We have seen brokers touting minimal documentation required, without explaining that you will be required to pay more than you need to. Please see simplified underwriting for more. We have also heard from lenders that brokers fraudulently create the missing documents they need.

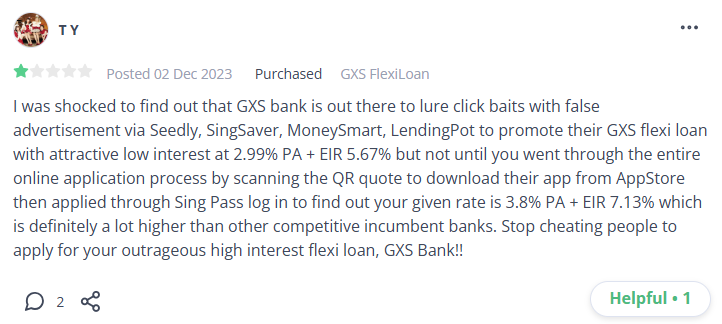

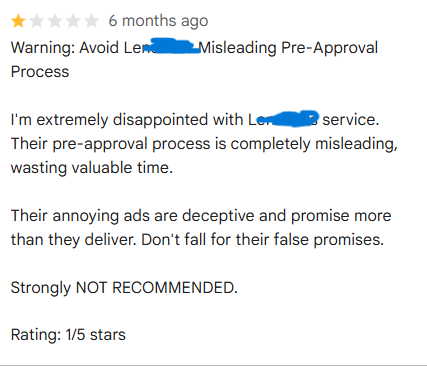

They could also be clickbait, giving you only an "indicative" offer where you head down to the lenders based on the indicative quote and, upon requesting your MLCB/CBS on the spot, have to turn you away due to your DSR. Or if their sole goal is to just get you into the door first, before asking for more documents, delaying your applications.

(These are publicly posted information that you can easily find on Google.)

Many websites in the US have been sued for misleading "offers" and certain sales tactics. See examples of these incidents here and here.

As FindTheLoan.com allows you to connect to multiple lenders at once, our forms for some loan types or borrowing profiles might be slightly longer than a single lender's.

Personal information (such as NRIC/Passport number) is required when it is necessary to establish or verify an individual’s identity to a high degree of accuracy for KYC purposes. Income information (like credit report, CPF contribution, payslip and NOA) allows our Financing Partners to gauge your repayment ability or Debt Servicing Ratio.

When applying for a Business Loan, they are required to allow the lenders to know if you, as an officer of the company, have any bad credit or pending litigation, which may impact your ability to run the company or repay a loan - especially for countries such as Singapore, where shareholders are often the guarantors for many loan types.

Share on: