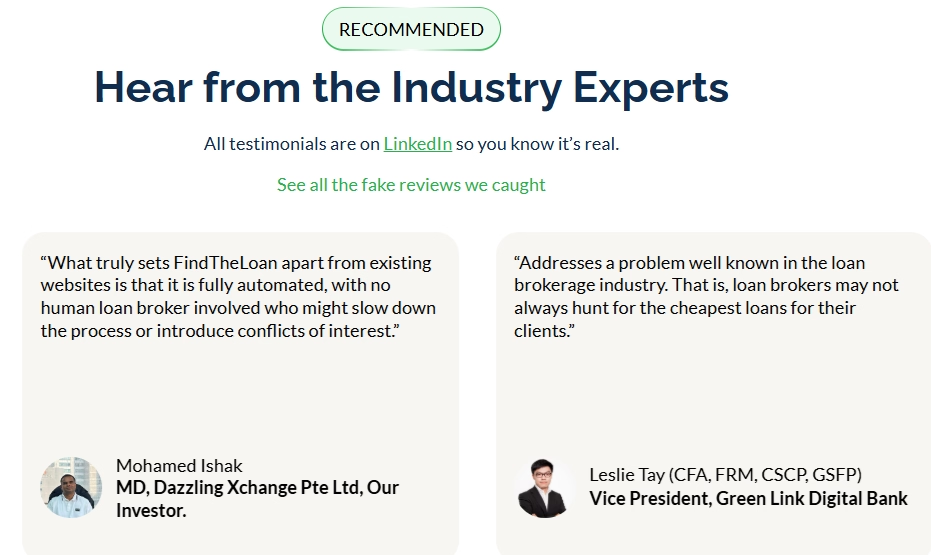

If you already have a broker you trust, that’s fine — just make sure you understand how they’re compensated and what alternatives they’ve excluded. For borrowers who prefer a more transparent route, our own loan marketplace provides a simpler solution. It forwards your single application to multiple lenders so you receive actual offers — not estimated rates or theoretical comparisons. You can start here: FindTheLoan.com registration or learn about our difference here.

—

If you found this article helpful, share it to help others make informed borrowing decisions. Even a small like or comment here helps the algorithm surface educational content instead of paid ads. Subscribe to our LinkedIn newsletter here or follow us on Medium for more evidence-based insights on Singapore’s loan ecosystem.

Share on: