credible.sg - Is it really credible?

Written at: 26 Nov, 2025

Credible is a new product by Moneysmart. But why a new product or website that seems to cannibalize their existing websites?

Because not every comparison site is what it claims — a large number are essentially sponsored listing platforms built to favour paying advertisers, not the users seeking honest guidance.

Regulators in markets from the U.S. to Australia are finding that these platforms commonly rank results by payment level, not by consumer benefit. The “comparison” you see is often just a curated list bought by whoever pays more, and some Singaporeans have unfortunately already experienced the consequences.

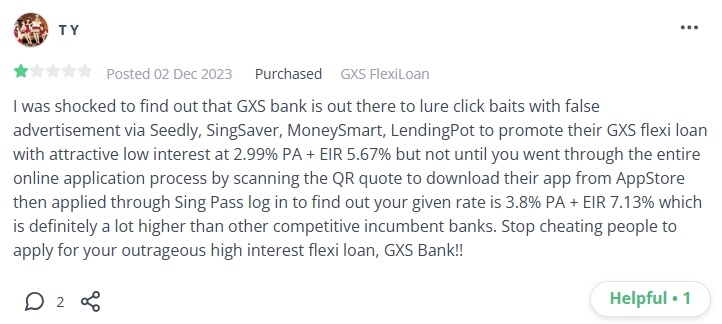

Credit: Public review ironically found on Seedly, another so-called comparison website.

But here is the smoking gun.

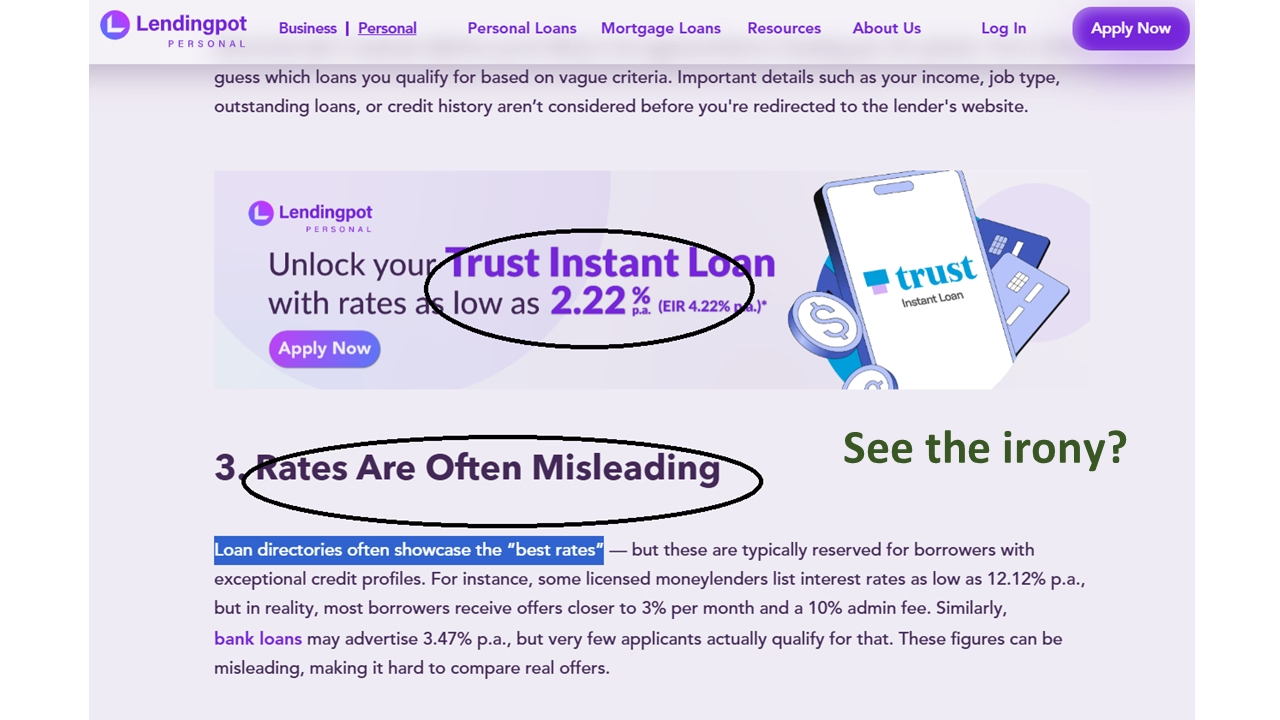

Credit: Head of Lendingpot.

We have no idea why Lendingpot is finally calling itself out. But for more on them, click here!

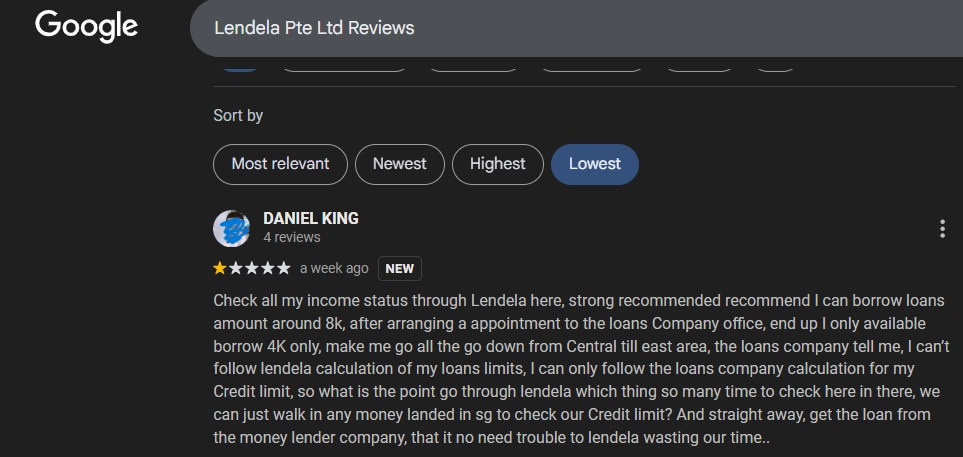

Perhaps it is due to the advent of new players such as Lendela, which claims personalized loan offers and isn’t without dispute. (We also did a review of Lendela here.)

One of Lendela’s and credible.sg’s key selling point is that you can compare across multiple moneylenders, and all you need is Singpass (or at least at some stage). But here’s what most people don’t realise: for an accurate credit assessment, moneylenders actually require your MLCB/Moneylenders Credit Bureau report — something Singpass cannot provide. The MLCB is overseen by the Ministry of Law, and you must download it yourself. While Singpass is simply the login method, the report comes from an entirely separate website.

Take a look at these screenshots that you can find on their Google reviews, from their actual users.

Just as you would consider several factors before lending money to a friend, any lender — bank or moneylender — must understand the borrower’s “character” before making a loan offer. We explain what “character” means in this article, along with the rest of the 5Cs lenders evaluate. In short, just like you would assess if your friend is reliable or already heavily indebted, lenders need your CBS or MLCB (depending on their category) to see how much debt you already carry. You might be earning $50,000 a month, but if you owe half a million elsewhere, repaying a new lender will still be difficult.

So is Moneysmart trying to mend their ways? Finding a new way to bait-and-switch? We have no idea. But while they are clearly drawing a distance and only saying that it is featured on Singsaver, Moneysmart (basically their own sister companies) — instead of making it clear that it is a product of Moneysmart, we guess they don’t want you to find out what we have been trying to educate the market about comparison websites for years. without outing themselves like Lendingpot did.

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurer were trying to out match each other and they increased the projections on their benefit illustration until it got to a point it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in. But it is not unheard of, even today, that an insurance agent, might try to pass it off as guranteed as either 5 or 9%, instead of projections, and you know what we are trying to say here.

We hope this review has been informative. And if you believe these platforms are misleading and more people should speak out, we welcome you to share your thoughts on any of our social media channels: Facebook. Tik Tok. IG. LinkedIn. If multinational companies and subsidiaries of listed companies can be flagged with such practices, what do you think is the state of loan advertising in Singapore, and what are the smaller players willing to do? We have tagged a number of MPs on LinkedIn who, during parliament, have asked about matters such as greater consumer protections. If more people weigh in publicly, MPs may be compelled to act on loan broker regulation and borrower protections.

"The world will not be destroyed by those who do evil, but by those who watch them without doing anything", Albert Einstein

--

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your actual personalized loan offers today! And sorry our forms are long because we do need to collect everything the lenders need, except that you can reach multiple lenders in one application

Share on: