OCBC Personal Loan - What You Need to Know Before Using It

Written at: 01 Oct, 2025

OCBC Personal Loan. As we have seen so many “comparison” websites or bloggers reviewing it, we thought we would chip in, but with a twist.

Many readers want to know how OCBC or various banks calculate their charges, how fast they respond, or how the loan process really works. You were searching online when you found this article. Unfortunately, as explained here, things don’t work that straightforwardly. While MAS has issued the Guidelines on Standards of Conduct for Digital Advertising Activities, they’re not yet as comprehensive as those in the UK. There, advertised 1% or 1-hour offers must apply to most borrowers — here, no such rule exists. And this is why you need to read this article.

Across markets from the U.S. to Australia, authorities are uncovering that these platforms often highlight results based on payment, not on what’s truly best for the borrower or consumer. What you see isn’t always an unbiased comparison but a curated list bought by those who pay the most.

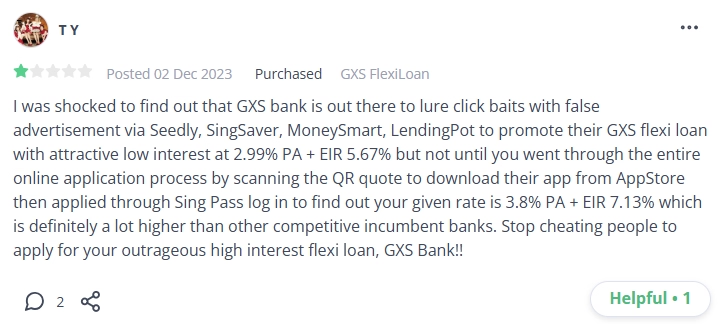

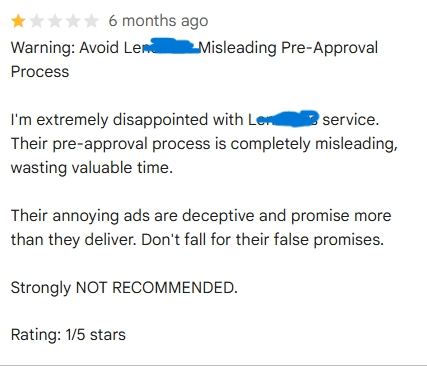

While general information, such as miles or points per dollar spent, is easy to research, loan amounts and interest rates are highly personal. They change from one borrower to another based on each individual’s credit score & profile. That rate they “reviewed” or “compared” for you is actually a teaser rate. They are rates that you may or may not get, and in many countries, regulators are either suing them for clickbaiting consumers or publishing warnings on them.

But if you are pressed for time, you don’t have to read the article above - here is an image that says it all. The image that will make you stop using "comparison" websites once and for all.

Credit: Head of Lendingpot. Strangely enough, Lendingpot appears to be exposing its own practices. For more of their contradiction or to join the conversation, click here. What’s more, when we pointed out the conflict of interest of brokers owned by lenders, they echoed it months later—despite being owned by IFS Capital & PhilipCapital!

Credit: Public review found on Seedly and Google

Every now and then, you’ll see them write comparisons like “this loan vs. that loan.” But think about it—if they claim to compare 10 loans, did they really take all 10 and pay interest on each one?

In the UK, at least 51% of borrowers must actually enjoy the quoted rate. Singapore, however, has no such law. And even if the rates are genuine, what about the loan amount or tenure?

And thus we built FindTheLoan.com, loan comparison 2.0. Instead of teaser rates or applying with multiple lenders one by one, you can reach multiple lenders at once with your actual documents, and they will make a full credit assessment as if you had walked in to them individually, and they will revert with their actual offer.

We can’t block lenders from teaming up with them, growing their wealth and reach, and amplifying the problem for more borrowers. But we can challenge misleading advertising and better protect borrowers, consumers, and SMEs. If you think you should speak up, share this article. "The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein.

Because time and again, reviews of SingSaver, Lendingpot, Roshi, and Lendela reveal one truth — the loan "comparison" industry keeps repeating the same misleading formula under different names. With a claimed 60 million Southeast Asian visitors, MoneySmart and such websites enjoys the backing of lenders and VCs who overlook its questionable marketing. Calling such websites out is the least we can do.

--

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Gain more practical insights in Loan Brokers: 10 Insider Tips Every SME or borrower Should Know.

Give us a try — it’s free to get your personalized loan offers today!

Share on: