What happens when you apply for a loan with minimal documentations?

Written at: 15 Nov, 2025

This may not be the article you had in mind, but trust us — it’s the one that can actually help you. Invest one minute and you could save thousands. Even ex-lenders have warned about this.

Many brokers (and even some lenders, but more on that later) claim they can help you get a loan without any or minimal documentation, just to stand out from other brokers. But it’s a hollow promise — just one of the many false claims they make.

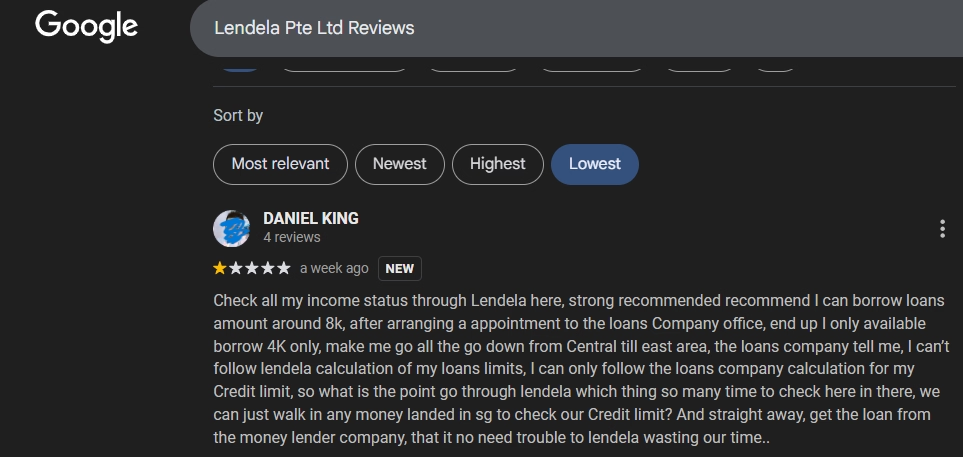

Credit: This is a publicly available review that you can find online. For our review on Lendela, click here.

Would you ever sign a loan document just by glancing at the first page? Then how does a reputable lender approve thousands in minutes with almost no checks? Why would they take that risk when even banks don’t?

At this point, you are wondering, how can all these be legal? Well, up until a decade ago, it was okay for a real estate agent to represent both buyers and sellers. 2 decades ago, insurer were trying to out match each other and they increased the projections on their benefit illustration until it got to a point it was multiple times the current 5% and 9% that have been standardized by MAS, after it had to step in. But it is not unheard of, even today, that an insurance agent, might try to pass it off as guranteed as either 5 or 9%, instead of projections, and you know what we are trying to say here.

See here and here, where loan brokers and finance companies in the US have been sued for millions for their deceptive practices, and now they are reaching our shores. The US and UK have had consumer credit laws like TILA and the Consumer Credit Act since the 1970s. Singapore, however, currently has no regulation governing brokers, nor any obligation for them to register as companies or formal brokerage representatives. Even though MAS recently rolled out the “Guidelines on Standards of Conduct for Digital Advertising Activities,” loan intermediaries appear to be excluded. Excluded moneylenders, which many non-bank lenders fall under, might not be considered as a financial institution, either. This gap has allowed misleading broker and lender ads to spread, forcing others to follow suit and undermining transparency. And yes, even lenders themselves engage in false claims, especially the smaller ones. We have even seen some advertised loan types that don’t actually exist. We’re pushing for reforms to stop this cycle. Learn how you can help here.

To see what a lender looks for when conducting their checks, click here.

—

If you enjoyed this article, we’d really appreciate it if you could share it with others who might benefit from it. Even a simple like or comment here helps boost visibility so more people can see it! Our mission is to share insights that Big Finance often overshadows with its massive budgets. Every interaction helps us reach more readers like you!

Subscribe to our LinkedIn newsletter here or follow us on Medium here so you never miss our latest pieces.

Share on: