Citibank corporate loan. Not the review you were expecting.

Written at: 02 Oct, 2025

Citibank corporate loan. Not the review you were expecting. Very catchy title right? Here's why.

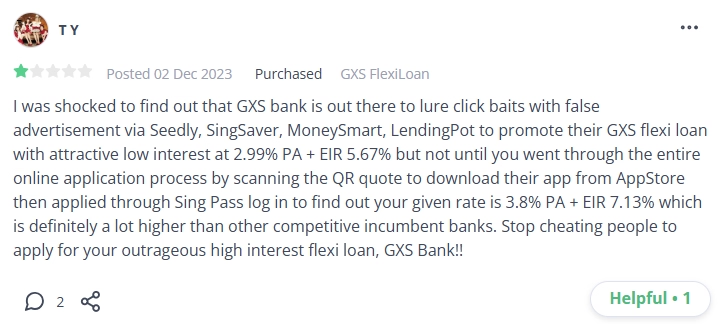

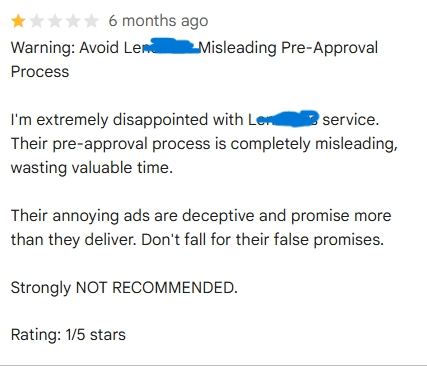

We understand you may want to know more about how their loans work, bank charges, or response times. And you were searching online when you found this article. Sadly, it doesn’t quite work that way as outlined here. While MAS introduced the Guidelines on Standards of Conduct for Digital Advertising Activities in September, but in our opinion, they remain limited. In contrast, UK regulations require that any 1% or 1-hour loan offer apply to at least 51% of borrowers — something not yet practiced locally. More concerning are third-party intermediaries generating leads for banks. And this is why you need to read this article.

We are not going to review their loan, or write things like " The roots of Citibank go back to 1812, beginning as the City Bank of New York, and later adopting the title First National City Bank of New York" - but rather expose how such reviews actually work so you are no longer reading advertisements when you are actually trying to learn more.

Across markets from the U.K. to the U.S., regulators are highlighting that comparison websites often prioritize results based on payments, not necessarily what’s best for the borrower. What looks like an unbiased comparison is usually a curated list bought by those who pay the most. They are not actually helping borrowers, but the banks and lenders. From insurance to shopping comparison, consumers have been misled for years.

While information like credit card rewards is easy to verify, loan amounts and interest rates are highly personal. They differ for each person’s credit score & profile. The rates you see online are usually just teaser rates. The link above explains what they are and how they function. Around the world, regulators are cracking down—either through lawsuits or by issuing consumer alerts. The article points to several cases, from the FTC in the United States to MoneySmart in Australia (their version of MoneySense in Singapore). Ironically, that regulator’s name is also MoneySmart. But here's more irony:

Credit: Head of Lendingpot. Ironically, Lendingpot seems to expose its own practices. By showing one such offer while condemning it. For more of their contradiction, see or join the LinkedIn conversation. We also exposed things like fake loan types to fake reviews in the same post! We were the first to call out conflicts of lender-owned loan brokers, which a number of them are. Months later, they echoed the same point—even though they’re owned by IFS Capital & PhilipCapital. Maybe imitation is just flattery—but it’s also hard to ignore.

These platforms often publish “this loan vs. that loan.” But can they really test ten loans by borrowing and repaying each one?

UK regulation guarantees that 51% of customers get the advertised rate. Singapore hasn’t set such a standard. And rates alone don’t tell the story—loan size and tenure matter too. A 1% rate sounds attractive, but not if it’s only on $500 when you need $5,000, correct? Or if you only have one week's tenure to pay up?

Up to $500,000 means nothing if it doesn't apply to you, right? But here’s the real concern—by trusting a loan “comparison” platform and choosing its top pick without shopping around, you could have easily overpaid by thousands. Another bank might have been willing to lend at a much cheaper rate. See the article above where we break down exactly how this happens.

And that’s why we built FindTheLoan.com, Singapore’s 1st loan marketplace. Instead of teaser rates or applying with multiple lenders separately, you can, in just a few minutes, reach many lenders at once with your actual documents. They’ll make a full credit assessment as if you had gone to them individually, then return with their real offer.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

If you think it's time to regulate these platforms, add your voice on TikTok, Reddit, LinkedIn or Facebook. More voices increase the chance that policymakers finally act, and we have tagged a number of them on LinkedIn. Those that have spoken about stronger consumer protections and safeguards for borrowers. Every comment, repost, or show of support counts. Because these are not small players. But multinational companies and even subsidiaries of listcos. And these aren’t isolated cases — they highlight a systemic issue within the loan industry, also evident among other loan intermediaries like MoneySmart, Lendingpot, Lendela, Roshi, and SingSaver.

--

If you enjoyed this article, we’d love for you to share it. Even a quick like or comment here helps boost visibility so more people see it. Our goal is to deliver insights Big Finance doesn’t want promoted, and your support helps amplify our work.

Subscribe to our LinkedIn newsletter here or on Medium here so you never miss an update! Curious about loan brokers and how to avoid common pitfalls? See our full article here.

Give us a try — it’s free to get your personalized loan offers today!

Share on: