Redbrick mortgage - What You Need to Know Before Using It

Written at: 01 Oct, 2025

Redbrick Mortgage is one of the largest loan brokerage firms in Singapore, focused on home loans. Unlike some brokers that handle both SME business owners and consumers seeking personal or home loans, Redbrick concentrates solely on this segment.

Though it appears, based on looking at some of the employees’ LinkedIn profiles, that it doesn’t always seem to be the case. Many insurance agents and real estate agents are also working with them behind the scenes to gather the lenders’ offers before presenting them to you - and in a way, operating like a loan broker too, except one is in charge of gathering the borrowers' information, while the other sends the information to multiple lenders and then simply collects the loan offers and collates them. Unlike our previous review of Lendela, Lendingpot, and Smart-Towkay, where we caught them lying with screenshots, we have not identified any direct issues on Redbrick’s website or in their marketing materials.

So, is Redbrick a reputable and trustworthy brokerage to use? Perhaps.

Still, it’s worth spending some time in understanding how brokers operate, the conflicts of interest they bring, and the laws passed in countries such as the US, UK, and Australia to regulate them. This knowledge can help you protect yourself and set realistic expectations when dealing with brokers.

A lot of Singaporeans are unaware that brokers have been regulated in countries such as the US for decades due to the conflicts of interest they bring. In fact, while mainstream coverage of the 2008 mortgage crisis centered around the banks’ greed and bailouts, those in the loan space are very familiar with the secondary conversation — that mortgage loan brokers also contributed to it. That’s why the Dodd-Frank Act amended the Truth in Lending Act (TILA) in 2010, tackling the conflicts of interest that helped fuel the mortgage crisis.Despite these reforms, a 2024 class-action lawsuit alleged that United Wholesale Mortgage (UWM) conspired with loan brokers to steer borrowers solely toward its products, even when cheaper alternatives existed, leading to an estimated $35 billion in excess fees. So, imagine where there is no regulation.

Consider reading our full breakdown, Loan Brokers: 10 Insider Tips Every SME or Borrower Should Know, to understand what to watch out for. Even if the firm is reputable, staff come and go. Surely, you want someone experienced to serve you properly, because in Singapore anyone can become a loan broker overnight while holding another full-time job.

Even if they are trustworthy, a bigger case — and therefore a bigger commission — may cause them to focus on another client instead of you. At least by understanding how the process works, you will know what to expect and how to ensure you are properly served.

We’ve tried to push for regulations, but regulators told us: hardly any complaints. But how can consumers complain when most don’t even understand how it works? Unlike tangible services, where dissatisfaction is clear, brokerage misconduct is hidden. If a borrower never knew a lower rate or better terms were available, how would they know to raise an issue? This information gap allows unethical actors to operate unchecked, leaving victims unaware they’ve been taken advantage of.

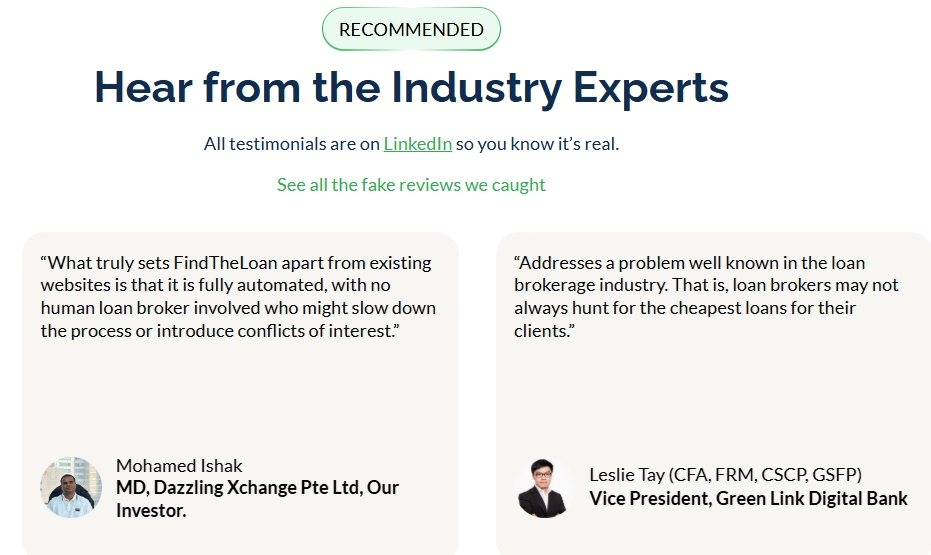

If you have a loan broker you trust, feel free to use them. However, for loan types where a broker fee applies (business loan brokers often charge anything from 5% to 15% of the loan quantum), we suggest negotiating with the broker to exclude lenders you can already approach directly or through FindTheLoan.com — which allows you to reach multiple lenders with a single application, instead of one by one. However, please note as of 2025, we are unable to assist with new residential bank loans. Refer to our glossary for other property or SME loan types.

—

If you enjoyed this article, we’d love for you to share it with others who might find it valuable. Even a quick like or comment here helps trigger the algorithm to reach more people! Our goal is to bring you insights that Big Finance doesn't want you to know, but they often get overshadowed by Big Finance's content due to the large budget they have. Every share helps amplify our work and reach more readers like you!

Subscribe to our LinkedIn newsletter here or on Medium here and never miss any new articles!

Give us a try — it’s free to get your personalized loan offers today!

Share on: